Leading economic indicators are measurable variables in an economy that normally change before the rest of the economy.

Businesses, investors, economists, and governments know that all expansions must end, but they do not know when a contraction in the economy will begin. Companies would love to know when a recession would start or end before deciding to expand a manufacturing facility or hire additional workers. Investors would likely sell a company’s stock if they knew a recession and lower profits were imminent. Governments have established policies to control their economies, intending to further economic growth and minimize the hardship of a recession. However, sometimes it is not easy to know when to implement them. Leading economic indicators help.

Economists and businesspersons use leading economic indicators to identify the future trends of the business cycle. Because leading economic indicators change before the rest of the economy changes, they are used to identify trends.

The consumer confidence index is a leading economic indicator. Economists pay close attention to the consumer confidence index because it measures consumer optimism. Increases in the consumer confidence index are indicative of an improving economy. Generally, consumers spend more when they are confident the economy is prospering because they are more likely to retain their job and/or earn a higher income.

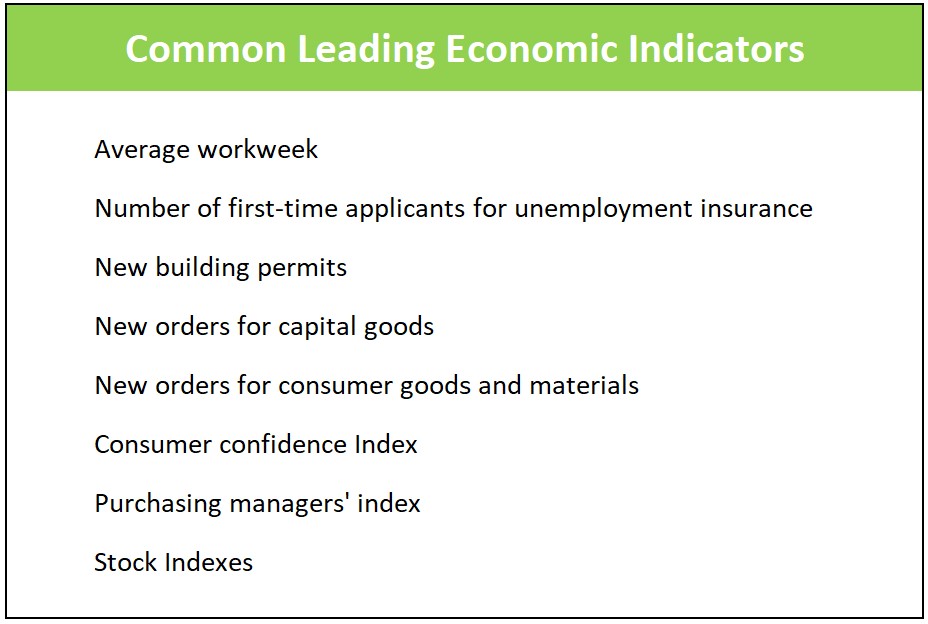

Frequently business behaviors are used as a leading economic indicator. Workers work longer hours when the economy is booming, so measuring changes in the average workweek is a leading economic indicator, especially in the manufacturing sector, because manufacturers alter their production to meet their expected demand. Companies may lay people off if they anticipate a drop in demand. Hence, the number of first-time applicants for unemployment insurance is a leading economic indicator. If the number increases, it is an indication that the economy is slowing. However, when it falls, it is a sign of economic growth. A list of common leading economic indicators is below.

Central banks monitor leading economic indicators. Frequently, they aspire to move before a severe problem manifests itself rather than wait for it to persist.

In contrast, economists and business analysts use lagging economic indicators to confirm economic trends. For example, when the number of first-time unemployment insurance applicants increases, the economy is slowing. However, it takes weeks to show up in the unemployment rate. An increase in the unemployment rate confirms that the economy is losing strength. Therefore, the first-time claims index is a leading economic indicator, and the unemployment rate is a lagging indicator.

Business Cycles

Gross Domestic Product - Measuring an Economy's Performance

Monetary Policy - The Power of an Interest Rate

Fiscal Policy - Managing an Economy by Taxing and Spending