Key takeaways from the Bureau of Labor Statistics report The Employment Situation – March 2025 include:

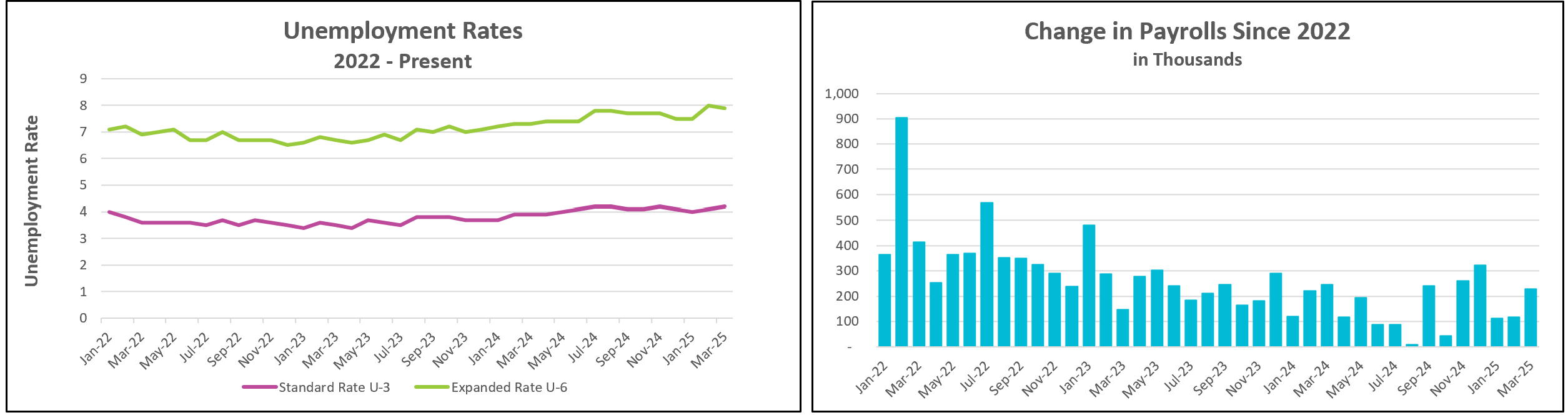

President Trump celebrated “GREAT JOB NUMBERS” on social media. He is right. The Bureau of Labor Statistics (BLS) reported that nonfarm payrolls increased by 228,000 in March 2025, the most since the beginning of the year, nearly double February’s increase. The unemployment rate was essentially unchanged. (The unemployment rate rose by 0.013%, but because of rounding, BLS reported it increased from 4.1% to 4.2%.) These figures surpassed most economists’ expectations.

However, surveys conducted during the second week of March provided the data used. They reflect neither the administration’s sweeping tariff announcements nor the full extent of the job cuts resulting from efforts to reduce the federal workforce. Financial markets immediately reacted negatively to the tariff news. Investors are concerned that these measures could slow economic growth and potentially trigger stagflation, a period of slow to no economic growth and inflation, which would adversely affect employment levels.

Many economists are skeptical despite the administration’s claims that tariffs will boost manufacturing employment. Companies that have previously outsourced production to reduce costs may hesitate to relocate operations back to the U.S. without assurance that tariffs will remain in place long-term. Moreover, any new domestic manufacturing facilities will likely incorporate advanced technologies, such as robotics, limiting the number of new jobs created.

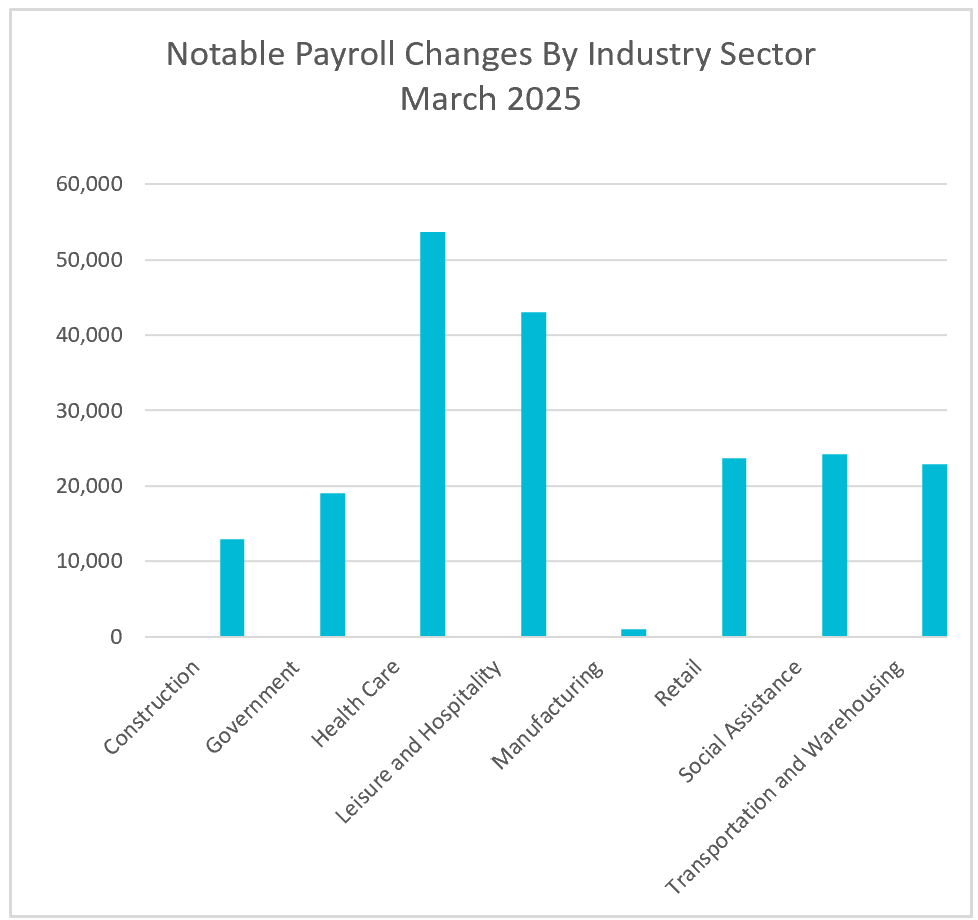

In the construction sector, employment rose by 13,000 workers in March. However, the number of specialty trade contractors declined by 12,900, suggesting that stringent immigration enforcement policies may contribute to labor shortages in the construction industry. The National Association of Home Builders (NAHB) has reported persistent shortfalls of hundreds of thousands of workers, emphasizing the critical role of immigrant labor in meeting industry demands. Increased deportations and immigration raids have exacerbated this shortage, causing absenteeism and heightened anxiety among both documented and undocumented workers.

Service industries experienced the largest increases in hiring. Health care added over 50,000 jobs for the second consecutive month. Retail payrolls increased by 27,300, partially reflecting the return of 10,000 Kroger workers following a strike. The leisure and hospitality industries rebounded from earlier setbacks due to adverse winter weather, and transportation and warehousing added 22,900 jobs, possibly as businesses increased inventory ahead of anticipated tariffs.

Government employment saw a net increase, primarily due to hiring by local municipalities. However, federal employment declined by 4,000 jobs in March, but the number could have been much higher. Eventually, it could exceed 275,000 workers, according to Challenger, Gray, and Christmas. The Department of Government Efficiency’s (DOGE) efforts to lay off thousands of federal workers have been partially impeded by lawsuits and court orders, resulting in some employees being placed on paid administrative leave or reinstated and thus still counted as employed.

Large-scale government job cuts can have ripple effects on the private sector. The Economic Policy Institute estimates that for every public sector job lost, approximately 0.67 private sector jobs are also eliminated because former government employees experience a significant drop in income, leading to decreased spending on goods and services, which in turn prompts private businesses to cut jobs. Federal job cuts impact those communities where federal employment constitutes a substantial portion of the workforce the most.

The BLS’s release confirms that the job market is healthy, reducing the likelihood that policymakers at the Federal Reserve will lower its benchmark rate the next time it meets. Policymakers have dual mandates of controlling inflation while maintaining a robust labor market. Policies for these mandates frequently contradict each other: Inflation calls for increasing interest rates to slow economic growth. In contrast, a soft labor market calls for stimulating the economy by reducing rates. Indeed, Federal Reserve Chairman Powell stated, “Looking ahead, higher tariffs will be working their way through our economy and are likely to raise inflation in coming quarters.” Policymakers will be encouraged by a cooling of wages. Average hourly earnings are up 3.8% over the prior 12 months. That is down from 4% and the lowest since July.

The BLS will release March’s Consumer Price Index (CPI) on Thursday, April 10. Analysts expect inflation to recede slightly, partly due to a decline in gas prices during March. Higher Rock will summarize and analyze the data shortly after the CPI is released.