Contractionary Fiscal Policy

View FREE Lessons!

Definition of Contractionary Fiscal Policy:

Contractionary fiscal policy includes fiscal measures aimed at relieving inflationary pressures by slowing down the economy. Two strategies used are increasing the marginal tax rate and cutting government spending.

Detailed Explanation:

Fiscal policy uses government spending and taxation to manage the economy. Taxes not only finance government operations, but also redistribute income in most economies. The size of a tax and how taxpayers will respond to changes in tax laws are crucial factors in determining the effectiveness of a particular fiscal policy.

A government may administer contractionary fiscal policy when the economy is overheated. An overheated economy is prone to high levels of inflation, shortages in available workers, and investment bubbles such as the real estate bubble that triggered the Great Recession. Contractionary fiscal policy includes raising taxes, decreasing spending, or combining the two. These actions reduce an economy’s aggregate demand. As a result, businesses cut production as their inventories increase. They may lay off workers or reduce their working hours to produce less. Incomes fall, and households curtail spending. Businesses delay hiring or investing in new equipment. Businesses lower their prices to reduce their growing inventories.

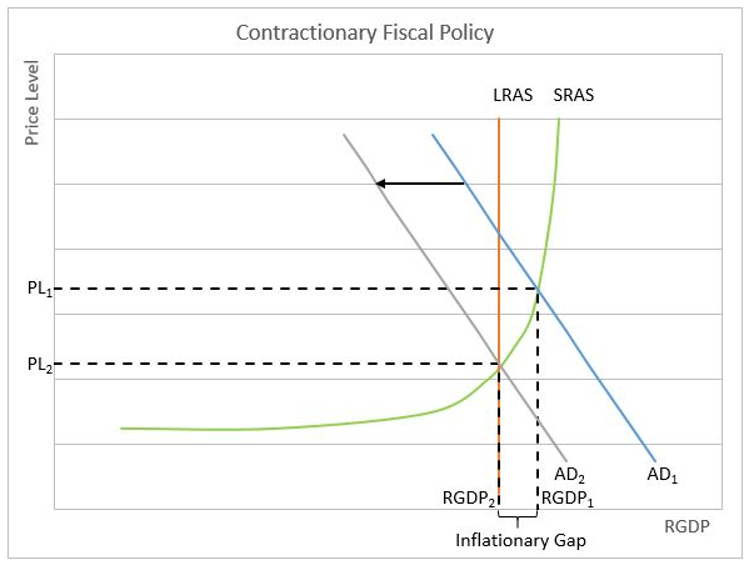

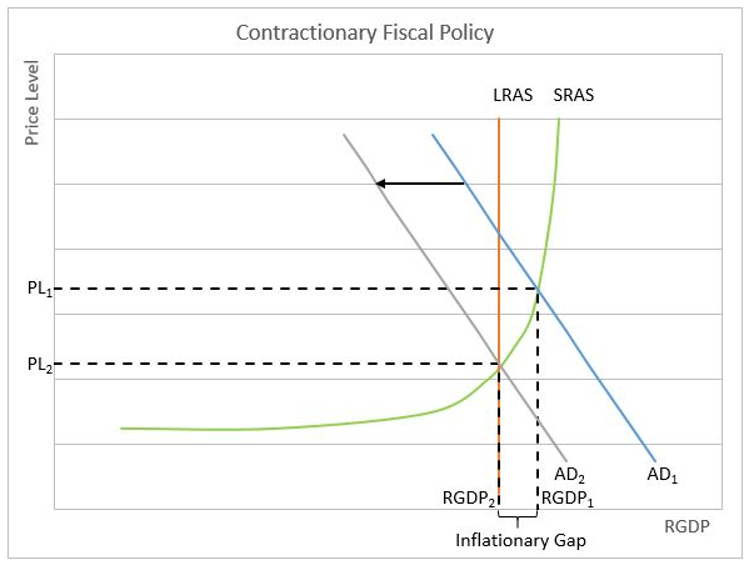

The graph below illustrates the use of contractionary fiscal policy. AD

1 represents the economy’s aggregate demand (AD), and its short-run aggregate supply is SRAS. The price level is at PL

1. The economy is overheated, which means it is operating beyond its long-run sustainability, as shown by the long-run aggregate supply curve (LRAS).

It’s important to note that any increase in aggregate demand would result in inflation and only a minimal increase in the economy’s real gross domestic product (RGDP). Contractionary fiscal policy is implemented by increasing taxes and cutting spending, causing aggregate demand to shift to AD2, which helps bring the economy into long-term equilibrium and reduces the price level to PL2.

While increasing taxes can help reduce inflation, it is often unpopular politically, so this approach is seldom employed. Similarly, cutting spending can be challenging because much of it is mandatory and needs congressional approval to modify. This includes expenses such as Medicare and Medicaid. For a representative, voting to reduce Medicare or Medicaid or spending proposals that directly benefit their district would likely jeopardize their position in Congress.

Fine-tuning an economy using fiscal policy is challenging. Recognizing a problem, agreeing on the best solution, and implementing a policy takes time. Once implemented, it takes time for the change to be felt throughout the economy. An action may prove counterproductive if the business cycle has entered a new phase. For example, if the economy is booming and there is excessive inflation, a contractionary policy is appropriate. However, if Congress takes an entire year before acting by passing a bill combining tax increases and spending cuts, it may be too late as the peak has passed and economic growth has already slowed. The consequence is that the economy slows more than is desired, which is why most economists favor monetary policy for fine-tuning the economy.

Dig Deeper With These Free Lessons:

Fiscal Policy – Managing an Economy by Taxing and Spending

Business Cycles

Causes of Inflation

Monetary Policy – The Power of an Interest Rate

The Federal Budget and Managing The National Debt