Highlights from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index – January 2025

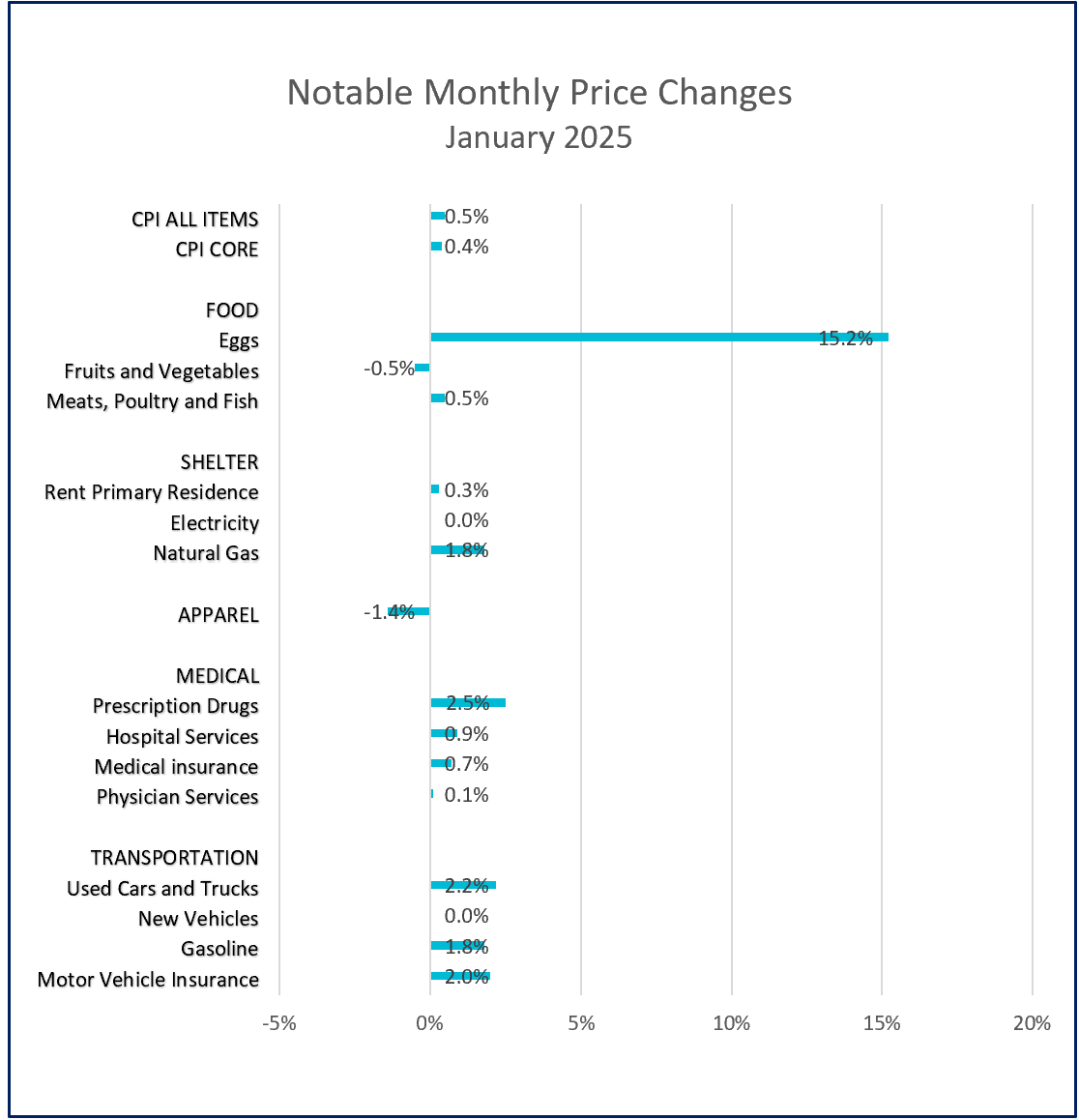

In January, the all-items Consumer Price Index (CPI) increased by 0.5%, which was higher than most economists had predicted. Price hikes were widespread, affecting essential goods and services such as food, shelter, medical care, and transportation, all of which rose by 0.5% or more. These necessities make up a significant portion of household budgets, especially for lower- and middle-income households that must allocate a larger share of their income to these essential expenses.

Compounding this issue, the Bureau of Labor Statistics (BLS) reported last week that average weekly earnings only rose by 0.2%, which is insufficient to keep up with inflation in critical spending areas. As the costs of essentials outpace earnings growth, many households may find it challenging to meet basic needs. This situation could force them to deplete their savings or incur debt.

Grocery prices rose 0.5%, marking the largest increase since October 2022. However, most food prices remained relatively stable—unless you bought eggs. Egg prices skyrocketed 15.2%, accounting for approximately 67% of the food-at-home increase. Without eggs, grocery prices would have risen by just 0.2%.

It is not uncommon for January’s CPI to accelerate—it did so in both 2024 and 2023. Many businesses implement new pricing strategies at the start of the year, which may explain the sharp increase in prescription drug costs, medical insurance, and car insurance.

Lodging away from home rose 1.4% after declining in December, suggesting that hotels may have adjusted their rates for the new year. This could partly explain why January’s shelter index increased. Fortunately, rental price increases remained unchanged from December after trending lower for much of late 2024. As a result, the 12-month shelter index posted its smallest gain in three years. However, families relying on natural gas for heating saw higher bills in January—and February’s costs will likely rise even more, given January’s colder-than-normal temperatures. AccuWeather

Transportation costs also hit Americans’ wallets hard. Gasoline prices, which had trended lower for most of 2024, surged 4.4% in December and another 1.8% in January. Additionally, used vehicles became significantly more expensive to purchase and insure.

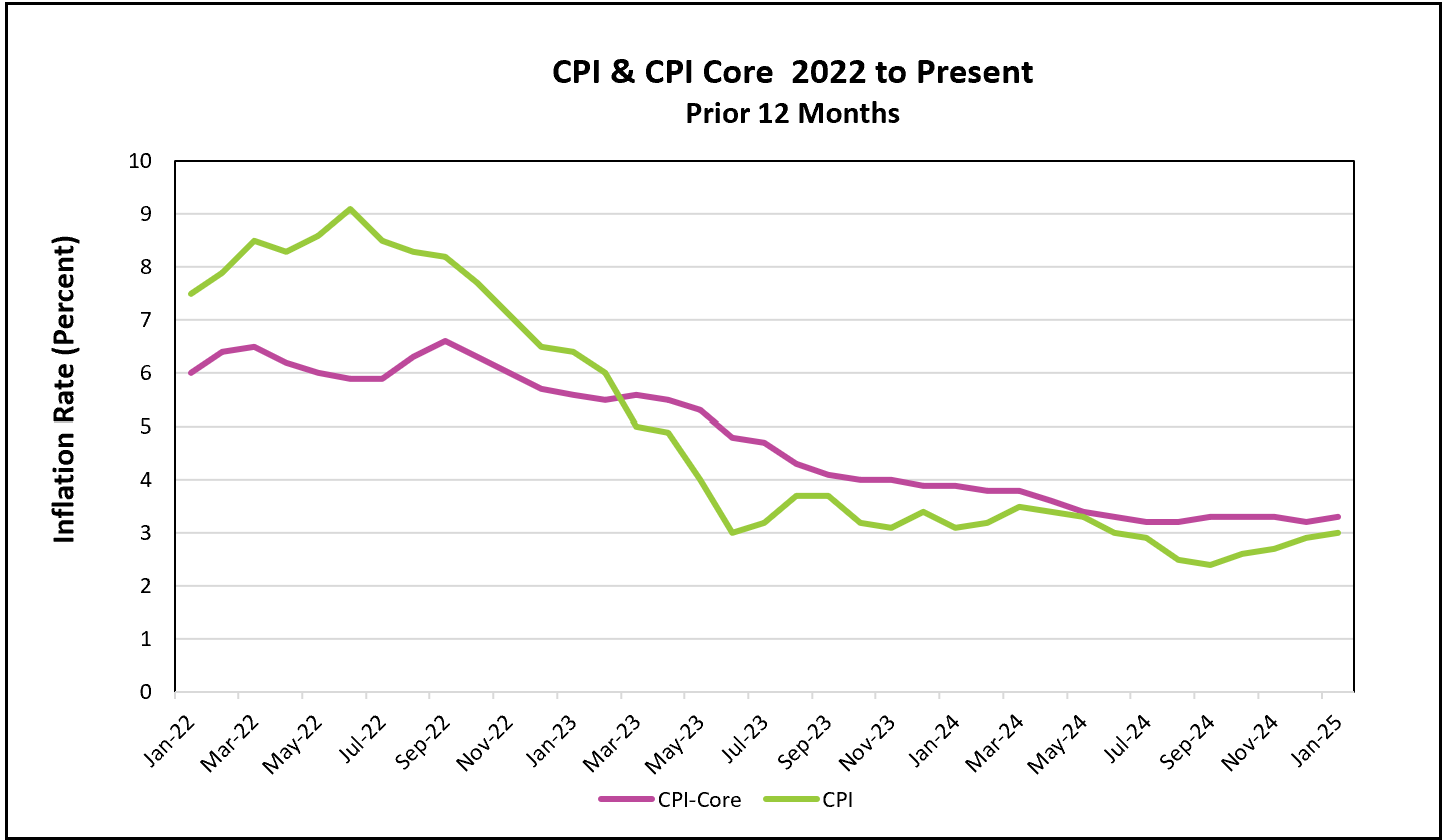

Federal Reserve Chairman Jerome Powell, in his semiannual address to Congress this week, stated that the U.S. economy remains healthy, but the Fed still has more work to do in controlling inflation. He cautioned against cutting interest rates too soon, emphasizing the need for further progress before lowering the Fed’s benchmark rate. Policymakers are closely monitoring how President Trump’s economic policies—including tariffs, immigration, deregulation, tax cuts, and potential increases in energy production—will impact inflation and growth.

Most economists believe that tariffs and immigration policies could drive inflation higher. Tariffs raise import costs, while tighter immigration policies can restrict labor supply, pushing wages up. However, lower corporate taxes, deregulation, and expanded energy production could reduce business costs, fueling economic growth without necessarily triggering an inflation surge.

For a deeper analysis of how President Trump’s policies may shape the economy in 2025, check out our blog post: U.S. Economy 2025 – Where Are We Headed?.

Looking ahead, the Bureau of Economic Analysis (BEA) will release the Personal Income and Outlays report for January 2025 on February 28. This report will include the PCE price index, the Federal Reserve’s preferred inflation measure, and the first snapshot of household income and consumer spending for the year. Higher Rock will publish a summary and analysis of the report shortly after its release.