Here are the key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – August 2024:

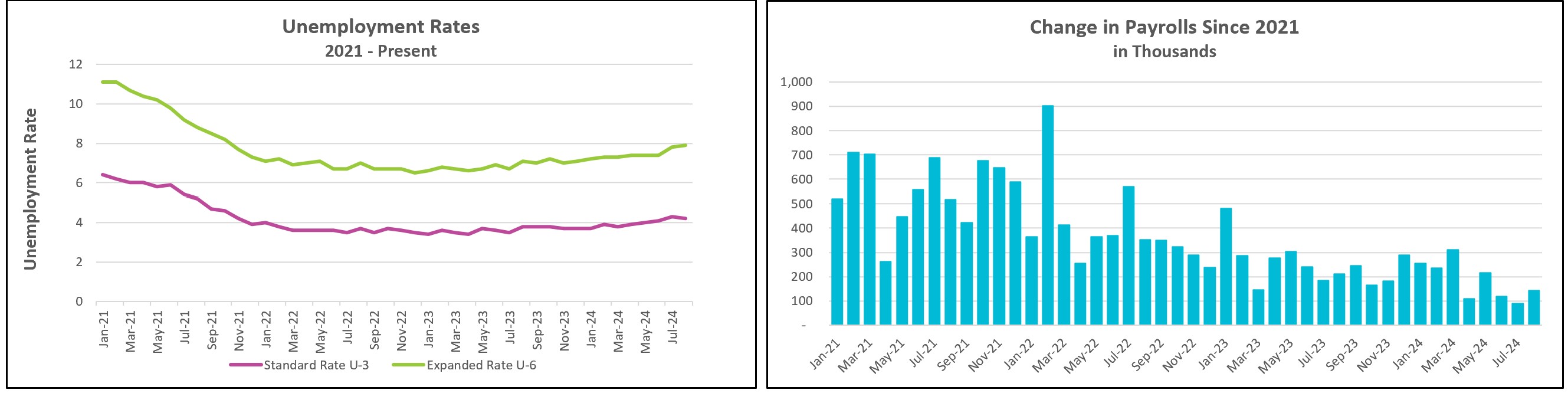

The labor market showed resilience in August as hiring exceeded expectations. However, it wasn’t enough to conclude that the market is gaining strength. Revised figures for June and July were lower, and much of the increase in August was due to the return of people who had been temporarily laid off in earlier months. Temporary layoffs decreased by 190,000 workers in August. As a result, the rolling three-month average of payroll gains reached its lowest level in four years. According to the BLS, there are fewer job openings, with the number falling to the lowest level since January (JOLT).

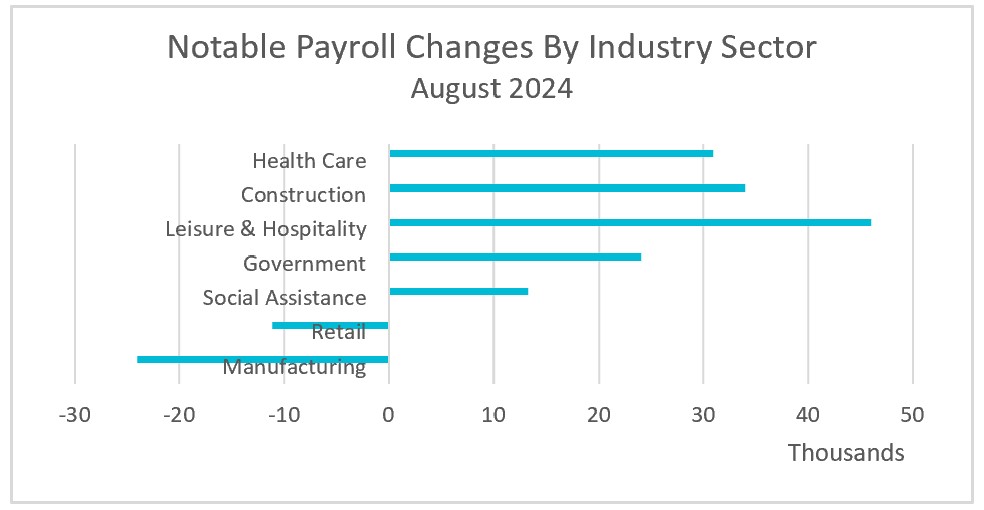

Hiring was less widespread than earlier in the year. Healthcare, leisure and hospitality, construction, and government industries added 151,000 workers, while manufacturing and retail lost 35,000 jobs. Most of the gains in construction were nonresidential, including heavy and civil engineering and nonresidential specialty trade. Most of the lost manufacturing jobs were in durable goods.

The unemployment rate fell slightly from 4.3% to 4.2%. However, the 0.1% difference is a bit misleading as July’s unemployment rate was 4.25% (rounded to 4.3%), and August’s rate was 4.22% (rounded to 4.2%), indicating only a 0.03% decrease in unemployment. The improvement in the rate was mainly due to workers who had been temporarily laid off being called back to work. A year ago, the unemployment rate was 3.8%. The broader measure of unemployment, U6, rose to 7.9%, encompassing those who are unemployed, discouraged, or working part-time due to economic factors.

In August, average weekly earnings rose 0.7%, wages increased 0.4%, and the average workweek was 0.1 hours longer. Wages have increased by 3.8%, while inflation in July was 2.9%. (The CPI for August will be published next week.) This additional income is expected to support consumer spending, potentially averting a recession.

This report coincides with the Federal Reserve considering a possible reduction in its benchmark interest rate at its upcoming meeting on September 18th. The Fed’s decision-makers are increasingly emphasizing the labor market rather than inflation. While a rate reduction is likely, there is debate over whether it will be 0.25% or 0.5%. However, the combination of increased payrolls, a lower unemployment rate, and higher wages makes a more cautious reduction of 0.25% probable.

In summary, although the labor market is still strong, the revised data and slight unemployment decline indicate a slowdown in the economy. However, rising wages and extended work hours are anticipated to bolster consumer spending, sustaining economic momentum as the Fed considers adjusting its monetary stance with a probable modest rate cut of 0.25%. The BLS will release its Consumer Price Index - August on September 11th. I will be on vacation for the next two weeks and will provide our summary and analysis shortly after I return.