Here are the key takeaways from the Bureau of Labor Statistics’ report, The Employment Situation – July 2024:

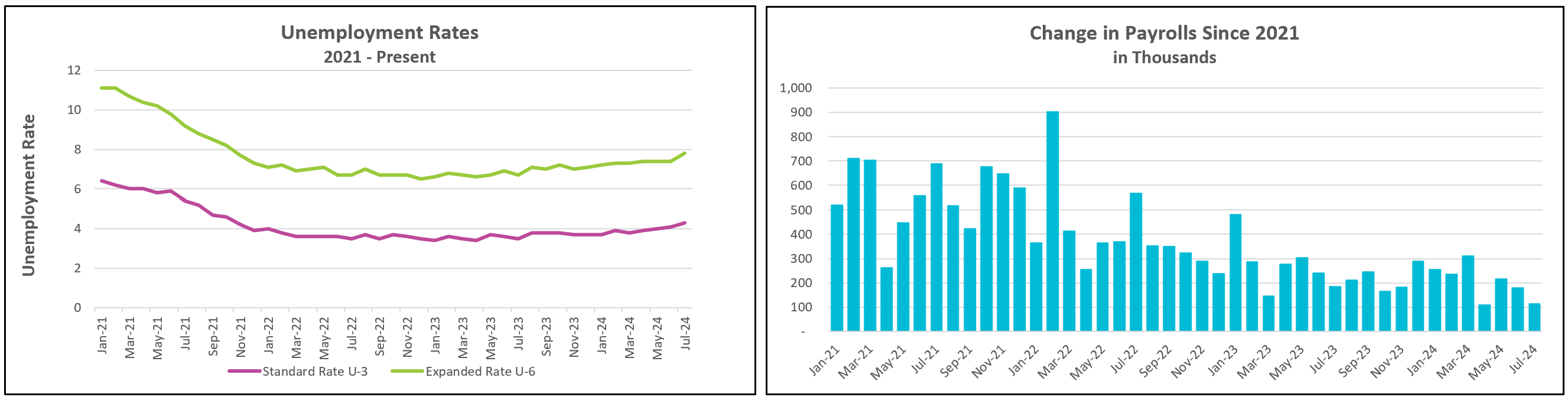

The unemployment rate increased for the fourth consecutive month and reached 4.1%, the highest since November 2021. However, it is encouraging that the rise in unemployment resulted from more people entering the workforce rather than people losing their jobs. The labor participation rate increased from 62.6% to 62.7%. Without the increased participation, the unemployment rate would have remained at 4.1%. However, many people had to settle for temporary or part-time jobs. U6, a broader measure of unemployment, increased because there was a significant rise in people accepting part-time work who would prefer to work full-time. Those individuals are considered employed in the standard unemployment measure. Workers are staying in their jobs longer than in recent months, and it is also taking longer for workers to find a job.

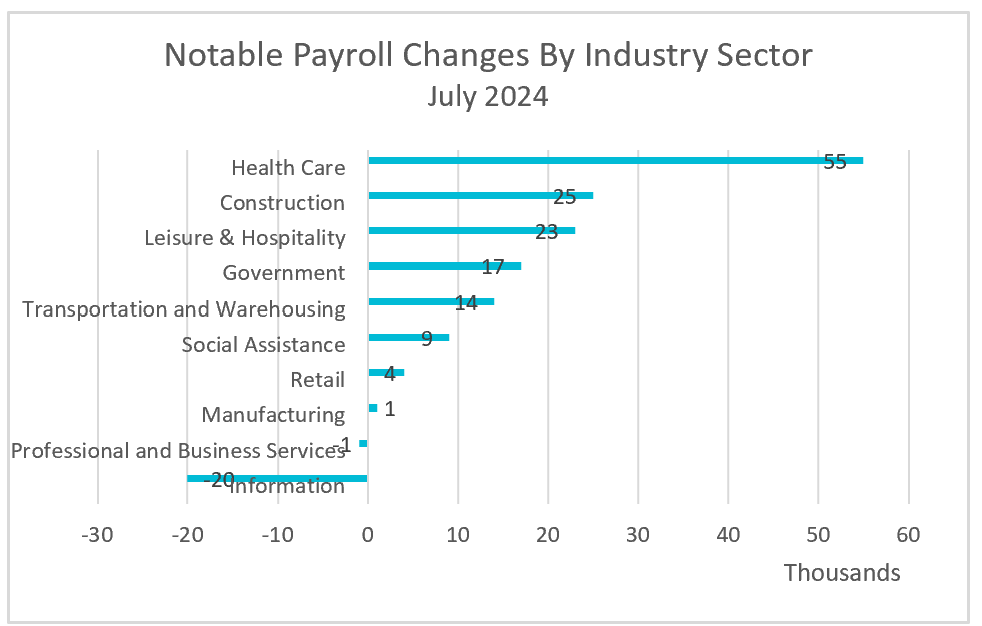

Payrolls increased, but the monthly growth rate is declining. Additionally, the Bureau of Labor Statistics (BLS) revised its payroll numbers downward by 29,000 in May and June. Service industries saw the most significant gains, with healthcare contributing almost half the monthly increase. However, the information sector lost 20,000 jobs in July. Hurricane Beryl made landfall in Houston and the central coast of Texas on July 8th, affecting employment surveys as many people could not work. Despite this, the BLS stated that the hurricane did not have a discernible impact on the surveys.

The United States may already be experiencing a recession. According to the Sahm rule, named after economist Claudia Sahm, the economy is probably in a recession if the three-month moving average unemployment rate rises by half a percentage point or more above the lowest three-month average from the previous year. Over the past three months, the unemployment rate has averaged 4.13%, which is 0.53 percentage points above the three-month average low of 3.6% from the past year. However, Dr. Sahm noted that the recent surge in immigration might invalidate her rule.

A strong labor market has sustained the economy. Rising payrolls, higher inflation-adjusted wages, and low unemployment have combined to provide the income and confidence for consumers to continue spending. Policymakers have resisted lowering their benchmark rate, citing wage inflation and the strong labor market as reasons for continuing their pause. Recent data, particularly July’s, suggest the labor market remains strong, but is showing signs of growing tired. While payrolls continue to grow, employers are hiring fewer people. Unemployment remains historically low but is quickly trending higher. Hourly wages continue to increase but at a slower clip and not enough to increase weekly wages when considering a shorter workweek. These trends all but guarantee the Fed will reduce rates in September. Many analysts believe that instead of a standard 0.25% rate cut, an aggressive 0.50% cut is justified.

Much economic data will be released before policymakers meet in September, including August’s employment report, the CPI for July and August, and the BEA’s PCE price index for July. Each of these releases will provide a better understanding of the state of the US economy. Higher Rock will write a summary and analysis shortly after each release.