The Federal Reserve is the lender of last resort. Banks can go to the Fed’s discount window when they need to borrow money to strengthen their reserves. Borrowing at the Philadelphia discount window increased from $1 billion in 2007 to $2.3 trillion in 2008, the year of the Great Recession. This added much-needed liquidity to the economy.

Imagine you manage Cloudy Bank, and your excess reserves are slightly lower than you feel comfortable with. You are about to release the bank’s financial statements and know that they will not be well received and you are concerned several of your largest depositors may withdraw their funds. You do not want to risk having your reserves drop below the required minimum. You know that Windy Bank has a lot of excess reserves. Windy Bank has been accumulating reserves because its management anticipates closing some large loans within the next few days. What would you do? One solution is to borrow some of Windy Bank’s excess reserves short term. Windy Bank likes that idea because these reserves would earn some interest.

Daily, banks with excess reserves lend to banks short of funds. After all, they want their excess reserves to earn interest. The federal funds rate is the Federal Reserve’s target rate for short-term (usually overnight) loans between banks. The Fed uses open market operations to nudge the federal funds rate toward the Fed’s target.

Unfortunately, Cloudy Bank is in financial trouble, so other banks are fearful you will be unable to repay them. Where do you go? You can go to your local Federal Reserve Bank and borrow from their “discount window.” The discount rate is the interest rate the Federal Reserve Banks charge when commercial banks and other depository institutions borrow from the Fed. The Federal Reserve requires collateral when making these loans. Usually, the collateral is treasury bonds or other government securities.

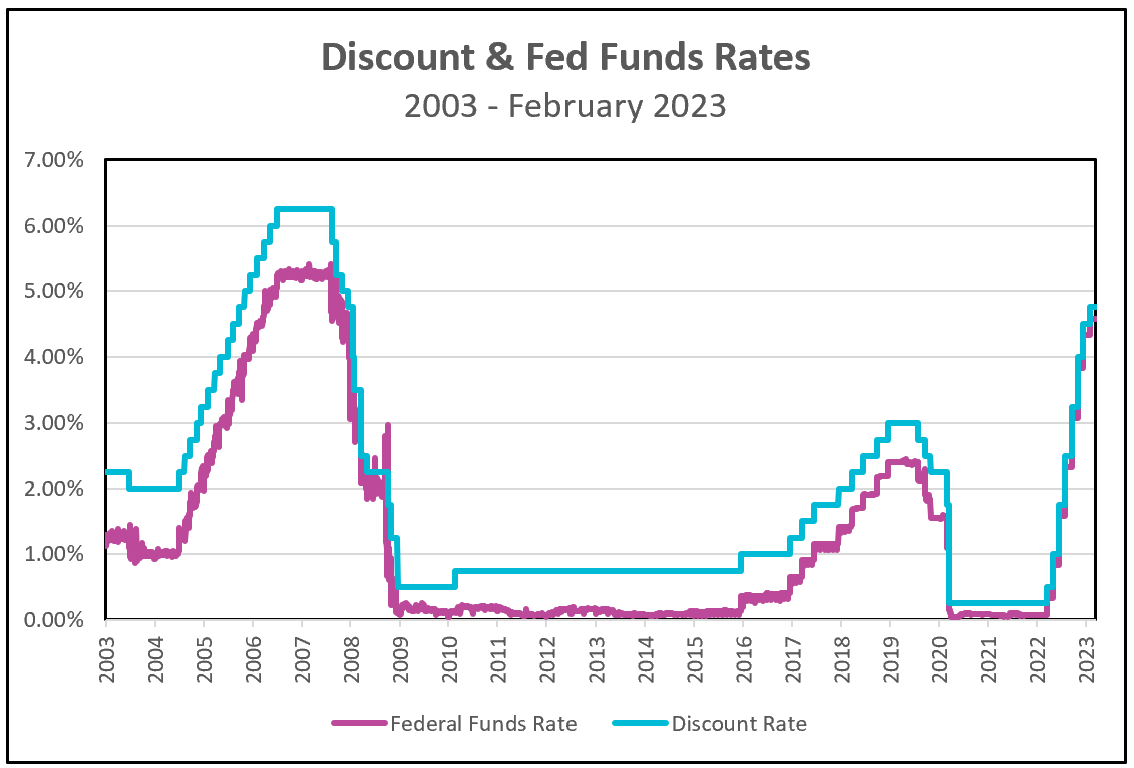

The discount rate is usually higher than the federal funds rate since the Federal Reserve wants to discourage banks from using the discount window. The graph below illustrates the relationship between the discount and federal funds rates since 2003.

Source: Federal Reserve

The Federal Reserve uses the discount rate to manage the economy. During periods of inflation, it raises the discount rate to increase borrowing rates and slow the growth of the economy’s aggregate demand while reducing business investment. It lowers the discount rate to prod economic growth.

Except for a brief downturn following 9-11, the economy grew between 2001 and 2007. Inflation was tame during the earlier years but began to heat up in 2004 and 2005. The Fed responded by increasing the discount rate in July 2004 after inflation exceeded 3 percent for three consecutive months. It continued to increase the discount rate gradually until June 2006, when it peaked at 6.25 percent.

Economic growth slowed in 2006. During the third quarter, RGDP grew by less than one percent. Signs of weakness became apparent, particularly in the residential real estate market. In August 2007, the Fed began significantly reducing the discount rate. It was probably too late, but policymakers had been concerned that inflation was too high because it remained above the Fed’s 2.0 percent target. Then the mortgage industry imploded. Lehman Brothers, the fourth largest investment bank, filed for bankruptcy on September 15, 2008. Ten days later, the Office of Thrift Supervision seized Washington Mutual’s banking operations. Washington Mutual was the largest savings and loan association in the United States. Many other financial institutions, including Merrill Lynch and Wachovia, were also in trouble. The Fed stepped in quickly and reduced the discount rate from 2.25 percent to 1.25 percent within a month. By the end of 2008, the discount rate equaled 0.50 percent.

The US economy prospered between 2009 and 2016. Inflation remained low, perhaps too low. Economists were concerned prices would deflate during 2009 and 2015 when inflation remained nearly zero. Others were concerned monetary policy would be ineffective during a recession if interest rates remained too low. So, in 2016 the Fed began to raise the discount rate slowly. By the end of 2018, the discount rate was 3.0 percent.

Then COVID struck in December 1919. At that time, the discount rate equaled 2.25 percent. However, policymakers envisioned a severe recession, possibly a depression if they did not take desperate measures. Congress quickly provided households with lost income while the Fed slashed rates. In less than two months, policymakers at the Fed had cut the discount rate from 2.25 percent to 0.25 percent. A severe recession was averted. But it was replaced by inflation. Government subsidies helped increase the economy’s aggregate demand; at the same time, suppliers were facing severe challenges in delivering their products. Their costs increased, and they raised their prices.

The Fed had a belated response to the escalating price level. Many policymakers believed inflation would subside when suppliers succeeded in addressing their supply constraints. But a labor shortage and a pent-up demand persisted and pushed prices higher. In June 2022, the consumer price index reached 9.1 percent. The Fed responded with an unprecedented eight increases in the discount rate beginning in March 2022, including four consecutive increases of 0.75 percent. On February 28, 2023, the discount rate equaled 4.75 percent.