Cryptocurrency is a digital currency that uses a network of independent computers to track and verify transactions with blockchain technology. Cryptocurrency is generally not issued by a central authority such as a central bank.

Bitcoin is the most used cryptocurrency, but over 9,800 cryptocurrencies are in circulation. (Visit Coinmarketcap for a list of currencies and their prices.)

Any payment system requires three key components: a buyer, a seller, and a way to transfer payments. For instance, if Roberta purchases a puppy from Jerry for $3,000 using cryptocurrency, the transaction differs from a traditional banking method. When Roberta pays Jerry via check, Jerry depends on the banking system to transfer $3,000 from Roberta’s account to his. The bank ensures that Roberta has sufficient funds for this transaction.

However, a decentralized cryptocurrency system has no intermediary like a bank. This raises a crucial question: how can Jerry be certain that Roberta has $3,000 to transfer? One of the most challenging aspects of any cryptocurrency transaction is validating that the appropriate party receives the correct amount of money. Understanding how transactions work is essential to grasping the mechanisms of cryptocurrency.

Roberta and Jerry Open Accounts: Where is Roberta’s cryptocurrency stored without a centralized bank or security company? How is cryptocurrency obtained? Both Roberta and Jerry need a digital wallet to hold their digital currency before they can send or receive a payment. Many companies, such as Coinbase Commerce, provide brokerage accounts that help people buy, sell, transfer, and hold cryptocurrencies.

Roberta Pays Jerry: Account holders are issued private and public keys when opening an account. A person’s private and public keys are a matched pair. Together, they enable an account holder to transfer cryptocurrency to and from accounts without a third party, like a bank, to verify transactions.

A private key is a large, randomly generated string of alphanumeric characters. It is like a password that enables Roberta and Jerry access to their digital wallets. Private keys should never be shared. A public key is more analogous to an email address and can be shared. Roberta would pay Jerry by opening her digital wallet, specifying $3,000, pasting Jerry’s public key, and hitting send. Once Roberta digitally signs her order, every computer in the network receives a record of the transaction. At this point, Roberta cannot reverse the transaction. Jerry would use his private key to unlock his digital wallet, which proves he owns the cryptocurrency sent.

The transaction is verified: What keeps Roberta and Jerry honest? Roberta could lie and claim she sent Jerry $3,000. Jerry could claim that he never received the money or received less than he really did. What prevents Roberta from spending the same $3,000 for something else? Cryptocurrency systems rely on blockchain technology to verify transactions. Each transaction becomes part of a vast ledger which is distributed to a disparate network of computers. Transactions are recorded in blocks and linked in chains, hence the term “blockchain.” Most ledger holders must confirm the verification before it is added to the blockchain, making fraud highly unlikely.

Bitcoin uses proof of work as its validation method. Miners race to verify the transaction by solving a very complex mathematical puzzle. Theoretically, anyone with a computer can be a miner. Some cryptocurrency is rewarded to the miner who first solves the puzzle. Because the reward goes to the first entity that solves the problem, miners use more and faster computers. As the processing sophistication has grown, so has the consumption of energy. CNET reported on July18, 2022, that mining Bitcoin consumes about as much power as Argentina.

Many cryptocurrencies use the more efficient proof of stake to validate a transaction. It differs from proof of work because there are fewer verifiers, and they must stake or pledge some of their cryptocurrency before being chosen to validate a transaction. If a validation proves wrong, they relinquish their stake.

Jerry waits to be paid: The validation process takes time, so Jerry will not receive his payment immediately. It usually takes a few minutes, but it has taken several hours. Bitcoin miners averaged 9.0 minutes to validate a transaction on October 19, 2024. (Blockchain median confirmation time.)

Bitcoin is the most recognized cryptocurrency, and many large companies, including Microsoft, ATT, Pizza Hut, and the Miami Dolphins, accept it. However, at the beginning of 2024, most retailers did not accept Bitcoin. Many potential customers prefer Visa because it takes just a few seconds to process a transaction. Visa also processes approximately 757 million transactions daily, about 1,000 times more than Bitcoin.

Source: Investing.com

Source: Investing.com

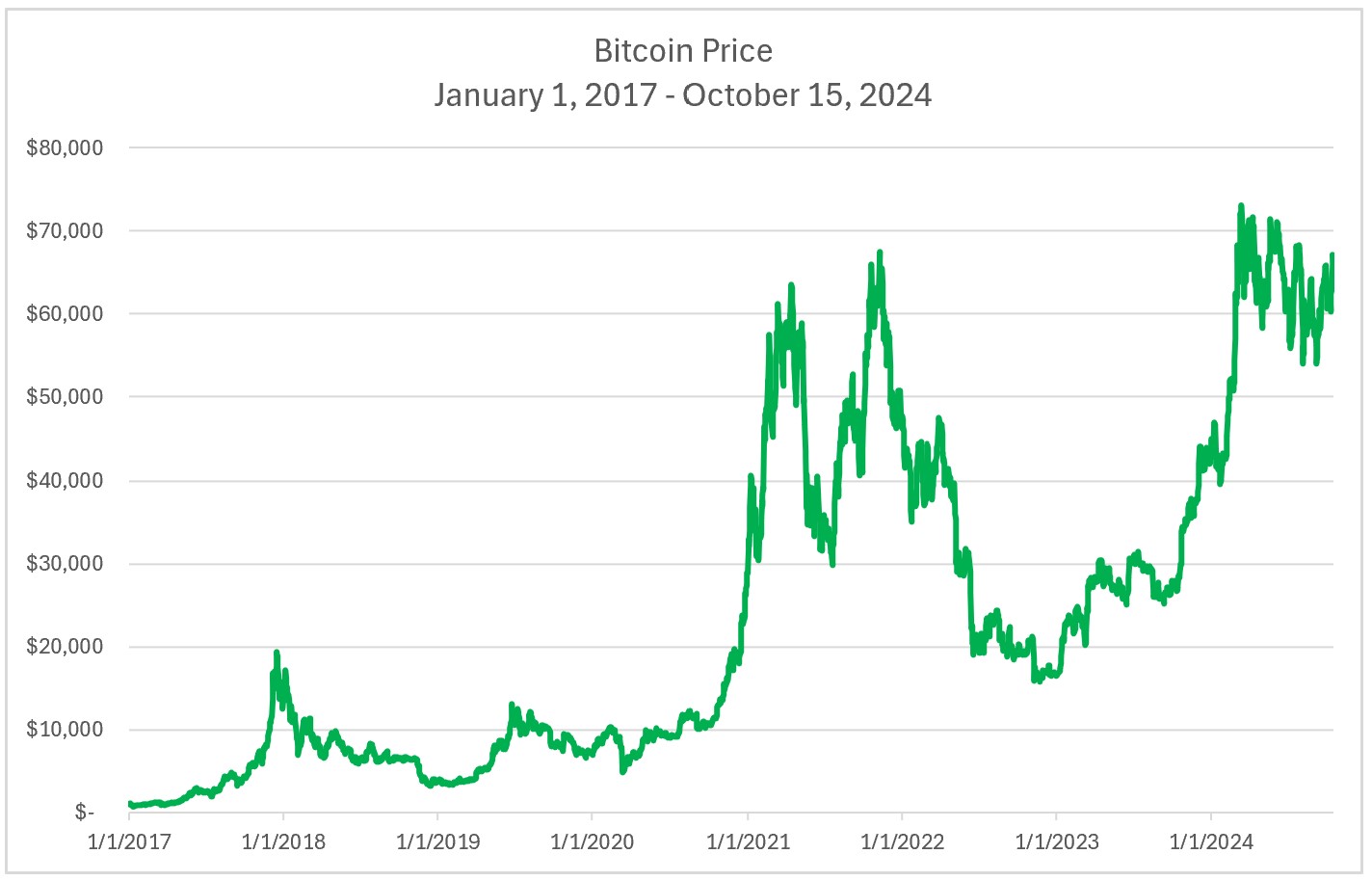

While cryptocurrency is designed as a medium of exchange, much of the excitement surrounding cryptocurrency is its value as an investment. An investor could have purchased one bitcoin for less than $200 on January 14, 2015, and sold it for $67,500 on November 18, 2021. However, Bitcoin’s price has been highly volatile, making it a very risky investment. Anyone should do extensive research and consult an expert before investing in cryptocurrency.

What Is Money

Monetary Policy – The Power of an Interest Rate

Fractional Reserve Banking and the Creation of Money