Tax Credit

View FREE Lessons!

Definition of a Tax Credit:

A

tax credit is a direct deduction of a tax bill. A tax credit is intended to reward businesses for behaviors that help their employees, community, and/or the economy.

Detailed Explanation:

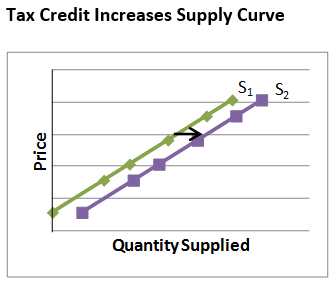

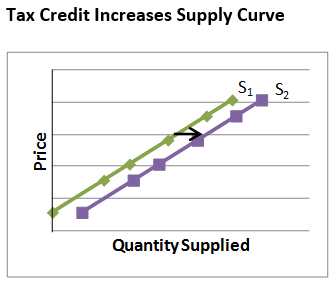

Governments may provide a tax credit to assist certain businesses. A tax credit is a direct deduction of a tax bill. Its intent is to reward businesses for behaviors that help their employees, community, or economy. Assume a business owes $100,000 in taxes in a specific year. Also, assume the business makes several investments that year that carried a tax credit of $10,000. The business would owe only $90,000 in taxes. (The $100,000 amount owed before the credit less the $10,000 tax credit.) Think of a tax credit as a negative tax, so a credit would reduce costs and result in a rightward shift in the supply curve.

Dig Deeper With These Free Lessons:

Changes in Supply – When Producer Costs ChangeGross Domestic Product – Measuring an Economy’s Performance

Fiscal Policy – Managing an Economy by Taxing and Spending

Supply – The Producer’s Perspective

Who Really Pays an Excise Tax