The long-awaited release of the Bureau of Economic Analysis’ Gross Domestic Product for the 3rd Quarter 2025 (Advance Estimate) painted a mixed picture of the US economy. The publication was delayed by more than two months due to the government shutdown. Its key takeaways include:

The long-awaited release of the Bureau of Economic Analysis’ Gross Domestic Product for the 3rd Quarter 2025 (Advance Estimate) painted a mixed picture of the US economy. The publication was delayed by more than two months due to the government shutdown. Its key takeaways include:

The U.S. economy continued to expand at a very healthy pace in the third quarter, posting a surprisingly strong 4.3% annual growth rate—the fastest in two years and an acceleration from the 3.8% pace recorded in the second quarter.

Consumers continued to spend despite a softening labor market and higher prices. Consumer spending rose at a 3.5% annual rate, up from 2.5% in the prior quarter. It is especially significant because it accounts for nearly 70% of overall economic activity.

Notably, the increase in spending was not supported by meaningful income growth. For the economy as a whole, disposable personal income (income after taxes) barely kept pace with inflation; however, this was not the case for lower-income families. In September, lower-income households saw a 1.4% increase, while higher-income households experienced a 4.4% rise in income. The data continue to highlight a K-shaped economy. In a K-shaped economy, higher-income households, skilled workers, and asset owners tend to benefit the most. They often experience rising wages, strong job security, and gains from investments in stocks, real estate, or business ownership. However, lower-income households, less-skilled workers, and service-sector employees may struggle with job insecurity, stagnant wages, and higher living costs, despite the overall economy appearing strong. (To learn more about the widening gap between lower and higher-income households, visit The Bank of America Institute’s Consumer Checkpoint: The Tale of Two Wallets.)

Business investment was mixed. Overall investment edged lower in the third quarter, following a sharp decline in the second quarter. Spending on residential and nonresidential structures, such as offices, factories, and warehouses, continued to decline. However, investments tied to the thriving artificial intelligence sector partially offset weaknesses in these areas. That category grew 5.4% in the third quarter, following a 15% surge in the second quarter.

Net exports also made a positive contribution to real GDP as exports increased and imports declined. Earlier in the year, net exports made a substantial negative contribution to the economy’s growth, as imports surged when consumers and businesses rushed to stock up ahead of tariff increases.

Government spending increased in the third quarter at both the federal and state levels. Defense outlays increased by more than 5%. In contrast, spending on nondefense programs declined during the quarter, resulting in a net gain of 2.9%. At the state and local level, government spending grew at a 1.8% pace, a slowdown from the 3.1% increase recorded in the second quarter. It is also worth noting that the government shutdown began in the fourth quarter and therefore did not affect third-quarter activity. Still, most economists expect the shutdown to have a negative impact on government spending and overall growth in the fourth quarter.

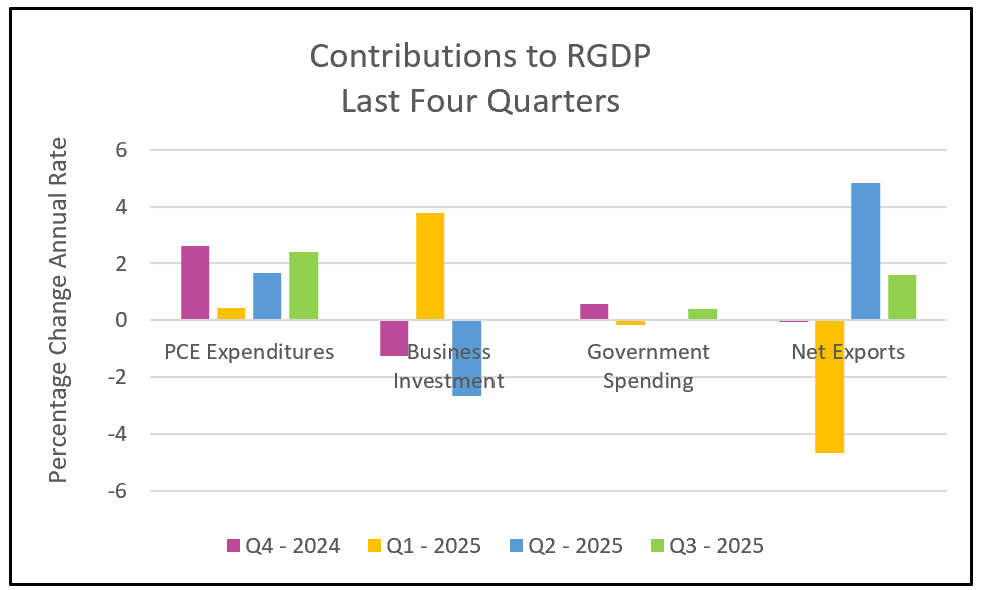

The graph below summarizes the contributions of all the components that comprise the US gross domestic product for the past four quarters.

Inflation pressures intensified. The PCE price index climbed from a 2.1% annual rate in the second quarter to 2.8% in the third, exceeding the Federal Reserve’s 2.0% target, while core PCE inflation rose from 2.6% to 2.9%.

Most economists expect growth in the fourth quarter to decelerate. They believe that the government shutdown slowed the economy’s growth. Many consumers likely purchased holiday gifts in the third quarter before the full impact of the tariffs on prices. According to the University of Michigan’s Index of Consumer Sentiment, consumer sentiment has also fallen since the end of the quarter. It fell from 58.3 in the third quarter to 52.5 in the fourth quarter.

Much of the economy’s health hinges on the labor market. An increase in the unemployment rate and a slowdown in hiring could dampen consumer sentiment, ultimately slowing spending and GDP growth. Economists should gain insights into the labor market’s health when the Bureau of Labor Statistics releases its Employment Summary for December on January 9th. HRE will provide a summary and its analysis shortly after it is released.