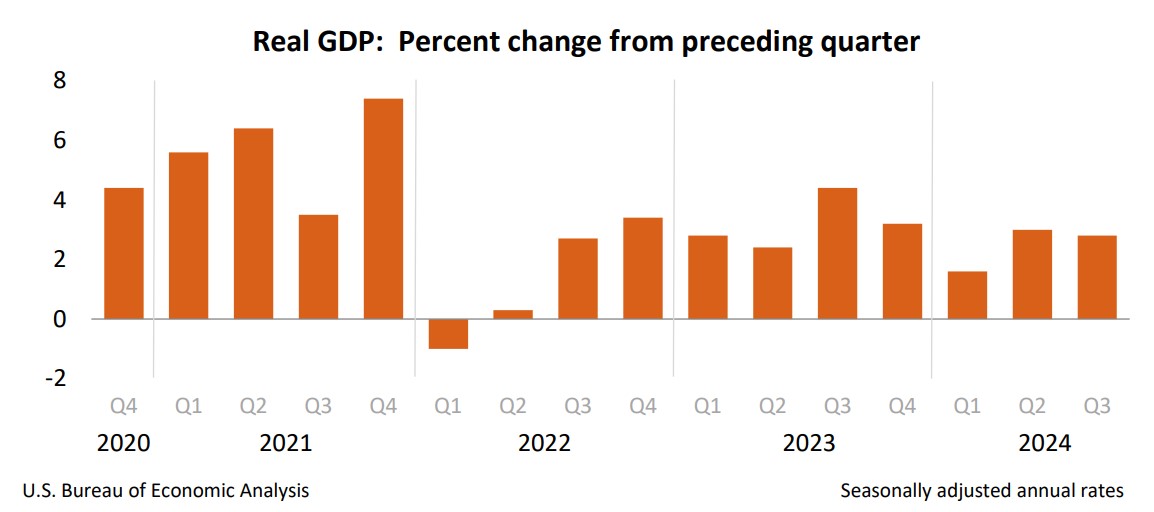

The Bureau of Economic Analysis’s news release Gross Domestic Product, Third Quarter 2024 (Advance Estimate) highlights are summarized below.

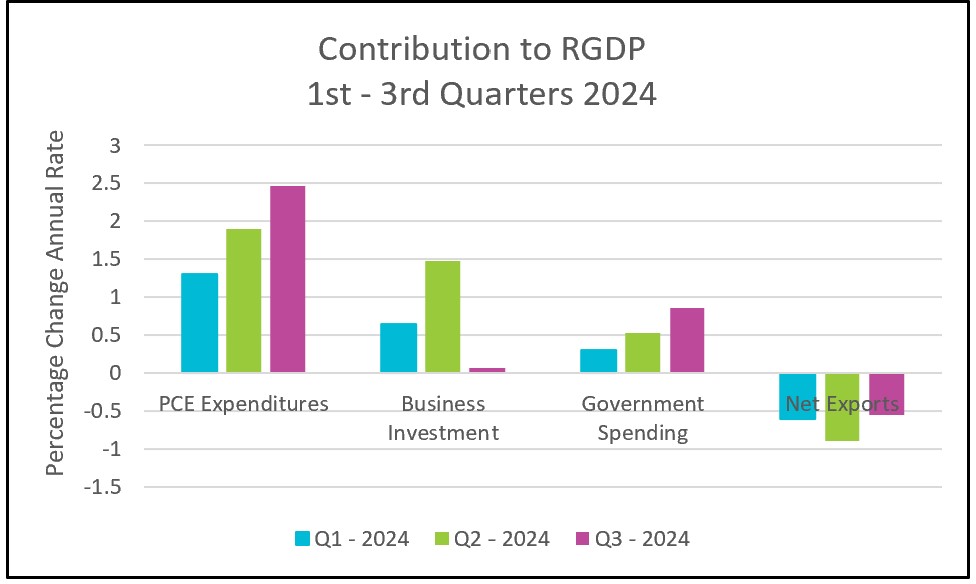

The U.S. economy remains healthy, supported by higher incomes, employment stability, lower inflation rates, and greater consumer confidence, all of which have fueled consumer spending, the economy’s primary driver. Analysts continue to be surprised by the resilience of U.S. consumers and the overall economy despite higher interest rates. Consumer spending increased by 3.7%, the largest gain since the first quarter of 2023, aided by improved consumer sentiment. According to the Conference Board, consumer confidence experienced its largest monthly jump since March 2021, with the index rising to 108.7 in October, up from 99.2 in September. Generally, people spend more when they are confident that their financial situation will improve or remain stable.

The modest deceleration in RGDP is primarily attributed to a significant slowdown in private inventory investment. Businesses continued to invest heavily in equipment, with equipment sales rising by 11.1%. However, the decline in inventories and residential construction reduced the overall growth to less than 1%. Inventories fell by 11.5%, indicating that businesses sold more goods than they produced. While strong sales (consumption) boosted the economy, the reduction in inventories signals less investment in future production, which contributes to a decrease in business investment.

Residential investment declined at an annual rate of 5.1%, the largest drop since 2022. High mortgage rates and elevated home prices have made it more difficult for prospective buyers to qualify for a mortgage. Additionally, many homeowners are opting to stay in their current homes with lower fixed mortgage rates rather than purchasing new properties that would require higher interest rates.

Both exports and imports increased in the third quarter. While exports rose by 8.9%, imports grew by 11.2%, offsetting the gain in exports. Businesses likely increased imports in anticipation of a potential dockworkers’ strike. Fortunately, the strike lasted only two days. Exports add to a nation’s GDP because they reflect domestic production, whereas imports are subtracted from GDP as they represent goods produced abroad.

Government spending also contributed to third-quarter growth, with a 5% increase adding nearly one percentage point to overall GDP growth. Federal spending surged by 9.7%, driven by a 14.9% increase in defense expenditures.

The graph below summarizes the contributions of the major components of RGDP to the increase in RGDP during each of the first three quarters.

The personal consumption expenditures (PCE) price index, the inflation measure preferred by Federal Reserve policymakers, slowed to 2.2%, slightly above the Fed’s 2.0% target. This deceleration may give policymakers room to continue lowering their benchmark interest rate, making interest-sensitive investments more affordable.

Real disposable income increased by 1.6%, meaning after-tax income rose more than inflation. This provides relief for low-income households, helping them manage their budgets more easily, a sharp contrast to the challenges they faced when inflation peaked in 2022. This economic reprieve could strengthen Vice President Kamala Harris’s chances in next week’s election. However, many voters are still frustrated that prices remain significantly higher than pre-pandemic levels.

Two additional economic reports will be released prior to election day. It is unlikely either will significantly affect the presidential race. The Bureau of Economic Analysis (BEA) will release its Income and Outlays report tomorrow, focusing on October’s data. Additionally, the Bureau of Labor Statistics (BLS) will release its Employment Summary - October 2024 on Friday. Higher Rock’s summary and analysis will follow shortly after each publication is released.