Key takeaways from the Bureau of Labor Statistics report The Employment Situation – November 2024 include:

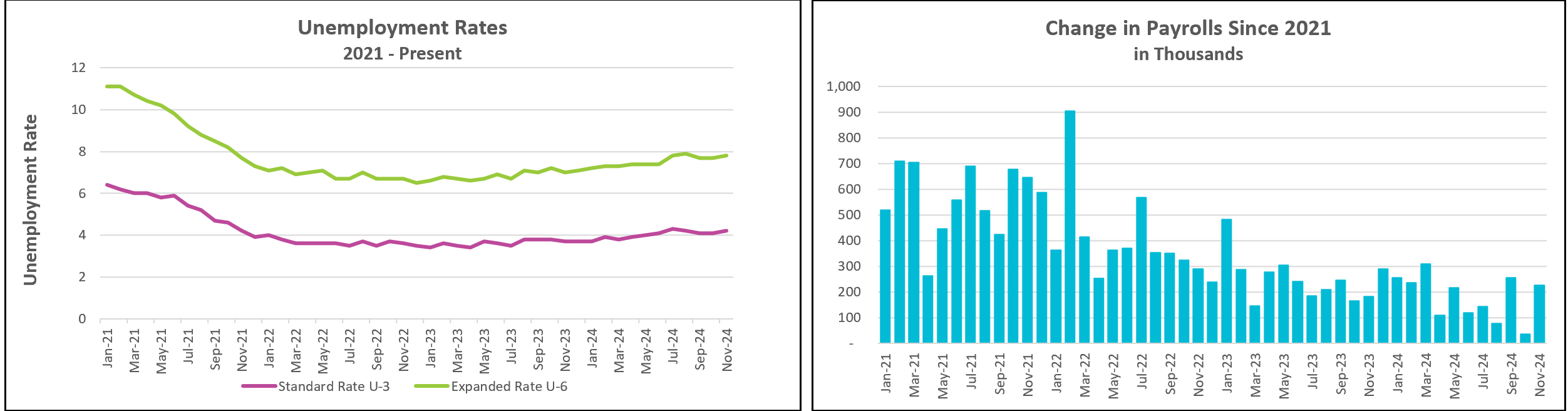

Hiring rebounded in November following a dismal October when Hurricanes Helene and Milton temporarily forced many businesses in the Southeast to close, and 33,000 Boeing workers were on strike. November’s unemployment rate ticked up slightly for unfavorable reasons, as some individuals left the labor force while the number of unemployed increased. Despite higher unemployment, the substantial payroll gains and upward revisions for previous months indicate that the labor market remains fundamentally robust, particularly within the service sector.

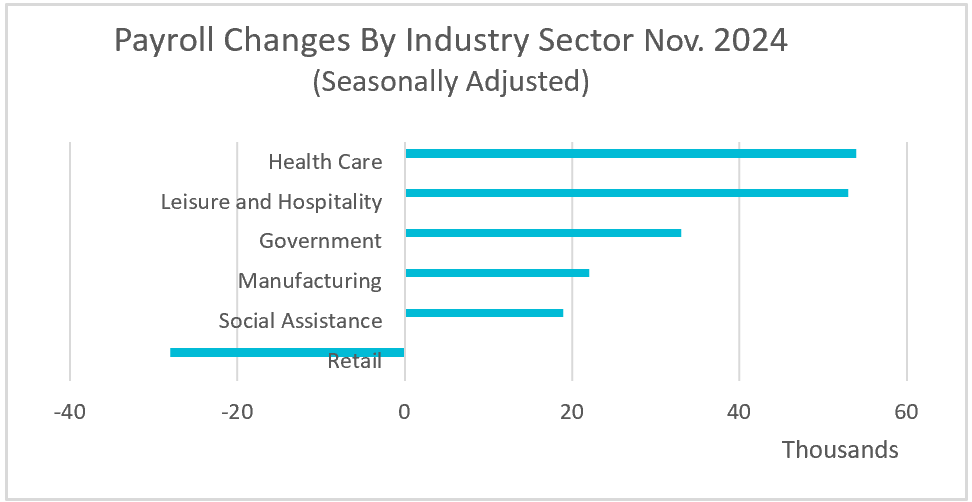

Over 70% of the job gains were concentrated in key industries: health care (54,000), leisure and hospitality (53,000), government (33,000), and social assistance (19,000). In the manufacturing sector, employment rose by 22,000, primarily due to the return of most of Boeing’s 33,000 striking workers. Without this boost, manufacturing payrolls would have declined. Over the past 12 months, the manufacturing sector has averaged a monthly loss of 5,000 jobs.

In retail, actual employment increased by over 250,000 workers, but after seasonal adjustments, it reflected a decline of 28,000 jobs. Economists apply seasonal adjustments to economic data to account for predictable fluctuations tied to seasonal patterns. These adjustments help uncover the underlying trends and cycles, free from the distortions caused by recurring seasonal variations.

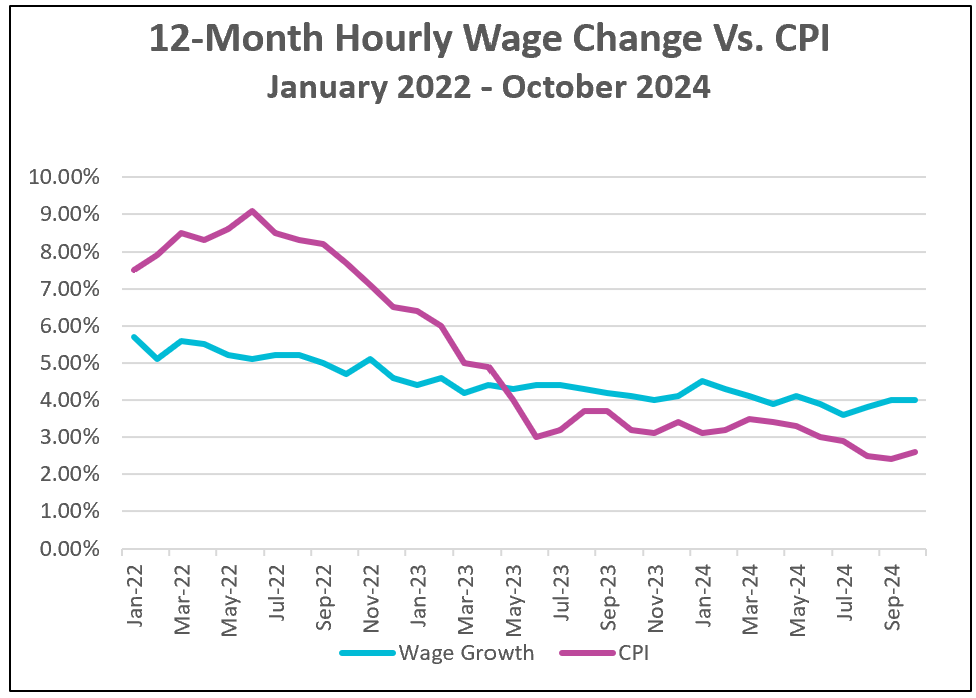

Earnings continue to outpace inflation. A 0.4% increase in hourly wages and a modest increase in the average workweek drove a 0.7% boost in weekly earnings. Higher real wages provide much-needed relief to many households by helping them balance their budgets.

However, challenges persist for the unemployed, who face greater difficulty securing new jobs. The average duration of unemployment has risen to 23.7 weeks—the longest in 2.5 years.

In a separate report, the Bureau of Labor Statistics (BLS) noted that job openings rose to 7.7 million in November, rebounding from a 3.5-year low in October. Additionally, the number of people quitting their jobs increased to 3.3 million. A higher quit rate typically reflects workers’ confidence in finding new employment. (JOLT)

Businesses, however, remain cautious. While they are hesitant to hire aggressively, they are also reluctant to lay off workers. There are currently 1.1 job openings for every unemployed worker, down from more than 2-to-1 two years ago, suggesting the labor market is stabilizing.

Most economists expect the Federal Reserve policymakers to continue cutting the benchmark interest rate at their meeting next week despite persistently high inflation. Inflation has trended lower, and the economy is showing signs of slowing. Policymakers fear that delaying loosening monetary policy may push the economy into a recession. However, President-elect Trump’s proposed economic policies will likely influence the economy. For instance:

Given these dynamics, the Federal Reserve may proceed cautiously, slowing the pace of monetary easing to assess the impact of the incoming administration’s policies.

Next week, when the Federal Reserve meets to discuss monetary policy, this report is unlikely to deter the expected 0.25% rate cut. However, the November’s Consumer Price Index (CPI) will be published on Wednesday. A significant increase may influence the Fed’s decision. Watch for HRE’s summary and analysis shortly after its release.