Deadweight Loss

View FREE Lessons!

Definition of a Deadweight Loss:

A

deadweight loss refers to the loss of economic efficiency that occurs when the equilibrium outcome in a market is not achieved or is distorted due to external factors, such as taxes, subsidies, price controls, or monopolistic pricing. It represents the value of the goods or services that are no longer produced or consumed as a result of these distortions, leading to a loss in total societal welfare.

Detailed Explanation:

A deadweight loss is the added burden placed on consumers and suppliers when the market equilibrium is altered because of tax, subsidy, externality, government regulation, or monopolistic pricing. A deadweight loss results when the supply and demand are out of equilibrium.

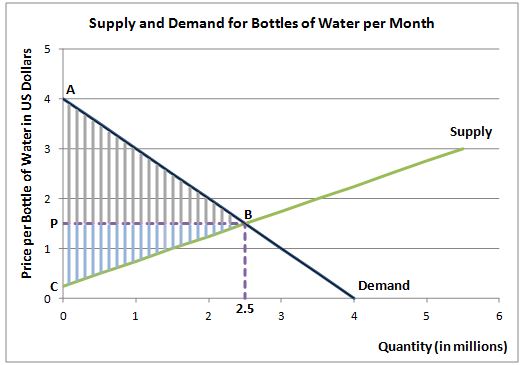

The greatest market efficiency occurs when the sum of the consumer surplus and producer surplus is maximized. Graphically this is where the supply and demand curves intersect. Graphs 1 and 2, the supply and demand for bottled water, illustrate a deadweight loss. The sum of producer and consumer surpluses is equal to the shaded areas on Graph 1, where APB is the consumer surplus and PBC is the producer surplus. The total surplus equals ABC.

Graph 1

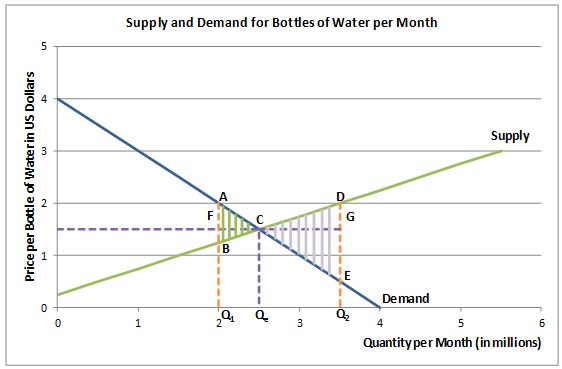

When the production is less than optimal, (Q

1 on Graph 2), there is a shortage and a loss of efficiency. This loss is the area ABC, with AFC being the loss of consumer surplus and CFB resulting from a producer surplus loss. At Q

2 there is a surplus. Overproduction results in a loss of efficiency. The total loss is CDE, with CDG being the producer surplus loss and CGE being the consumer surplus loss.

Economists refer to this loss as a deadweight loss. A loss of efficiency from overproduction means that too many resources have been allocated to the production. When there is a shortage, society would like more resources allocated to produce a good or service. Deadweight loss is a measure of the efficiency lost from production levels that are less than or more than society’s optimal production level (as defined by where the supply and demand curves intersect). Deadweight loss can be measured by the reduction in consumer and producer surpluses. In other words, at quantities less than the optimal, suppliers are “leaving some money on the table” by not producing the amount society would be willing to purchase, so there is a loss to producers. Consumers are paying more than they would need to so they too lose. When more is produced than is socially desirable, higher-cost producers lose money, so there is a loss of producer surplus, while consumers pay more than they need to at the larger quantity.

Graph 2

Government policies such as the minimum wage result in a surplus of workers. The social cost is the increase in unemployment because the minimum wage exceeds the equilibrium wage. Rent control causes a housing shortage because the lower-than-market rent increases the number of families seeking housing while reducing the number of investors willing to provide rental units. The deadweight loss is the social cost resulting from the shortage of housing.

Taxes that shift the supply curve result in a deadweight loss. A deadweight loss is determined by assessing the loss of production and the higher price when the tax alters the market equilibrium. The inefficient allocation of resources causes a social cost. For example, two costs resulting from an excise tax are included in the deadweight loss. First, the equilibrium price increases because the tax pushes the equilibrium price higher. Second, there is also a drop in the equilibrium quantity. A deadweight loss is determined by assessing the loss of production and the higher price when the tax alters the market equilibrium.

Dig Deeper With These Free Lessons:

Supply And Demand – Producers and Consumers Reach Agreement

Managing Supply Using Tariffs, Subsidies, Quotas & Licenses

Supply And Demand – The Costs And Benefits Of Price Controls

Who Really Pays An Excise Tax

Market Structures I – Perfect Competition and Monopoly