Key takeaways from the Bureau of Labor Statistics report The Employment Situation – February 2025 include:

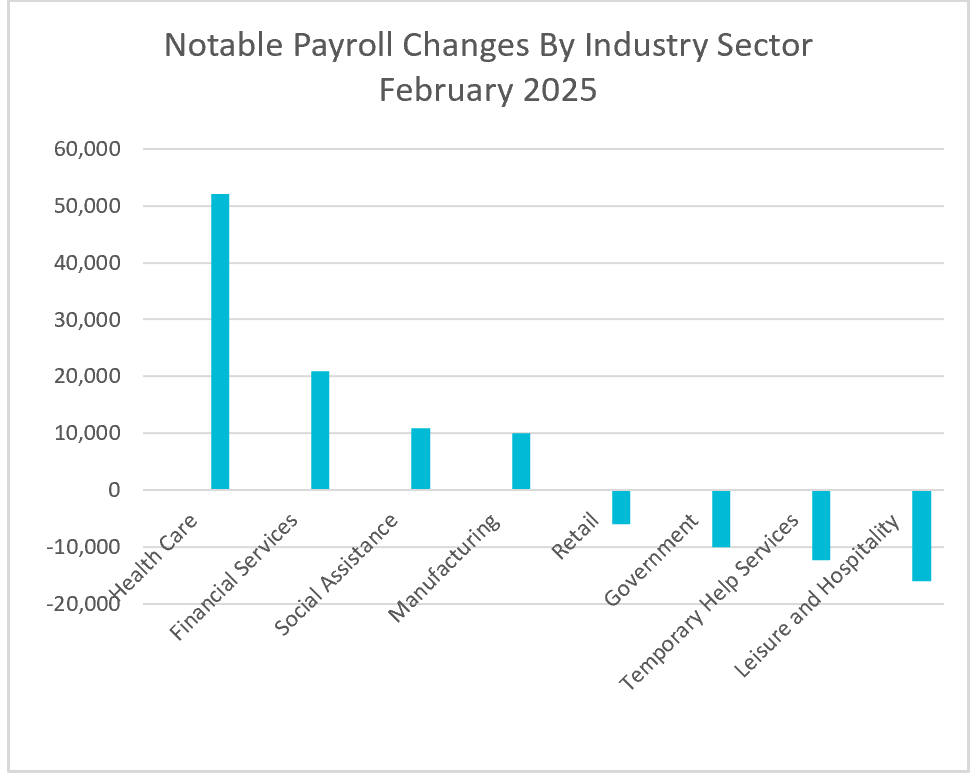

The job market remains healthy but is showing signs of strain. In February, hirings rebounded from a poor showing in January but continued to trend lower as the three-month moving average dipped from 236,000 workers to 200,000. The healthcare industry added 52,000 workers, while the Federal government employed 10,000 fewer workers. Government payrolls are expected to contract in March because February’s payroll drop was measured just after the massive cutbacks began.

A decline in temporary workers is often considered a negative economic indicator, as it suggests businesses are becoming more cautious about the future. Companies typically hire temporary workers when anticipating increased demand but facing uncertainty about long-term prospects. Cutting these jobs could signal expectations of slower growth or even a recession.

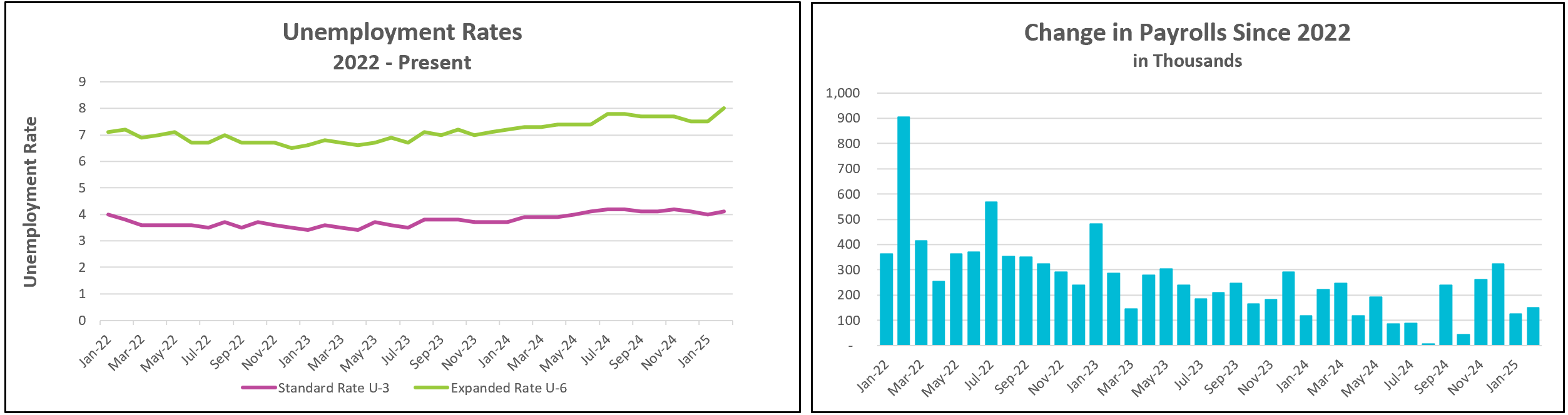

A combination of a decrease in the labor force and an increase in the number of unemployed caused the unemployment rate to dip 0.1%. The labor force participation rate—the share of the population that is employed or actively looking for work—fell to its lowest level in two years. One possible explanation is that many undocumented workers have exited the workforce out of fear of deportation. More concerning is the sharp increase in the U-6 rate, a broader measure of unemployment that includes the unemployed, underemployed, and marginally attached workers. In February, the number of people not in the labor force but desiring employment rose by 414,000. Additionally, the number of workers classified as employed due to part-time work—despite preferring full-time positions—reached 460,000, the highest level since May 2021.

Wages continue to outpace inflation, rising by 0.3% in February and up 4.0% from a year earlier.

February’s surveys were completed before fully implementing President Trump’s policies relating to tariffs, government cutbacks, and intensified immigration enforcement. Many economists warn that these measures could push the economy into stagflation—a dreaded combination of stagnant growth and rising inflation. Consumer confidence fell to its lowest point since August 2021, with households cutting back on spending. The Bureau of Economic Analysis’s Personal Consumption Expenditures (PCE) index revealed that consumer spending declined in January for the first time in four years. Investor sentiment also soured, sending major stock indexes lower.

Federal job cuts and tariffs will likely weigh on the job market and the broader economy throughout the year. Although reducing government spending is often the goal of federal job cuts, the potential economic slowdown and decline in public services could have lasting repercussions. Businesses that rely on government contracts will face reduced revenue, while GDP growth could slow due to decreased government spending and weakened consumer confidence. The extent of the impact will depend on the scale of the cuts, the targeted agencies, and how well the private sector absorbs displaced workers.

Tariffs will impact industries differently. Protected industries frequently see job growth as employers respond to increased production. However, businesses that rely on tariffed goods as inputs—such as car manufacturers—could cut jobs due to higher costs. Tariffs tend to be inflationary, with rising prices potentially hampering real economic growth. The overall impact is typically negative, as higher costs, reduced efficiency, and retaliatory tariffs weigh on the economy.

Stricter border security and increased deportations will reduce the number of migrant workers—a labor source historically vital to the U.S. economy, particularly in agriculture, hospitality, construction, and food services. For example, immigration restrictions may already affect employment in food services and drinking establishments, which shed 27,500 jobs. These industries traditionally depend heavily on immigrant labor.

Conversely, tax cuts, deregulation, and streamlined approval processes foster growth and job creation. The hope is that these benefits will outweigh the economic drag imposed by other policies.

Federal Reserve policymakers face the challenge of curbing inflation while maintaining full employment. Recent comments by ranking Fed officials suggest a reluctance to lower interest rates further without clear evidence of easing inflation. While a robust labor market has made it feasible to maintain current policies, sustained labor market weakness could force a reassessment of priorities.

Economists and policymakers will gain further insights into the impact of tariffs on prices following Wednesday’s release of the Bureau of Labor Statistics’ February Consumer Price Index. HRE will provide a summary and analysis shortly thereafter.