Depreciation is a measure of the amount a capital good is used up over time due to wear and tear or becoming obsolete.

Is your two-year-old car worth as much today as when you purchased it? Probably not. Your car has depreciated. In other words, it has lost value because its useful life has shortened. For example, if you purchased your car for $20,000 and it is now worth $10,000, it has depreciated by $10,000.

In accounting, depreciation refers to the reduction in an asset’s value due to use, wear and tear, or obsolescence. When an asset generates income over multiple years, taxpayers typically cannot deduct its entire cost in the year of purchase. Instead, depreciation spreads the cost over the asset’s useful life. Initially, the cash spent on the asset often exceeds the depreciation deduction. However, in later years, no additional money is spent, yet depreciation continues to reduce taxable income.

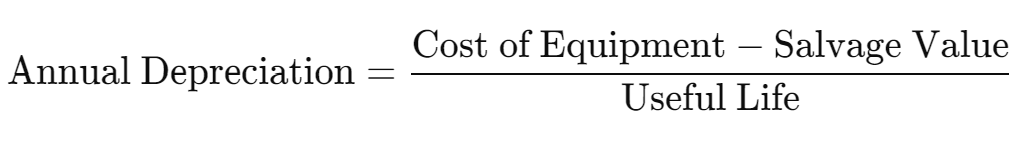

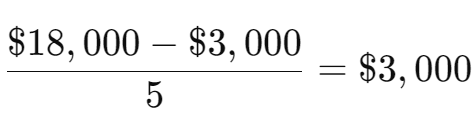

For example, suppose you buy business equipment for $18,000 with a useful life of five years and an expected resale value of $3,000 at the end of that period. Using the straight-line depreciation method, you would deduct $3,000 annually over five years. The formula is:

resulting in the following calculation.

Suppose your business generates an income of $73,000 per year before depreciation. In the first year, your business would generate $73,000 in operating income, but after spending $18,000 on equipment, your positive cash flow would be $55,000 ($73,000 income minus $18,000 spent). However, for tax purposes, you would deduct only $3,000 for depreciation, leaving taxable income of $70,000 ($73,000 - $3,000). Your cash flow is lower than your taxable income in the first year.

Assume that in years 2 through 5, your business continues to generate $73,000 in income annually. Since no further cash is spent on the equipment, your positive cash flow would remain $73,000. However, you would still deduct $3,000 for depreciation each year, leaving a taxable income of $70,000.

(Note: This example is for illustrative purposes only. Consult your accountant for the appropriate depreciation calculation and tax treatment specific to your situation.)

IRS Requirements for Depreciation

The IRS manual outlines the following conditions for claiming a depreciation deduction:

Economic depreciation refers to a decrease in the value of an asset resulting from market conditions. For example, if the price of a stock falls, it indicates a depreciation in its value. However, since the stock’s usage does not cause this decline, the Internal Revenue Service (IRS) does not permit the depreciation to be spread over several years. Instead, any loss in value is usually claimed as a capital loss when the stock is sold.

On the other hand, an asset that increases in value is said to appreciate. Real estate, for example, often appreciates over time. Despite this, the IRS allows the depreciation of income-producing properties for tax purposes. This favorable treatment is one of the most appealing aspects of real estate investment, as it allows investors to deduct a portion of the property’s value each year, thereby reducing taxable income.

Depreciation is also a term commonly used to describe changes in currency exchange rates. A currency depreciates when its value decreases relative to another currency. For example, if $1.00 is initially equivalent to €1.00, but six months later, it takes $1.50 to purchase €1.00, the dollar has depreciated relative to the euro, as more dollars are needed to buy the same amount of euros. Conversely, this also means the euro has appreciated relative to the dollar. In summary, when it takes more of Currency A to purchase Currency B, Currency A has depreciated, and Currency B has appreciated.

Gross Domestic Product – Measuring an Economy’s Performance

Factors of Production – The Required Inputs of Every Business

Capital and Consumer Goods – How They Influence Productivity

Capital – Financing Business Growth