Signs of the labor market softening continued in August, a year and a half after the Federal Reserve began increasing interest rates to reduce inflation by slowing the economy. August payrolls rose, but the trend remains downward. The unemployment rate increased, but for a good reason – more people returned to the labor market.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – August 2023, are listed below.

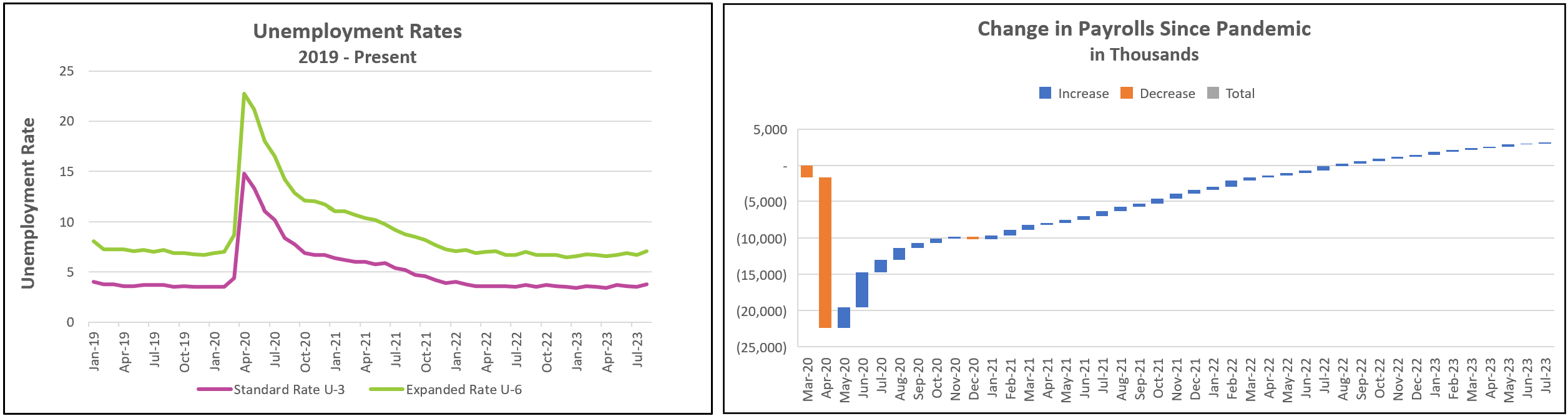

Hiring picked up in August, but the overall trend remains downward. Revisions to the June and July figures lowered payrolls by 110,000. August’s increase appears to be a blip. The three-month rolling average fell from a rise of 180,000 to 150,000 workers. Because more people entered the labor force, unemployment rose to 3.8%, a rate not seen since February 2022. Economists do not consider a person to be unemployed unless he is actively seeking employment.

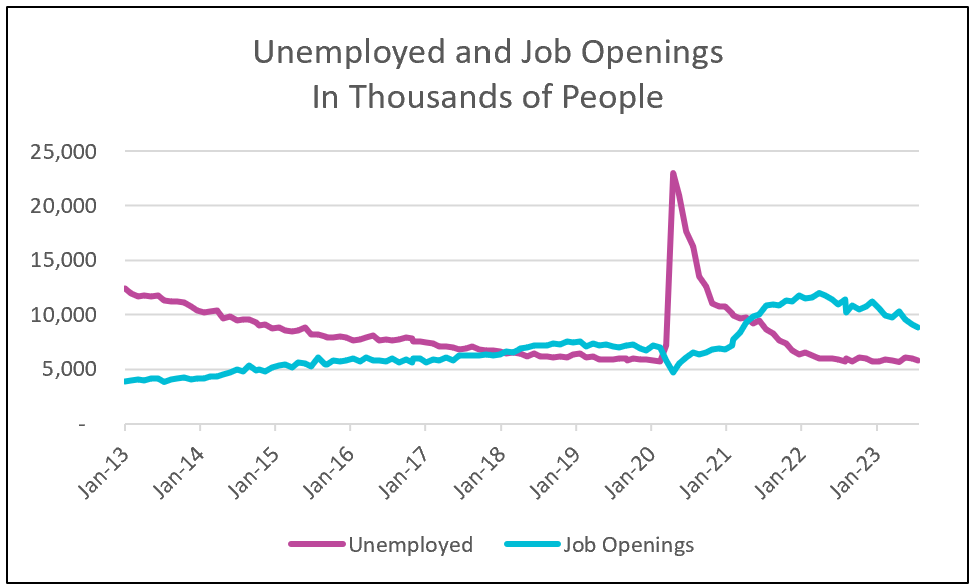

The increase in labor participation is welcome news for policymakers at the Federal Reserve. Job openings have exceeded available workers since May 2022. Between 2013 and 2018, the supply of workers exceeded the number of job openings, and workers saw minimal wage increases. There was an average of ten workers for every seven job openings. But, after the pandemic, a labor shortage developed, and the ratio of job openings to workers peaked at over two in March 2022. Companies raised wages to attract and retain employees. Many also increased their prices to protect their profits. (BLS: Job Openings and Labor Turnover – July 2023)

The bidding war and shortage of labor promoted job hopping. Many workers quit their jobs if a better opportunity presented itself. Job hopping has recently slowed, and the quit rate has fallen, indicating that workers are more apprehensive about quitting their jobs and finding another one quickly. In August, the number of employed people increased by 222,000, while 514,000 more were unemployed. More workers and the fall in job openings (approximately 1.4 workers for every job opening in August) helped contain the average hourly wage increase to 0.2%, the lowest rate since February. Furthermore, a reduction in the average number of hours worked limited the increase in the average weekly compensation to 3.9%.

Another indication of a cooling labor market is the 19,000 drop in temporary hires. Changes in the number of temporary workers are a leading economic indicator because temps are some of the first hired early in an expansion and the first let go when businesses anticipate a cooling of the economy.

The labor department noted that the transportation industry lost 37,000 jobs following Yellow’s bankruptcy, and the strike contributed to the motion picture industry losing 16,000 jobs. Industries that added the most workers included health care (71,000), leisure and hospitality (40,000), social assistance (26,000, and construction (22,000).

Rate increases by the Federal Reserve are manifesting themselves in the labor market. The continuing moderation of hiring and wages should contribute to a reduction in prices. However, the full impact of the rate hikes can take years to filter through the economy, making it probable that the influence of the past hikes has yet to run its course. Policymakers at the Fed will likely pause its rate hikes to monitor the effect of past rate increases. The August consumer price index will be released on September 13th. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.