The economy’s gross domestic product (GDP) has recovered to pre-pandemic levels. Over half a million people have been added to payrolls every month since May, and over one million in July – that is until August when only 235,000 people were added. Incomes are higher – but a pent-up demand and supply chain problems have propelled inflation to unacceptable levels. Now, a spreading Delta variant threatens the recovery by causing concerns that deter people from spending. Policymakers have a choice to make. They could continue using aggressive fiscal and monetary policies to maintain the economy’s momentum at the risk of overheating the economy and risk pushing inflation to harmful levels. Or they could choose to limit spending and raise interest rates to dampen inflationary pressures and risk choking the recovery. To learn more about these options, read our summary of vital statistics and analysis.

The Bureau of Economic Analysis released its second estimate of the economy’s RGDP in the second quarter of 2021. Economic growth was slightly higher than initially estimated in the advance estimate. Real gross domestic income (RGDI) was also reported and was significantly less than the RGDP, primarily because of the drop in government transfer payments during the second quarter. Many economists consider the average of RGDP and RGDI to be a better indicator of an economy’s health than RGDP.

Personal consumption expenditures continued to contribute the most to the economy's growth. Vaccinations provided security. The government aid provided money, and establishments continued to reopen. All helped drive consumer spending to the largest increase since the third quarter of 2020 and the third largest in half a century. Consumers returned to restaurants and traveled more, propelling the service industries to healthy quarterly gains. But most economists and macroeconomic models project that the growth rate will slow in the third quarter because of the Delta variant of COVID-19. GDPNow is a macroeconomic model used by the Atlanta Federal Reserve and bases its prediction solely on empirical data. It predicts the economy will grow 5.1% in the third quarter.

The BEA increased its advanced PCE price indexes. The combination of a growing demand and supply challenges have pushed prices up to the highest levels since 1981 and far more than the Federal Reserve's 2% target. To access the full report, visit Gross Domestic Product, Second Estimate Second Quarter 2021. The BEA will release its third estimate for the second quarter of 2021 on September 30.

July’s increase in income reflects more people entering the job market and demanding higher wages. The beginning of government assistance of advance childcare tax credit payments also contributed to the jump in income. July’s figures precede the surge in COVID-19 cases caused by the highly contagious Delta variant. August’s spending number will reflect the consumer’s response to the Delta Variant.

The increase in demand and supply interruptions continue to push prices higher. Inflationary pressures eased slightly in July but remained much higher than the Fed’s target of 2%. Read the full report Personal Income and Outlays – July 2021. The highlights are listed below.

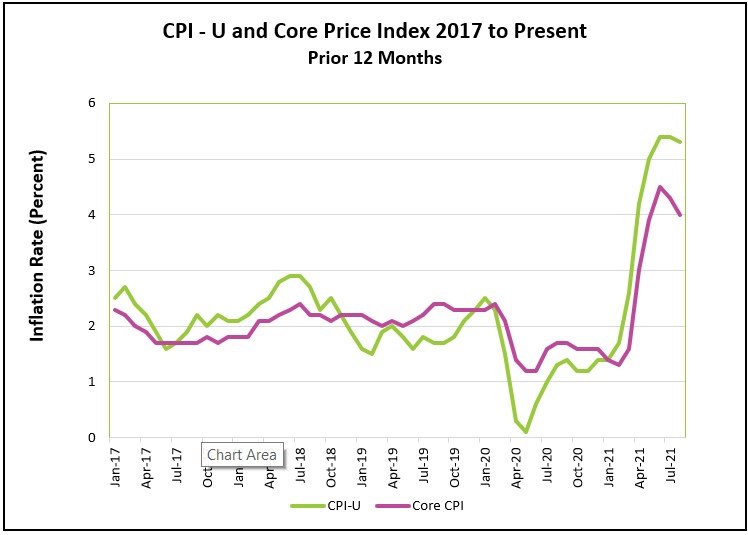

Inflationary pressures continued to lessen, especially in goods and services that experienced the sharpest increases as the economy reopened, such as used vehicles and airline fares. According to the Bureau of Labor Statistics, growth in wages exceeded inflation for the first time since December. However, prices remain above the Federal Reserve’s 2% target, and demand-pull and cost-push inflationary pressures remain. Government officials insist that the pressure is short-term. Whether or not they are correct has enormous policy implications. Some are discussed below in the Summary and Analysis section. Read the complete report Consumer Price Index – August 2021. Here are the highlights of the report.

Gains in employment fell dramatically in August, but the unemployment rate fell. A renewed concern of COVID has prompted many consumers to curtail their activities and employers to slow their hiring. Employment in the leisure and hospitality industry was unchanged after monthly increases averaging 350,000 workers since January. Retail payrolls shrunk by 29,000 people in August. The decline in the unemployment rate is more indicative of people choosing not to enter the workforce than of employers hiring. An individual must be actively seeking employment to be considered unemployed. However, employers continued paying their employees more. The highlights from The Employment Situation – August 2021 are listed below.

Economists are lowering their projections of the US economy’s growth in the third quarter. Thirty-six economists surveyed by the Philadelphia Federal Reserve expect the economy to grow at an annual rate of 6.8%, down from an earlier prediction of 7.5%. Goldman Sachs lowered its projection from 9% to 5.5%. All cited the surge in COVID cases as their reason. However, they also increased their predictions for 2022 as the economy emerges from the pandemic.

Pessimism has replaced the optimism generated by expectations that the pandemic was ending. Consumer sentiment fell 13.4%, more than it has in a decade, according to the University of Michigan’s consumer sentiment index. The pessimism influenced consumers’ willingness to open their wallets. Consumer spending in July rose a meager 0.1% after increasing 1.1% in June. Most economists expect August’s spending to fall even more, especially in services, because many consumers have once again cut back on indoor activities such as eating out and traveling. Consumer spending is the largest contributor to GDP. Any decline in consumer spending would slow the recovery.

Household income and employment rose in July. Many businesses offered higher wages and improved benefits to attract workers. This trend reversed itself in August when companies became more hesitant in hiring. Payrolls only increased by 235,000, the smallest rise since January. August payrolls were unchanged in the leisure and hospitality sector after increasing an average of 350,000 workers for the prior six months.

A prolonged recovery depends on workers returning to the workplace. In August, 5.3 million fewer people were employed than in February 2020, and COVID prevented 1.6 million people from seeking employment. The pandemic prevented an additional 400,000 workers from working between July and August because their employer either closed or lost business. In other cases, people became more apprehensive about returning to work, especially mothers who fear a COVID outbreak in their child’s school or cannot find childcare.

Inflation subsided for the third straight month, but it remains historically high. Whether measured by the Federal Reserve’s preferred PCE price index or the more often quoted consumer price index, inflation far exceeds the Federal Reserve’s target rate of two percent. But economists differ on whether or not the Federal Reserve Board of Governors should increase interest rates to curb inflation or maintain its aggressive monetary policy and keep interest rates near zero. A moderating inflation rate and less than expected payroll expansion should deter the Fed from raising interest rates when it meets next week. Most Federal Reserve officials insist the inflationary pressures are linked directly to COVID and should dissipate. For example, June’s 10.5% increase in used car prices was tied to car manufacturers’ trouble securing chips and shipping delays, but used car prices decreased 1.5% in August. These economists believe pressure on wages will abate when many of the 5.3 million people who left the workforce return.

Covid cases will continue to escalate and will influence the economy and economic policy. The pandemic will continue to delay a full recovery, but it is underway. The Fed will defer increasing interest rates until it sees how the Delta variant plays out. But the trends are encouraging. The economy is growing at a near record pace. People are returning to work, and wages and salaries are increasing. While consumer spending is lower, households have trillions of more dollars in savings than before the pandemic, which should prevent spending from declining sharply. Inflation is subsiding, which provides households with additional purchasing power. Fortunately, vaccinated people will prevent the economy from returning to the depths of March 2020. Vaccinated people will continue to visit restaurants and other venues. The Delta variant of COVID will slow the economy’s momentum, but it is unlikely to throw us back into a recession.

Stay Healthy