Key takeaways from the Bureau of Labor Statistics report The Employment Situation – January 2025 include:

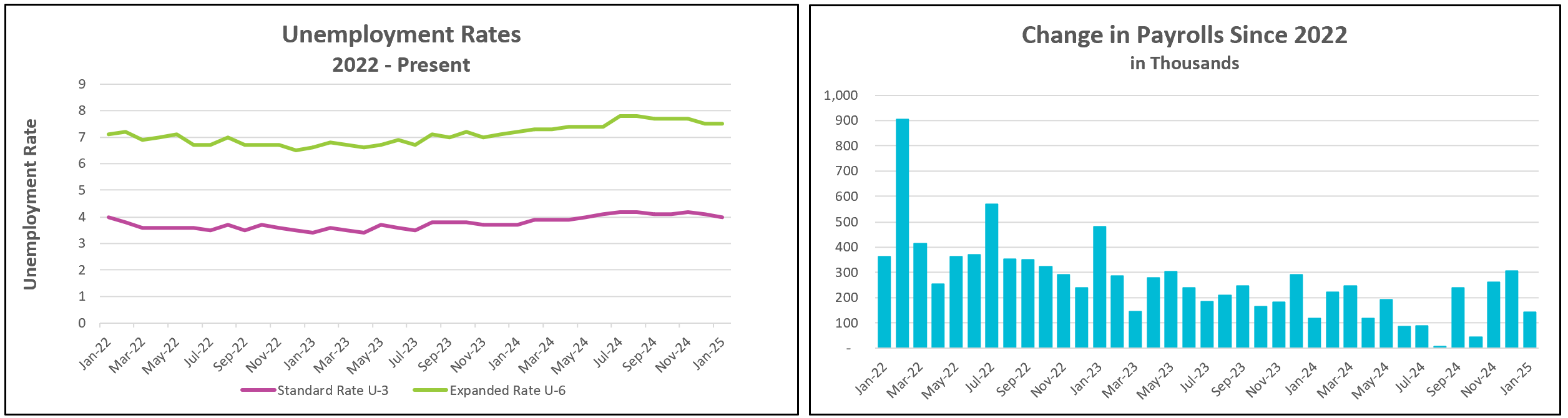

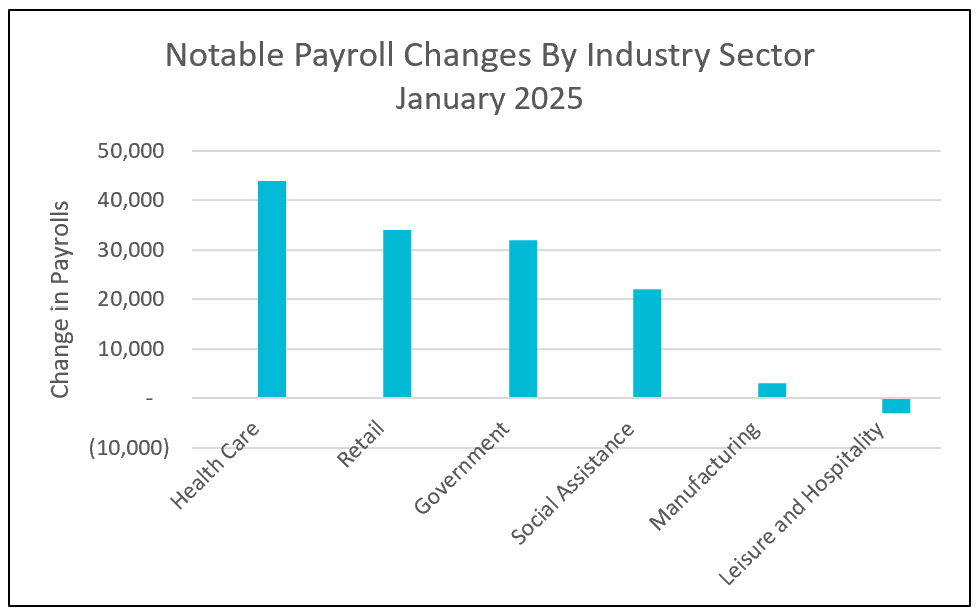

The job market remains healthy. While hiring increased less than expected in January, the impact is minimal when considering the significant upward revisions for November and December. Average job gains remained well above 100,000—the threshold needed to sustain a 4% unemployment rate, according to the Federal Reserve Bank of Atlanta’s Jobs Calculator. The Bureau of Labor Statistics revised its 2024 employment estimates, lowering the average monthly job gain from 186,000 to 166,000. Although job openings declined slightly, they still outnumber unemployed workers. The table below summarizes payroll changes across key industry sectors.

The BLS compiles data for this report using two monthly surveys. The household survey estimates population, civilian workforce, labor force participation, and unemployment rates, while the establishment survey provides payroll and wage figures. Discrepancies between the two are common. For instance, the household survey indicated that the labor force grew by over two million people in January, and the participation rate increased. However, the establishment survey concluded that payrolls rose by only 143,000, and the unemployment rate declined to 4%. This discrepancy likely stems from the household survey incorporating new Census Bureau estimates, with the labor force increase reflecting a surge in immigration since the last Census update. While the household and establishment surveys may produce differing results in any given month, they align over time, providing a consistent overall picture of employment trends.

Wages rose by 0.5% in January, the largest monthly increase since March 2020. However, the average workweek declined from 34.2 to 34.1 hours. Despite the shorter workweek, the higher wages resulted in a modest 0.2% increase in average weekly earnings. Severe weather and wildfires may have contributed to the decline in work hours, though the BLS reported that the Southern California fires and widespread adverse weather had no “discernible impact” on employment figures.

The effects of President Trump’s policies on employment will take time to materialize. Tax cuts and tariffs aim to stimulate economic growth and job creation, with manufacturers expected to be most affected by tariffs. While tariffs are intended to protect specific industries, they can sometimes have unintended consequences, potentially harming the very sectors they intend to support.

Meanwhile, federal job cuts have displaced many workers. Hopefully, they will transition into private-sector jobs. Stricter border security and increased deportations will reduce the number of migrant workers, a labor source the U.S. economy has historically relied on—particularly in agriculture, restaurants, hotels, and construction. Monitoring job openings in these industries will help assess whether immigration policies negatively impact these sectors.

The BLS will release January’s Consumer Price Index on Wednesday, and HRE will provide a summary and analysis shortly thereafter.