An excise tax is a tax levied on a specific product or service at production or purchase and is normally included in the price of a product or service.

Excise taxes are usually paid by the producer and “passed through” to the consumer in the form of a higher price. They are “hidden” from consumers because they are not easily recognized in the price. Examples of products commonly charged an excise tax are gasoline, firearms, airline tickets, cigarettes, and alcohol. Federal excise taxes provided approximately three percent of total US federal tax revenues between 2008 and 2011.

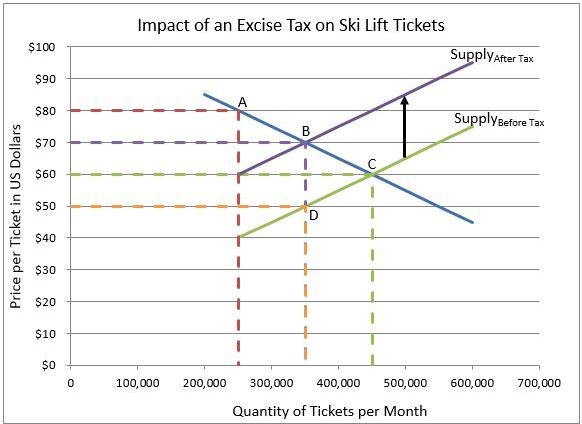

The effect of an excise tax on the price and quantity sold of a good or service can be illustrated using a supply and demand graph. Assume a municipality imposes a $20 excise tax on every ski ticket sold. Suppliers would be willing to provide fewer tickets at all prices. A $30 ticket now yields $10 in revenue because the ski resort would be required to pay the municipality $20. Likewise, a $110 ticket generates $90 in revenue for the resort. The resort's supply curve would have a parallel shift upward of $20, or the amount of the excise tax. Prior to the tax, 450,000 tickets were sold at $60, point C on the graph below. After the tax, the equilibrium price increases to $70, and the equilibrium quantity decreases to 350,000 tickets. Note that the price of the ticket does not increase by the full amount of the excise tax. At $80 ($60 plus the $20 excise tax), only 250,000 tickets would be sold. (Point B on the graph.) Instead, management chooses to absorb some of the tax to prevent sales from falling to 250,000.

In this example, the tax burden is shared equally. However, this is not always true. The party that bears the greatest burden is the party with the more inelastic demand or supply curve, or in other words, the party with fewer options. Consumers bear most of the excise tax when the demand curve is more inelastic than the supply curve. Suppliers bear most of the tax incidence when their supply curve is more inelastic than the demand curve. Intuitively, this makes sense. Consumers with an elastic demand for the good or service (such as skiing) typically have substitutes (such as ice skating). Or they may view the good or service as inessential and decide not to pay the tax. These consumers may choose to use a substitute good or service or to do without it entirely. Conversely, consumers with an inelastic demand are less sensitive to price increases and would be more willing to pay a tax. They will pay a higher price because they need access to the goods or services. Suppliers with an inelastic supply have less flexibility in managing their supply, so they are better off absorbing more of the tax rather than reducing production more at a higher price.

Who Really Pays an Excise Tax

Supply and Demand – The Cost and Benefit of Price Controls

Price Elasticity of Demand – How Consumers Respond to Price Changes

Gross Domestic Product – Measuring an Economy's Performance