A deficit is a shortage or deficiency, most often related to finances.

Trade Deficit

A trade deficit occurs when a country imports more goods and services than it exports over a specific period. In economic terms, the value of a country’s imports exceeds the value of its exports, resulting in a negative balance of trade.

Trade Deficit=Value of Imports−Value of Exports

A trade deficit is not inherently good or bad but depends on factors like the country’s economic structure, the reasons for the deficit, and how it is financed. A trade deficit can indicate strong domestic demand for foreign goods, possibly signaling economic strength. Alternatively, it may suggest over-reliance on imports or weak competitiveness in export markets. A country may need to borrow from foreign lenders or attract foreign investment to finance a trade deficit, which could increase debt or dependency on external capital. Persistent trade deficits can affect a country’s currency value, potentially leading to depreciation.

Budget or Fiscal Deficit

Governments have a budget deficit when tax revenues are less than government spending. Conversely, a budget surplus emerges when tax revenues exceed spending. Governments finance their spending through a mix of tax collection, issuing debt, or printing money. However, determining how to address increased spending or a growing deficit presents a dilemma. Tax hikes are generally unpopular and can impede economic growth while printing money risks inflationary pressures. Issuing debt escalates government interest payments and may crowd out investment by businesses and households.

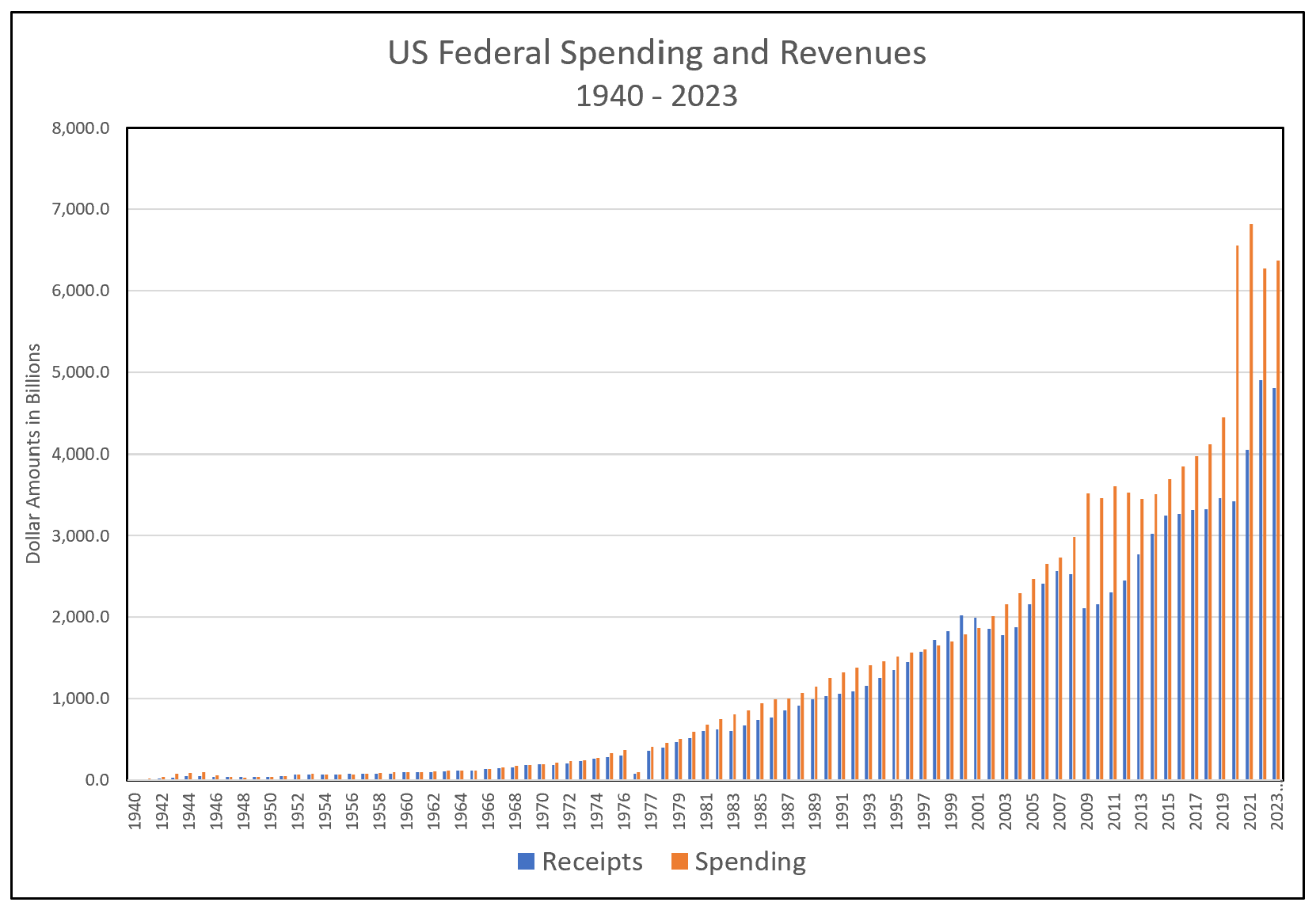

Moreover, cutting spending to reduce deficits can be politically contentious, as beneficiaries of government programs often resist such measures. Since 1970, the only period the US government recorded a surplus was from 1998 through 2001. In response to the economic fallout from COVID-19, the US government incurred significant deficits to mitigate its impact. The accompanying graph illustrates the rapid expansion of government spending and depicts the historical correlation between government outlays and revenues.

Source: OMB Historical Tables, Table 1.1

Most economists concur that the United States needs to address its deficit. They argue that healthcare, social services, or military expenditures are too high. Recognizing the issue of overspending is straightforward. However, reaching a consensus on deficit reduction poses a significant challenge due to the diverse ideologies shaping our politicians’ perspectives on which services to trim or who should bear the burden of tax increases.While deficits are typically associated with government fiscal management, households, and businesses can operate at deficits when their expenses surpass their income.

Economics – Managing our Scarce Resources

The Federal Budget and Managing the National Debt

Opportunity Costs – The Cost of Every Decision

Fiscal Policy – Managing an Economy By Taxing and Spending

Marginal Analysis – How Decisions Are Made

Economic Systems