Here are the key highlights from the Bureau of Labor Statistics press release Consumer Price Index - October 2024:

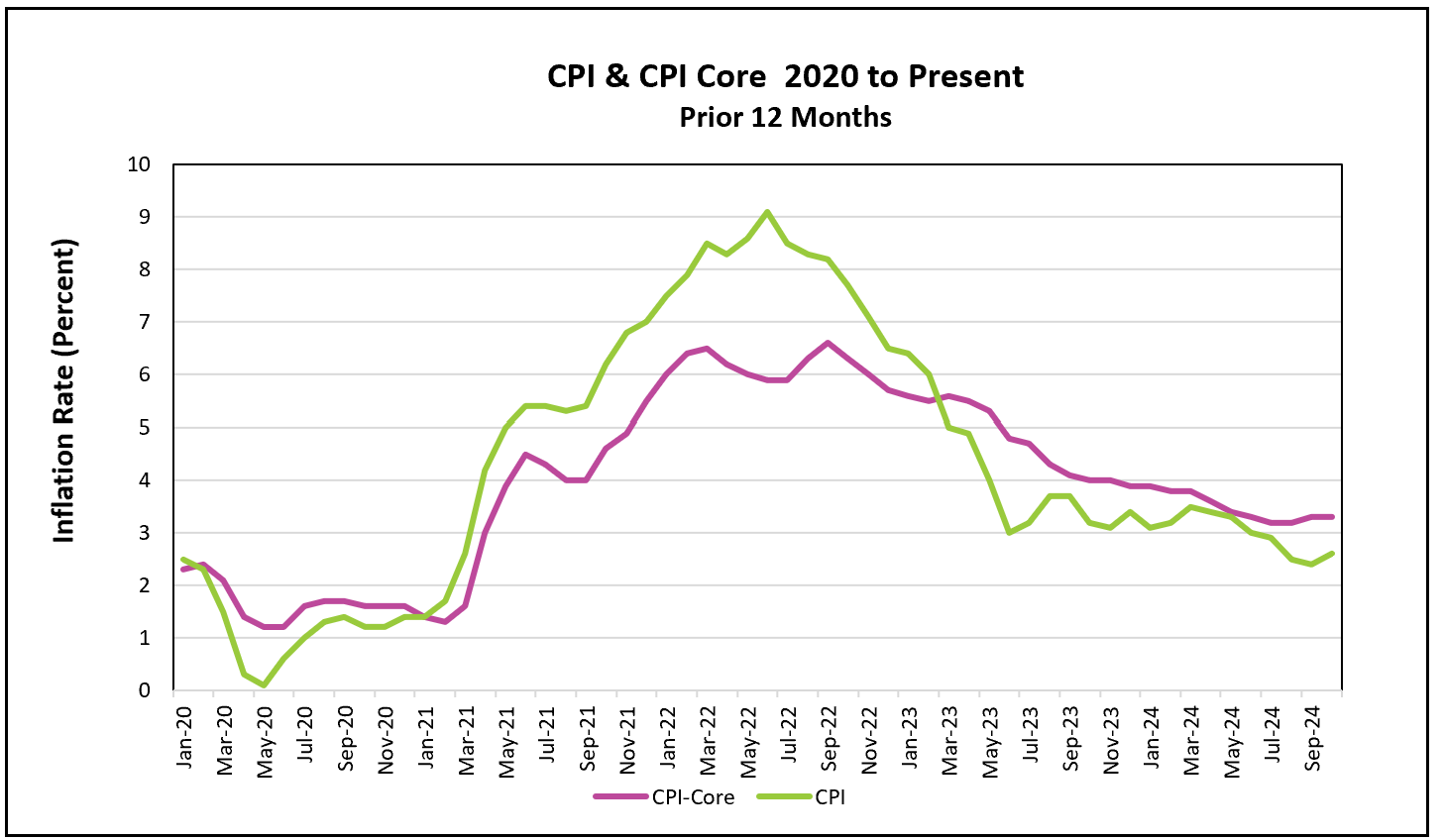

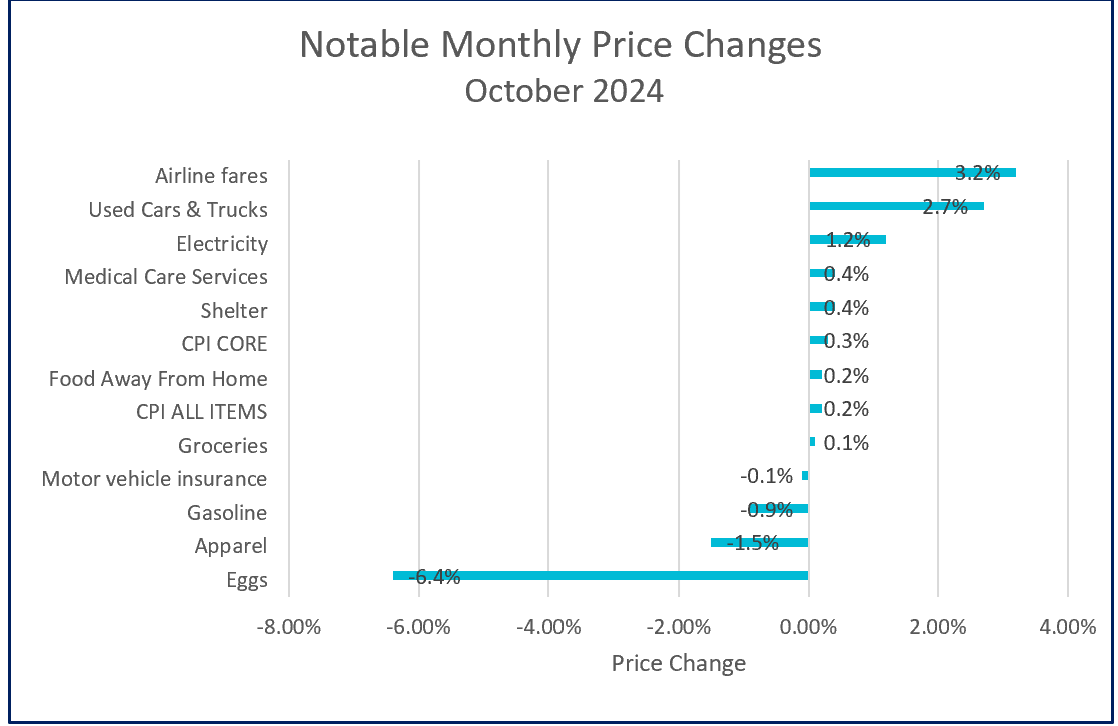

Disinflation stalled as prices increased slightly in October. While monthly figures were unchanged, the 12-month all-inclusive index accelerated, marking the first increase in the overall CPI since March. The monthly core index has not decelerated since June and is only 0.1% lower than at the start of the year. The slower decline of the core index compared to the overall CPI is mainly due to the exclusion of energy prices, which have seen significant decreases recently. Gasoline prices fell 0.9% in October and are down 12.2% from a year ago. Lower gas prices have supported consumer spending by leaving households with more disposable income to spend on other goods and services.

Food prices rose 0.2% in October, down from 0.4% in September. Over the past 12 months, food prices have increased by 2.1%, a sharp decline from 2022, when they surged over 10%, causing significant hardship for consumers.

Prices of most services have decelerated. During the pandemic, businesses faced labor shortages and raised wages to attract and retain employees, often increasing their prices to maintain profit margins. Since most service companies are labor-intensive, a slowdown in service price increases suggests reduced pressure on wages.

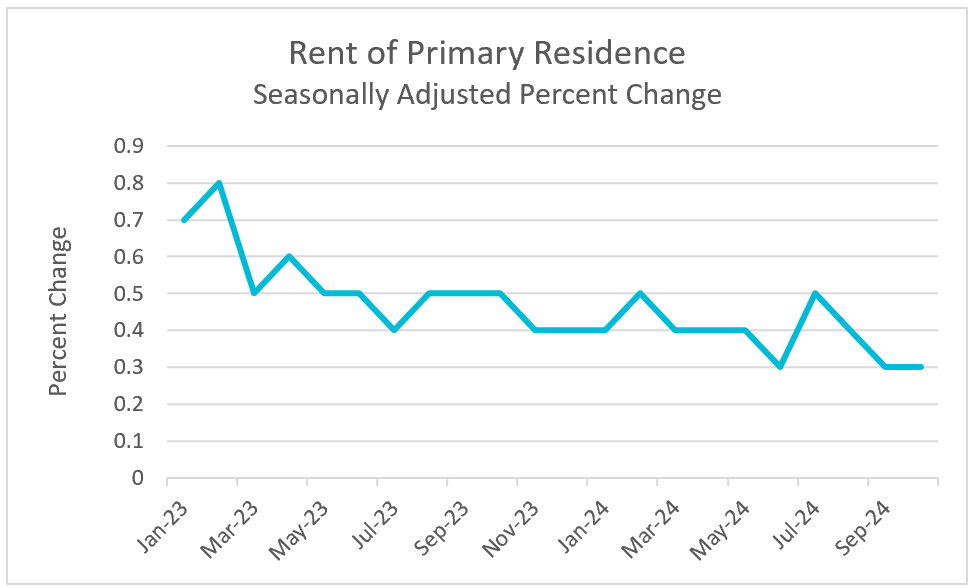

Policymakers will find it encouraging that rents are trending lower. The shelter index has consistently accounted for over half of the overall CPI. Rent is a lagging economic indicator that reflects past economic performance and confirms existing trends. The graph below shows that the rent of primary residence index is slowly trending downward.

Inflation remains above the Federal Reserve’s 2% target, yet policymakers were confident enough to reduce their benchmark interest rate by 0.5% at their September meeting and by 0.25% last week. This report indicates that most price increases are slowing, with much of October’s uptick driven by higher shelter costs, which are expected to moderate in the future. The consensus is that policymakers will cut rates by another 0.25% at their December meeting.

Many economists believe President-elect Trump’s policies could raise inflation. Tariffs increase the cost of imported goods, and suppliers typically pass much of that added cost onto consumers. Additionally, large-scale deportation of immigrants could exacerbate labor shortages, pushing wages higher. The bond market has reflected these concerns, with yields rising after Trump’s victory. As a result, policymakers may delay future rate cuts to counter these inflationary pressures.

Policymakers will have additional data to consider before their December meeting. The Bureau of Economic Analysis (BEA) will release October’s PCE price index, the Federal Reserve’s preferred inflation gauge, on November 27th. Although October’s employment report was weak, most analysts attributed this to temporary disruptions from hurricanes and strikes. November’s employment report, set for release on December 6th, should provide a clearer picture of the labor market. The BLS will release its next CPI report the week before the Federal Reserve’s meeting. Higher Rock will summarize and analyze these key reports shortly after they are released.