Key takeaways from the Bureau of Labor Statistics (BLS) report, The Employment Situation – December 2025The Employment Situation – December 2025, include:

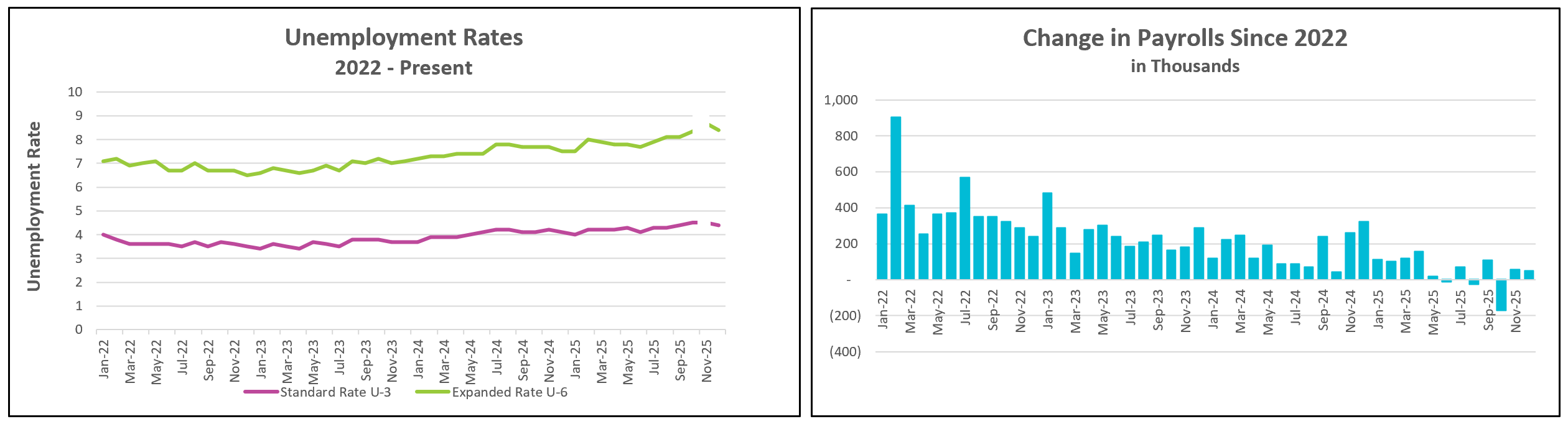

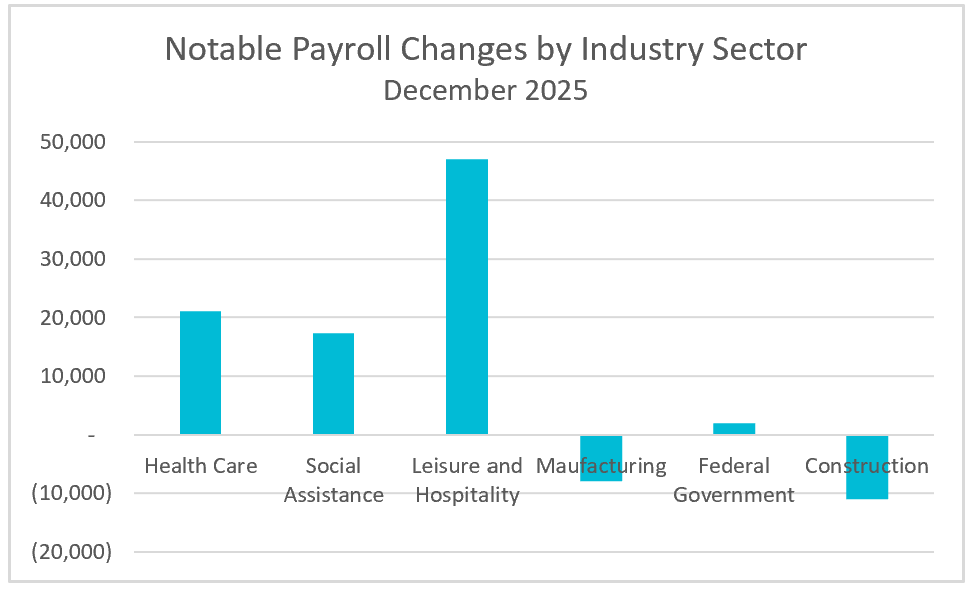

2025 was a year in which the labor market weakened. Employers created 584,000 jobs over the course of the year, a sharp slowdown from the more than 2 million jobs added in 2024, making 2025 the poorest year for job growth since 2020. While hiring clearly cooled, job creation continued, particularly in the health care and social assistance sectors. Unemployment edged higher, and wage growth barely kept pace with inflation, underscoring a labor market that lost momentum without tipping into outright contraction. The unemployment rate rose to 4.4% by year’s end, up from 4.0% in January 2024.

Employers added 50,000 workers in December, a figure that pointed to ongoing, albeit restrained, job creation. Economists took some encouragement from the December decline in the unemployment rate—the first dip since June—which lowered the odds that policymakers will lower their benchmark rate when they meet at the end of January. However, the drop in unemployment came with an important caveat: it reflected a shrinking labor force rather than robust hiring, as 46,000 people exited the workforce in December.

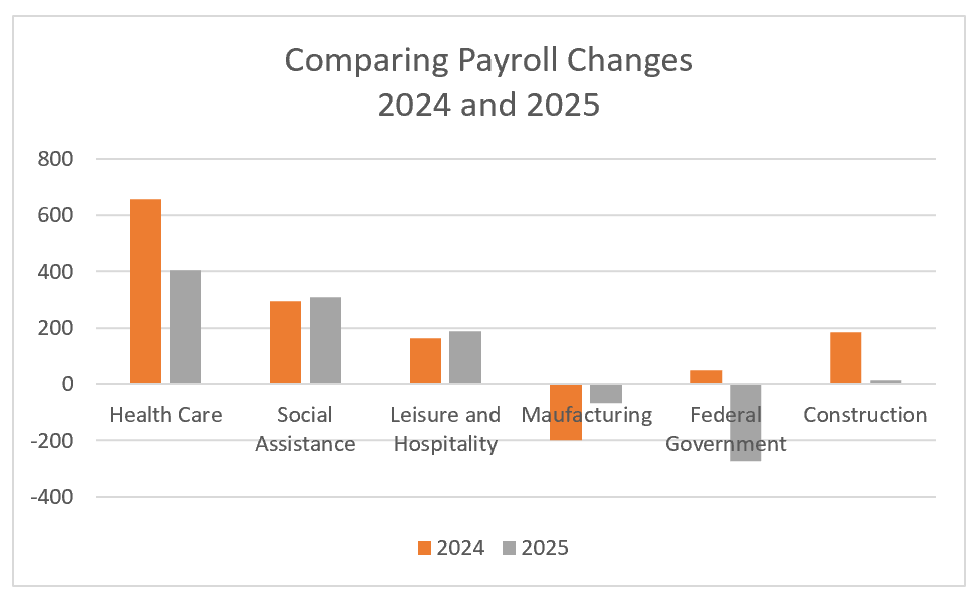

Job gains in December remained heavily concentrated in health-related fields. Healthcare companies increased their payrolls by 21,000 workers, while social assistance added 17,000 new workers. Over the full year, health care and social assistance accounted for 713,000 of the 733,000 private-sector jobs created, highlighting how immune these industries tend to be to business cycles. In contrast, retail trade was the largest loser in December, shedding 25,000 jobs.

Federal government employment also increased modestly, rising by 2,000 in December; however, federal payrolls have decreased by 277,000 since December 2024, following the initiation of broad government cutbacks. The graph below compares increases in the sectors we follow the most closely in 2024 and 2025.

Manufacturing continued to show pronounced weakness. Payrolls fell by another 8,000 jobs in December, extending a year-long downward trend that has left employment 68,000 lower than at the start of the year. The average workweek declined to its lowest level since October 2024, and the purchasing managers index has now fallen for four consecutive months, signaling sustained contraction in the sector.

Construction employment declined by 11,000 jobs in December, a notable development given that the JOLTS report indicated 292,000 job openings in the construction sector. This disconnect suggests that labor shortages—exacerbated by an immigration squeeze—are constraining hiring in the construction industry despite a strong demand for workers.

There were a few encouraging signs beneath the surface. The number of people working part-time because they could not find full-time employment declined in December, although it remains significantly higher than the levels seen at the beginning of the year. Average hourly earnings rose 0.3% during the month and were 3.8% higher than a year earlier. Still, temporary services lost 5,700 jobs, a development that raises concern because temporary employment is widely viewed as a leading economic indicator, often weakening before broader labor market conditions deteriorate.

Overall, the data suggest that finding a job has become more difficult for new graduates and job seekers, even as new jobless claims remain low. This combination suggests that employers are reluctant to fire workers, yet also hesitant to hire new ones. Several forces contributed to the slow pace of hiring in 2025. After the pandemic, businesses embarked on an aggressive hiring spree to replace laid-off workers and prepare for an economic recovery, but that demand has since faded. Productivity surged 4.9% in the third quarter (Productivity and Costs),which means businesses can produce more with fewer workers. Advances in artificial intelligence (AI) helped boost productivity, and many employers are still assessing how AI may alter their future labor needs. Additionally, uncertainty stemming from the Trump administration’s economic policies—particularly tariffs—has influenced hiring decisions. At the same time, a large share of job losses reflected the purge of federal government employees. However, a reduction in taxes will spur the economy.

The reluctance to hire reflects broader economic uncertainty. Businesses remain uncertain about how inconsistent tariff policies will impact costs, while questions persist about the extent to which AI will influence productivity and staffing needs. At the same time, industries such as construction are struggling to find workers amid large-scale deportations, even as anxious workers cling tightly to existing jobs. Policymakers at the Federal Reserve face a delicate balancing act: they are tasked with fostering economic growth while keeping inflation near 2% and maintaining a stable employment market. Those worried about economic weakening favor lower interest rates to stimulate borrowing and expansion. However, those more concerned about inflation oppose rate cuts, arguing that added growth could fuel demand-pull inflation. Inflation, after all, remains stubbornly above the Fed’s 2% target.

The labor market may be weaker than reported. Economists expect the employment figures will be revised lower next month when annual benchmark revisions are released, with initial estimates suggesting payrolls will be revised lower by 1.0 million in late 2024 and early 2025.

Meanwhile, the Bureau of Labor Statistics will release December’s CPI tomorrow. Last month’s report showed tentative signs that inflation was cooling. Whether that trend continues will be closely watched, and Higher Rock will provide a summary and analysis shortly after the data are released.