Here are the key points from the June 2024 report on employment by the Bureau of Labor Statistics:

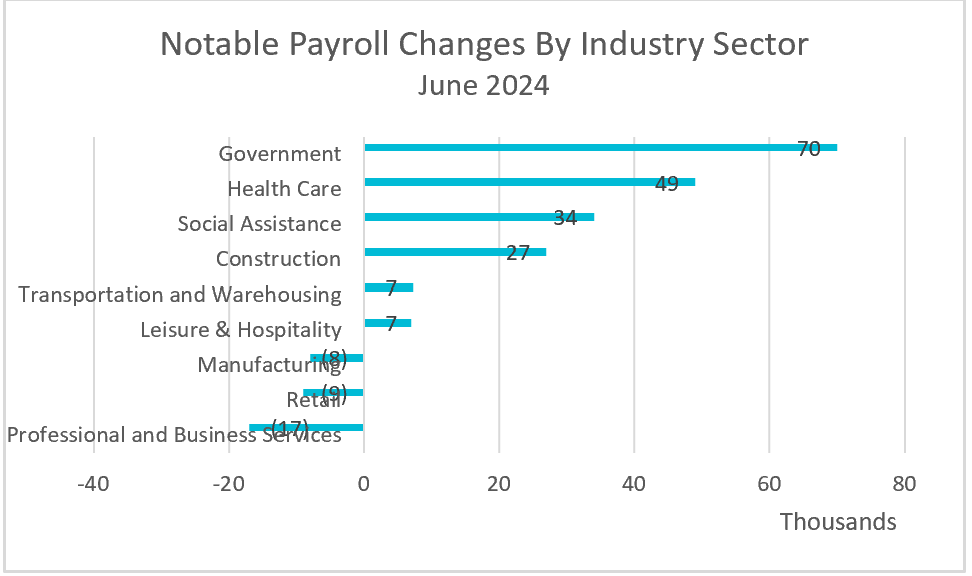

The recent increase in payroll was not as widespread as in previous months. The service industries showed the most significant gains, with government, health care, and social assistance accounting for 74% of the payroll increase. Most industries added fewer workers than in May, except for the public sector, which added 70,000 workers, up from 25,000. Local governments were responsible for most of the hiring. Unlike in May, several industries, including professional and business services, retail, and manufacturing, saw a decrease in the number of employees.

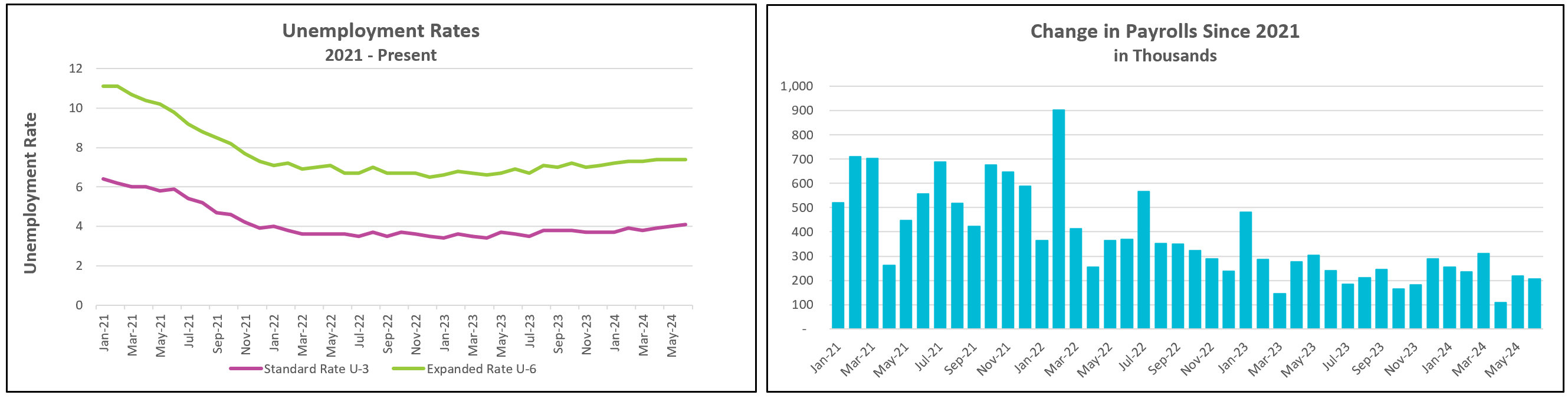

The unemployment rate is trending upward and reached 4.1%, the highest it has been since November 2021. However, it is encouraging that the jump in unemployment resulted from more people entering the workforce rather than people losing their jobs. (Only people actively seeking employment are considered part of the workforce.) In June, the civilian labor force grew by 277,000, boosting the participation rate from 62.5% to 62.6%.

Finding a job is now taking longer. The percentage of unemployed people who need more than fifteen weeks to find a job has increased. This is mainly due to there being over a million fewer job openings than a year ago (according to BLS Job Openings and Labor Turnover). Meanwhile, the number of temporary workers has fallen to its lowest level in three years. Trends in temporary worker employment are a leading indicator because temps are often the first to be hired and the first to be laid off. Employers hire temporary workers when they expect growth, but they are the first to be let go when they expect a slowdown.

Wages increased by 0.3% in June and are up 3.9% from a year ago, the smallest annual rate increase in three years. While growth in average earnings continued to slow down, it still remained above the inflation rate.

In summary, hiring is slowing, the unemployment rate is rising, wage increases are decelerating, and job openings are decreasing, all indicating a softer labor market. Recently, the Federal Reserve has hesitated to lower its benchmark interest rate due to the resilience of the labor market. However, the softening might prompt them to lower rates sooner. Additionally, real economic growth slowed to 1.4% in the first quarter, and consumer spending has also declined.

Policymakers will convene at the end of July. Several key economic reports will be released before then, providing better insights into the state of the US economy. The Bureau of Labor Statistics will release June’s CPI on July 11th, and the BEA will publish its initial estimate of growth in the second quarter on July 25th, along with June’s PCE price index, the preferred inflation measure by policymakers, on July 26th. If these reports confirm a decelerating economy and decreasing inflation, policymakers may start reducing rates; otherwise, analysts expect them to wait until their meeting in September. Higher Rock will provide a summary and analysis following the publication of each of these reports.