M2 is the measure of the money supply that includes M1, time deposits less than $100,000, and retail money market funds. M2 is less restrictive than M1 but does not include stocks, bonds, and other investment accounts that M3, the broadest measure of money, includes.

There are several measures of money. Cash is accepted everywhere. But what about money in a certificate of deposit (CD) or a savings account that does not have check-writing privileges? Technically these are not money because merchants do not accept them as a medium of exchange. However, they certainly are “near money” because a buyer can convert them into cash within hours. In other words, a CD is liquid enough that most people would consider CDs money. Economists use two measures of money depending on the asset’s liquidity. M1 is the most limiting measure because it does not include time deposits. M2 includes M1, time deposits, and retail money market accounts.

M2 is a broader definition of money because it includes M1 and deposits economists refer to as “near money.” These include accounts that do not have check-writing privileges, such as time deposits and retail money market accounts. (CDs exceeding $100,000 and institutional money market accounts are not included in M2 but are included in M3.)

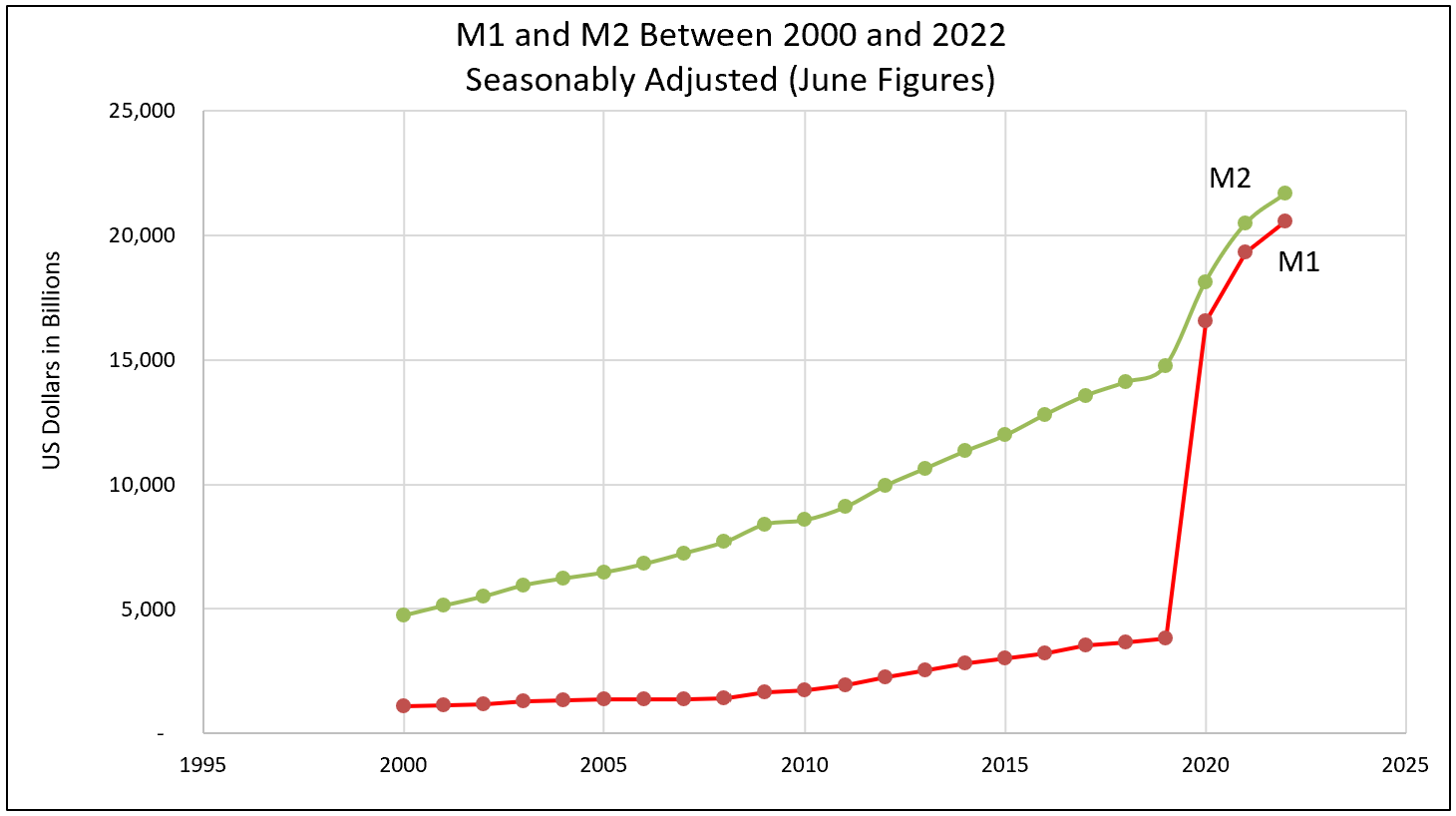

Source: Federal Reserve Money Stock Measures - H.6 Release, May 23, 2023

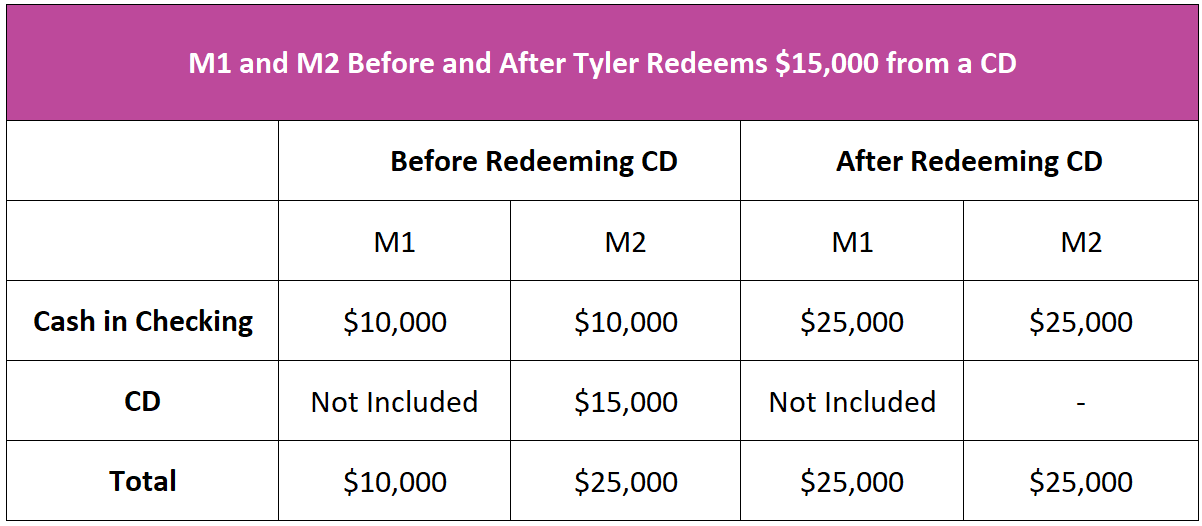

Economists frequently prefer M2 because it is a more stable measurement of money. For example, assume Tyler purchases a $25,000 truck and is paying “cash” for it. He does not have enough money in his checking account, so he redeems his $15,000 CD. Before, he had $10,000 in cash, but after withdrawing his CD, he has $25,000 in cash. The table below illustrates how M1 would increase from $10,000 to $25,000 after redeeming his CD, but M2 equals $25,000 before and after withdrawal.

Time deposits have restrictions. For example, certificates of deposit lose interest if withdrawn prematurely. Retail money market accounts may restrict the number of transactions and/or require a minimum check amount. Before May 2020, savings accounts were less liquid than today because deposit holders were limited in the number of withdrawals they could make in a month as part of Regulation D. Few savings accounts had check-writing privileges. However, on April 24, 2020, the Federal Reserve waived the Reg. D limit on the number of transactions permissible. Suddenly many money market accounts and savings accounts became more liquid, and the definition of M1 changed to include these other checkable deposits.

The graph below illustrates the growth of M1 and M2 since 2000. The graph’s enormous increase in M1 between 2019 and 2020 results from adding other transaction deposits to M1. The $1.5 trillion difference between M1 and M2 beginning in June 2020 represents the small-denomination time deposits without check-writing privileges and retail money market accounts included in M2 but not M1.

Source: Federal Reserve Money Stock Measures - H.6 Release, May 23, 2023

The sharp increase in 2020 and 2021 reflects the Federal Reserve’s addition of money to the economy during the pandemic to prevent a severe recession. The curves begin to flatten and will eventually curve downward as the Federal Reserve tightens its monetary policy to slow inflation in 2023.

Fractional Reserve Banking and The Creation of Money

Monetary Policy – The Power of an Interest Rate

What is Money