Thank you, American consumers! Your spending powered the U.S. economy’s growth despite inflation and higher interest rates. Consumer spending—comprising roughly 70% of the U.S. economy—accelerated throughout 2024, growing by 2.8% for the year. Businesses continued hiring and offering higher wages, with wages rising 3.9% while inflation stood at 2.9%. As a result, higher real wages helped families manage their budgets and further fueled spending.

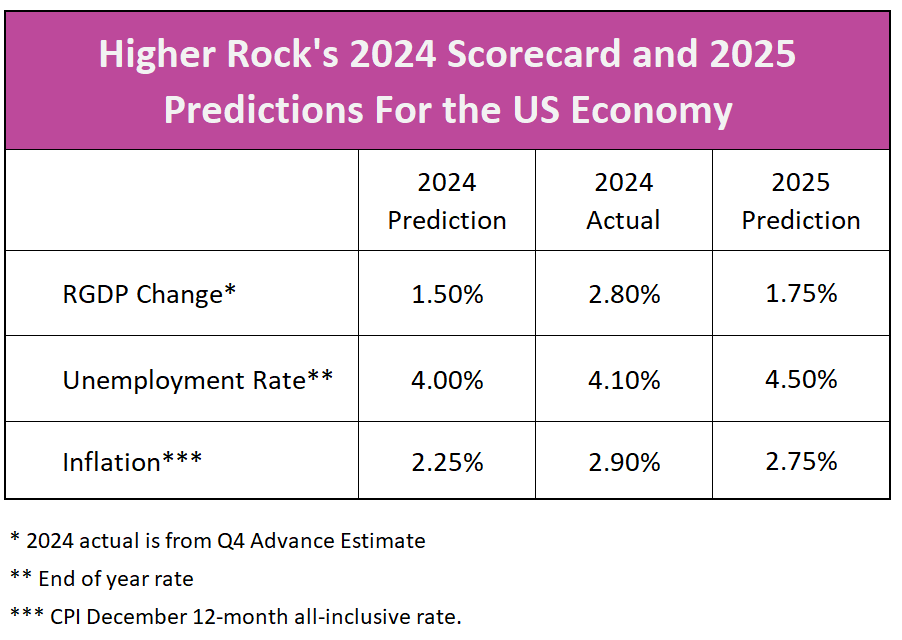

What is next for the U.S. economy in 2025? Each year, Higher Rock Education forecasts key economic indicators, including GDP growth, inflation, and unemployment. The table below highlights our 2024 predictions alongside actual results and presents our latest projections for 2025. Last year, the economy performed better than we predicted—let’s hope our 2025 forecast also proves conservative.

In his inaugural address, President Trump vowed to restore America to a “golden age.” His strategy relies on tariffs to create jobs and reduce trade deficits with key partners. He encourages foreign and domestic companies to manufacture in the U.S. to avoid tariffs, while offering incentives such as lower taxes and fewer regulations.

The overall impact of President Trump’s policies on real GDP will depend on how they are implemented and balanced. Tax cuts and deregulation could stimulate economic growth, but widespread tariffs, the risk of a trade war, and large-scale deportations could hinder progress and stall growth.

Tax Cuts

During President Trump’s first term, Congress passed several tax cuts, but those benefits expire in 2025. The President seeks to extend them, arguing that lower taxes drive economic growth. Reduced corporate taxes boost profits, incentivizing companies to expand domestic production. Additionally, lower business costs often translate into lower prices for consumers.

Deregulation

Deregulation is another key component of President Trump’s plan to stimulate business expansion. Excessive government regulations can make a country less attractive for foreign investment and discourage businesses from expanding, innovating, or hiring. Compliance with strict labor laws, environmental regulations, and financial reporting requirements can slow decision-making and reduce flexibility.

Regulatory enforcement also carries a significant cost. In 2022, the U.S. government spent approximately $81 billion on regulatory agencies overseeing financial, environmental, labor, and other regulations, according to the Office of Management and Budget (OMB). Reducing regulatory burdens could encourage investment and economic growth.

Tariffs

Tariffs are taxes on imported goods. The importing company pays them. For example, Nike, an American company, must pay a tariff to the U.S. government for shoes manufactured in Vietnam and sold in the U.S. To offset this cost, a company like Nike may absorb it, pass it on to consumers through higher prices, or relocate production to the U.S.

The primary goal of tariffs is to protect domestic manufacturers and their workers by encouraging consumers to buy American-made goods. Higher import prices reduce demand for foreign products, making domestically produced alternatives more attractive.

However, do tariffs always work as intended?

In 2018, during President Trump’s first term, the U.S. imposed 25% tariffs on imported steel under Section 232. Initially, U.S. steel companies benefited as prices rose. However, the higher costs also hurt industries reliant on steel, leading some companies to move production offshore to avoid inflated prices. For example, Harley-Davidson was one of many companies that relocated some manufacturing overseas rather than pay more for U.S. steel. As a result, domestic demand for American steel declined, and U.S. steel production ultimately fell.

This unintended consequence illustrates a key challenge of tariffs: while designed to protect certain industries, they can sometimes harm them instead.

President Hoover also imposed tariffs, hoping to revive the U.S. economy during the Great Depression. While most economists agree that tariffs were not the primary cause of the Depression, they likely contributed to a decline in domestic production.

Historically, Republicans in the late 1800s generally supported tariffs to protect American industries from foreign competition. The McKinley Tariff Act of 1890, which imposed tax rates between 38% and 49.5%, negatively impacted international trade and is credited with contributing to the economic recession of 1893.

For a detailed analysis of tariffs and their effects, see our lesson: Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas, and Licenses.

Many economists hope President Trump is using the threat of tariffs as a negotiating tool but will back off from using them. Tariff threats have been effective in securing agreements on border control. For example, Columbia agreed to accept deported migrants (AP), while Canada and Mexico strengthened their border security measures in response to U.S. pressure.

Closing Our Border and Deportation

According to the Pew Research Center, there were 11 million unauthorized immigrants in the U.S. in 2022, with approximately 8.3 million participating in the workforce. These individuals contribute to the economy by consuming U.S. goods and services, meaning a significant reduction in their numbers could negatively impact aggregate demand.

Imposing tariffs on Mexico could severely damage its economy, potentially leading to unintended consequences. A weakened Mexican economy could drive more people to seek work in the U.S., creating the very immigration pressures that President Trump aims to reduce. Implementing a policy that exacerbates the issue would be counterproductive.

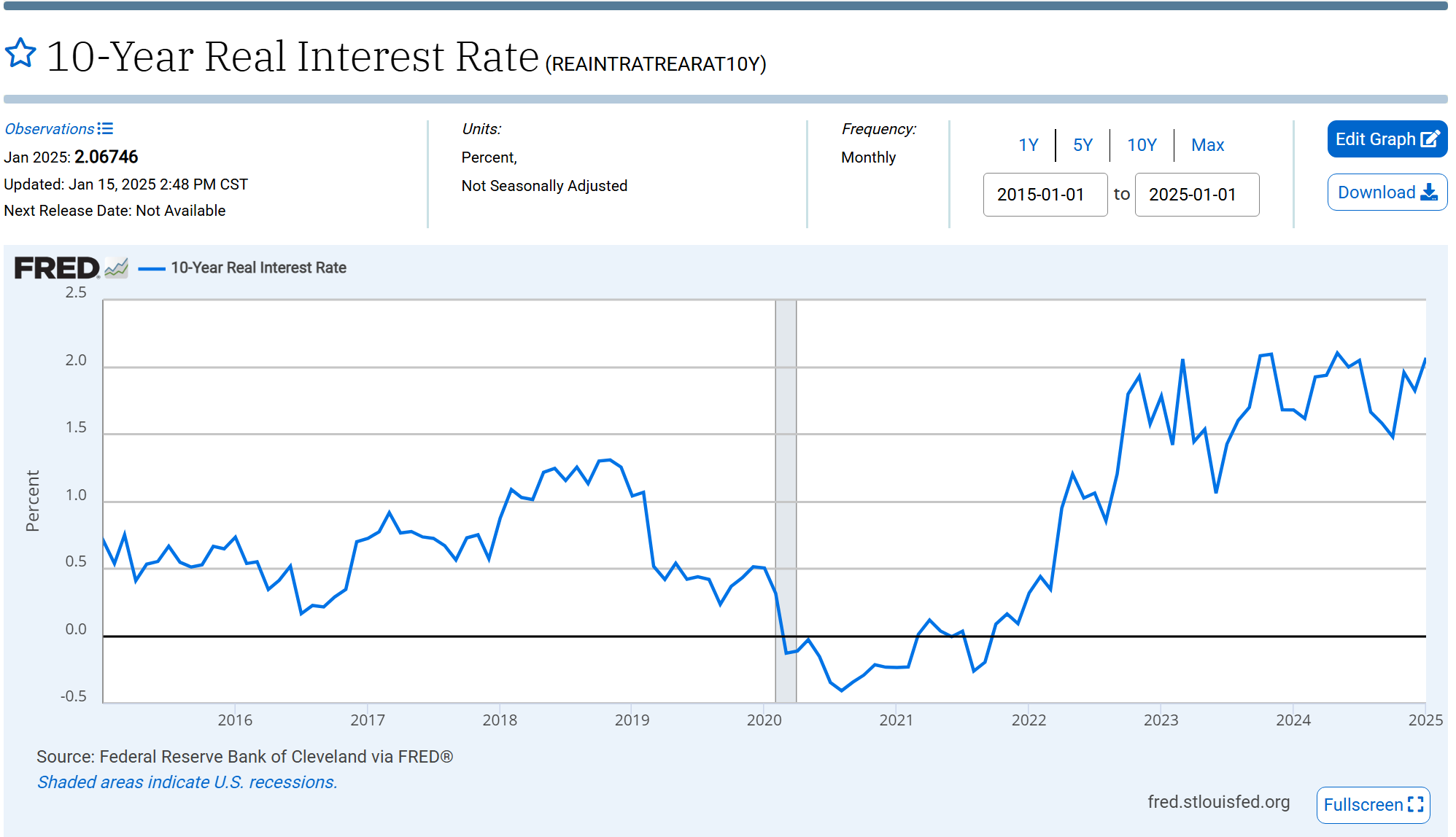

Record Deficits and High Real Interest Rates

A rising budget deficit could also hinder economic growth. The Congressional Budget Office projects that the deficit will increase from $1.9 trillion to $2.7 trillion by 2035. Congress faces two options: ignore the growing debt—risking higher interest rates that could crowd out business investment—or cut spending, which could also slow economic growth. Real interest rates are already at their highest levels in a decade. Further increases could drive up mortgage rates, putting additional strain on the housing market and stifling industry growth.

Most economists view President Trump’s policies as inflationary. The US economy heavily relies on immigrant labor, particularly in the agricultural, construction, restaurant, and hospitality industries. These sectors will face challenges in replacing workers, especially since most Americans are unwilling to take these jobs. Employers must raise wages to attract the necessary workforce, often leading businesses to increase prices to maintain profit margins.

Imported goods are typically less expensive than domestically manufactured goods because they can be produced at a lower cost in other countries. For example, US shoe companies import most of their shoes because manufacturers in Vietnam and China can produce them more efficiently than domestic producers. Some of the cost savings are passed on to consumers. The extent of the price increase depends on the tariff rate and the availability of substitutes. When substitutes are limited—especially for goods with inelastic demand—consumers bear a larger share of the tariff’s cost. For example, the US imports approximately 60% of its fruits and 40% of its vegetables, which means they can expect to pay more for these essential foods at the grocery store (NBC).

The job market remains strong, with payroll growth sustaining economic expansion and unemployment holding steady at a healthy 4%. However, significant cuts are likely in the public sector.

President Trump, with the assistance of Elon Musk, aims to cut federal spending and improve efficiency, which includes a substantial reduction in the federal workforce. More than 2 million federal employees were offered an eight-month severance package. The administration intends to shrink the federal labor force by approximately 200,000 workers—surpassing IBM’s historic layoff of 60,000 employees, the largest in US history. So far, around 50,000 have accepted the offer. However, President Trump has warned of further job cuts, threatening reductions at multiple agencies for those who do not resign.

One of the hardest-hit agencies is the US Agency for International Development (USAID), where nearly all 10,235 employees have been placed on paid leave and instructed to return home within 30 days.

The labor market will remain strong in 2025, but hiring will likely slow as economic growth moderates. The extent of this slowdown will depend on the administration’s new tax policies and its stance on tariffs, immigration, and federal workforce reductions.

As 2025 unfolds, the US economy faces both opportunities and challenges. Consumer spending and job growth have remained strong. Policies on tariffs, immigration, and federal workforce reductions will shape the trajectory of economic expansion. Tax cuts and deregulation may encourage business growth, but rising deficits, high interest rates, and potential inflationary pressures pose risks.