Here are the highlights from the Bureau of Labor Statistics' report, The Employment Situation – May 2024:

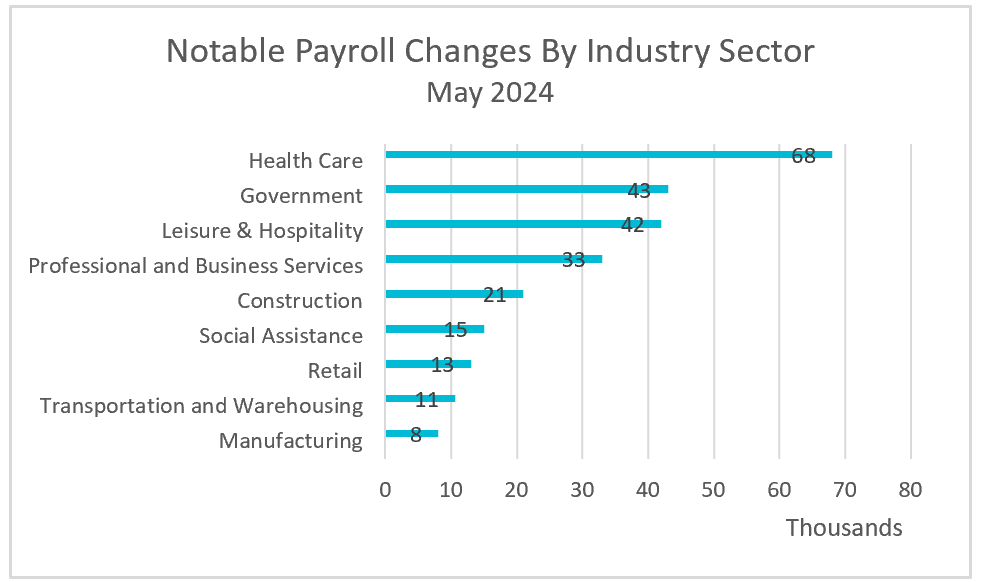

Once again, employers defy expectations by continuing robust hiring, surprising economists who expected the increase in interest rates and a slowdown in consumer spending to reduce the demand for labor. Employment gains were broad-based, with services including healthcare, government, leisure and hospitality, and professional and business services leading the way.

The jobs report uses two surveys: one of households, which measures unemployment, labor participation, and employment demographics, and a second of businesses, which gathers information about hiring and wages. The reports provided conflicting data. The household survey concluded that 408,000 fewer people were employed in May, while the employer survey concluded that payrolls increased by 272,000 workers.

Why the difference? The surveys contact different people. The household survey samples 60,000 individuals. Self-employed individuals, unpaid family workers, or those on unpaid leave are considered employed in the household survey but not in the establishment survey. Conversely, the establishment survey double-counts people working multiple jobs. While this accounts for a slight difference, it is unlikely to explain a discrepancy exceeding 600,000. Many economists believe the household survey has not accounted for the wave of immigration. Statisticians and economists favor the employment survey because it has a smaller margin of error due to its much larger sample size, which includes employees from over 600,000 worksites. Usually, the surveys converge and reach similar conclusions over time. (See BLS Employment Situation Technical Note).

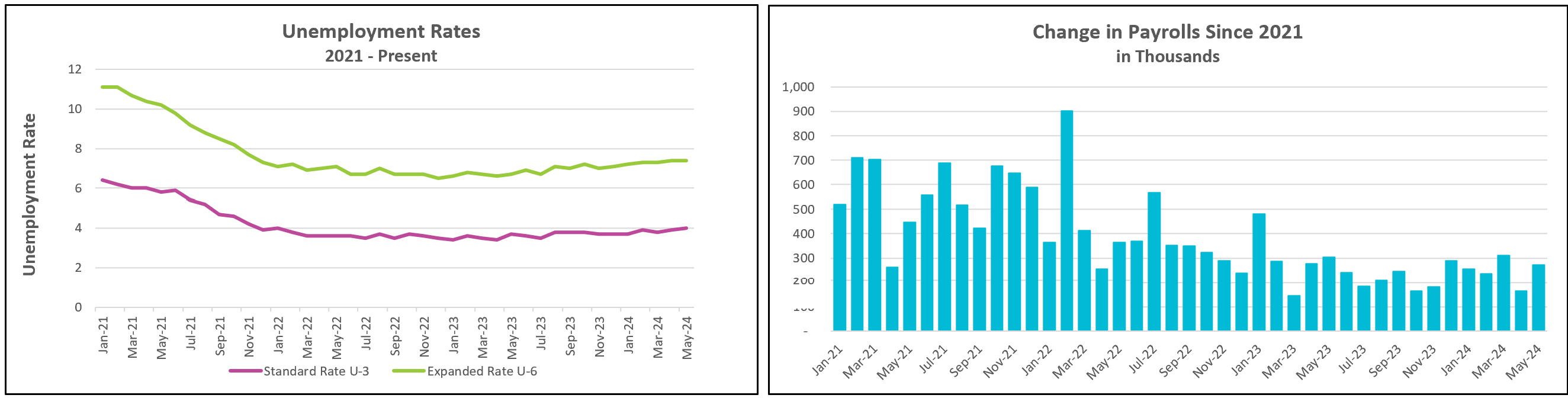

The combination of a 250,000 decrease in the workforce and 157,000 more people being unemployed increased the unemployment rate from 3.9% to 4.0% in May. U6, a broader measure of unemployment, remained at 7.4%, the highest it has been since November 2021. U6 includes people whose employment status has been harmed by the state of the economy, either by being unemployed, discouraged, or forced to work part-time.

It is doubtful that the uptick in the unemployment rate will sway policymakers at the Federal Reserve to begin reducing interest rates. Growth in payrolls and wages is expected to continue fueling spending. Higher stock prices and increases in investment income have also contributed to spending by providing households with additional cash and confidence.

Policymakers will closely monitor the Labor Department’s release of the Consumer Price Index (CPI) for May on June 12. The Federal Reserve’s preferred measure, the PCE price index, has recently declined slightly. May’s CPI data will offer valuable insights into whether this trend continues. If it does, the Federal Reserve may consider easing interest rates sooner rather than later. A comprehensive summary and analysis will be available at HigherRockEducation.org after the release.