The Bureau of Economic Analysis’s news release Gross Domestic Product, Second Quarter 2024 (Advance Estimate) highlights are summarized below.

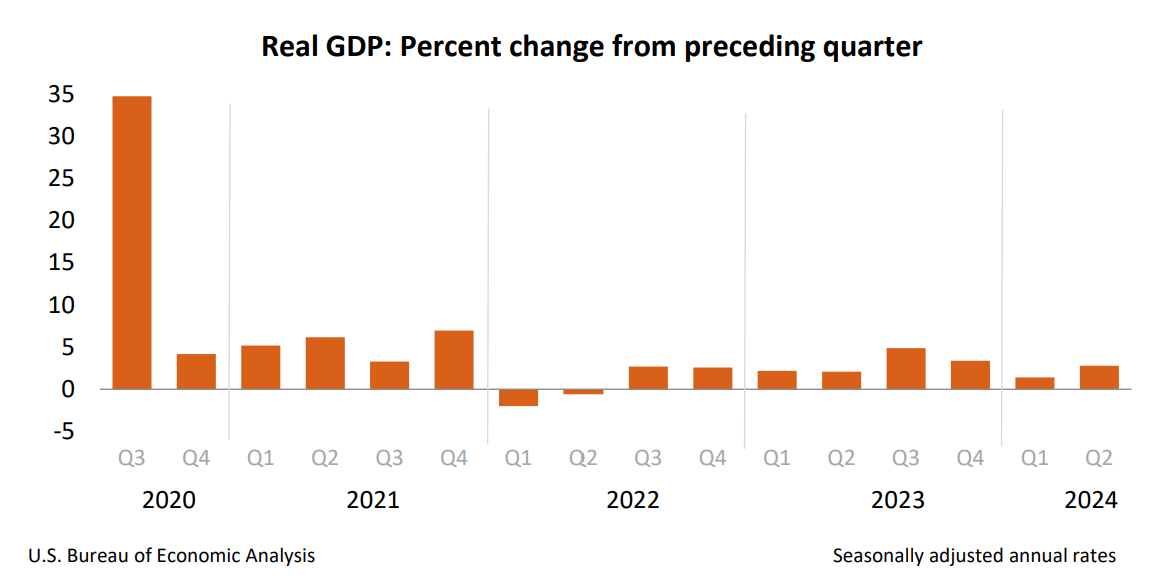

The US economy is proving resilient in the face of higher interest rates. It grew at an annual rate of 1.4% in the first quarter and accelerated to 2.8% in the second quarter. The growth was driven by continued consumer spending and rising inventories. Despite the increase in economic growth, there are signs that the economy is cooling but not heading towards a recession. While the economy expanded in the second quarter, it’s still lower than the growth seen in the second half of last year, primarily due to a slowdown in consumer spending, a key driver of the economy.

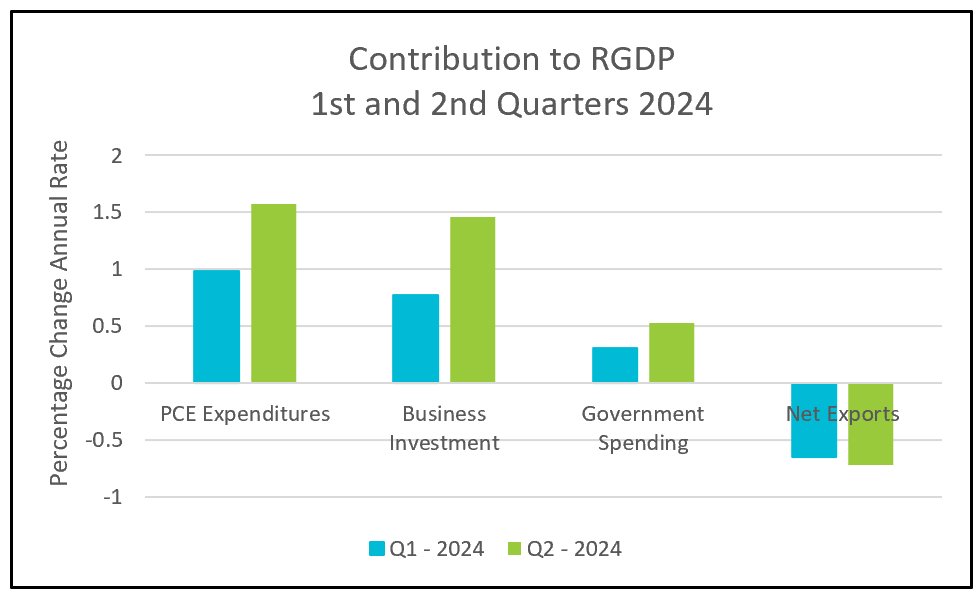

Private business investment jumped by 8.4%, driven by a significant increase in equipment purchases and inventories. However, this growth was tempered by a decrease in residential construction. In the first quarter, inventories declined, resulting in a 0.42% reduction in real gross domestic product (RGDP). However, during the second quarter, businesses invested to replenish their inventories, contributing 0.82% to RGDP. The growth in the first and second quarters is approximately 0.2% apart when not accounting for inventory adjustments. Economists tend to discount inventory changes when analyzing trends due to their high level of volatility.

The graph below summarizes the contributions of the major components of RGDP to the percent increase in RGDP during the second quarter.

The PCE price index, the preferred index used by most economists to measure inflation, increased by 2.6% in the second quarter, down from a 3.4% increase in the first quarter. The core index also slowed, dropping from 3.7% to 2.9%. Although inflation remains higher than the policymakers’ 2% target, the PCE price index has decreased significantly since reaching its peak in 2022.

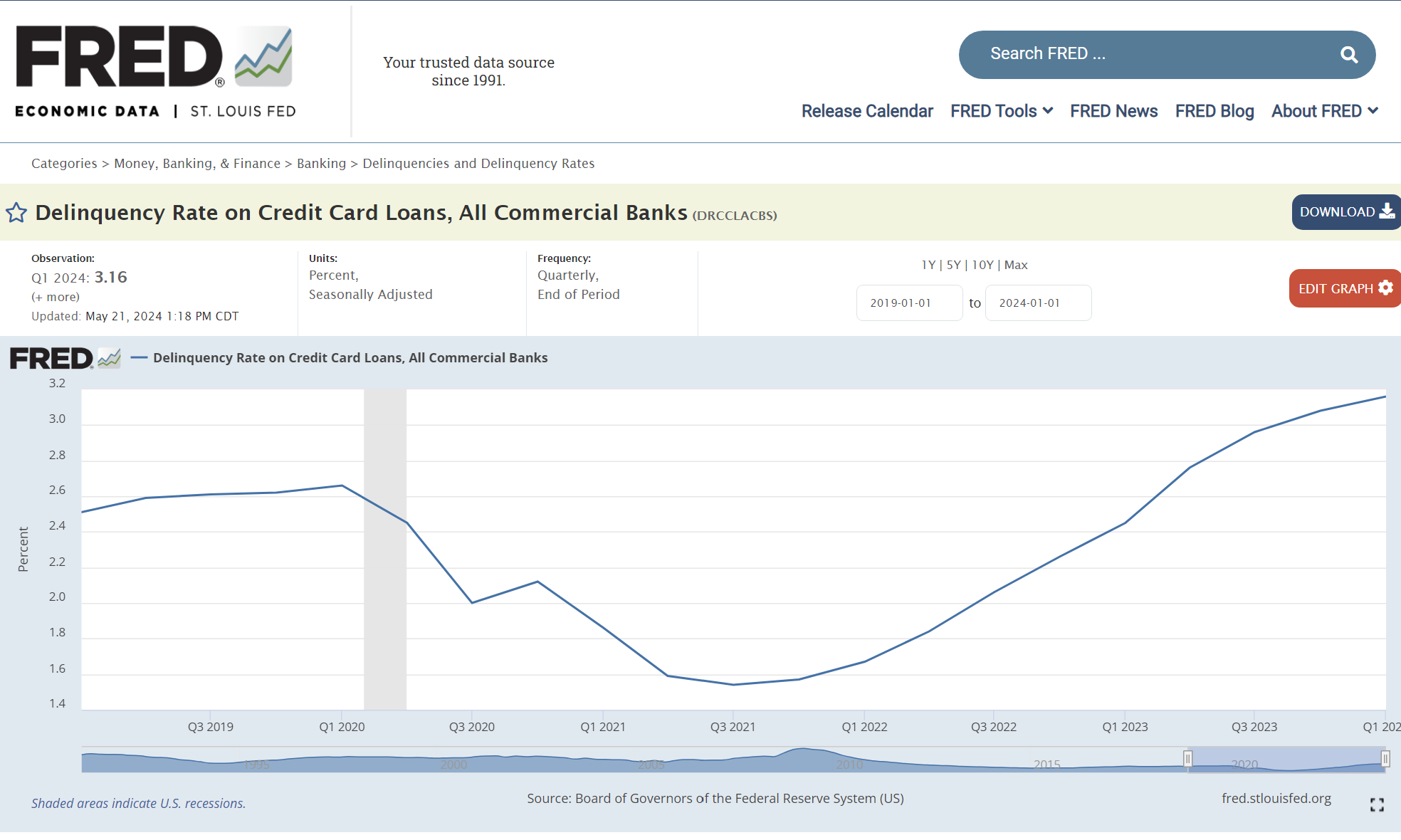

Over a year ago, policymakers increased their benchmark interest rate target from 0% to between 5.25% and 5.5%, marking the highest rate since June 2006. They aimed to combat inflation by reducing the demand for items sensitive to interest rates, while avoiding a recession. Recent data suggest that their approach has been successful, as inflation has decreased significantly. Consumer spending has remained strong, but its growth has slowed. Real disposable income has risen by 1%, indicating that household income has outpaced price increases. However, many households are still facing financial difficulties, and the substantial price hikes in 2022 have continued to pose challenges, leading them to make difficult choices. Many households have depleted their savings and taken on more debt. The savings rate has dropped to 3.5%, down from 3.8% in the first quarter, marking the lowest point in a year and a half. Additionally, there has been an increase in credit card delinquencies.

The Federal Reserve’s policymakers will meet on July 30th and 31st, but they are not expected to begin lowering rates until their September meeting. The BEA’s publication Personal Income and Outlays – June was released earlier today. June’s income, output, and price levels fell modestly, supporting views that the Fed should begin easing its monetary policy. (Higher Rock’s summary and analysis will be released published this weekend or Monday.) Policymakers will also benefit from additional employment information that the Bureau of Labor Statistics will release next week. There has been a recent weakening of the labor market, with payroll increases trending lower and the unemployment rate rising slightly in each of the last three months. A softening of the labor market supports lowering interest rates.