The inflation figures from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index (CPI) – November 2025.

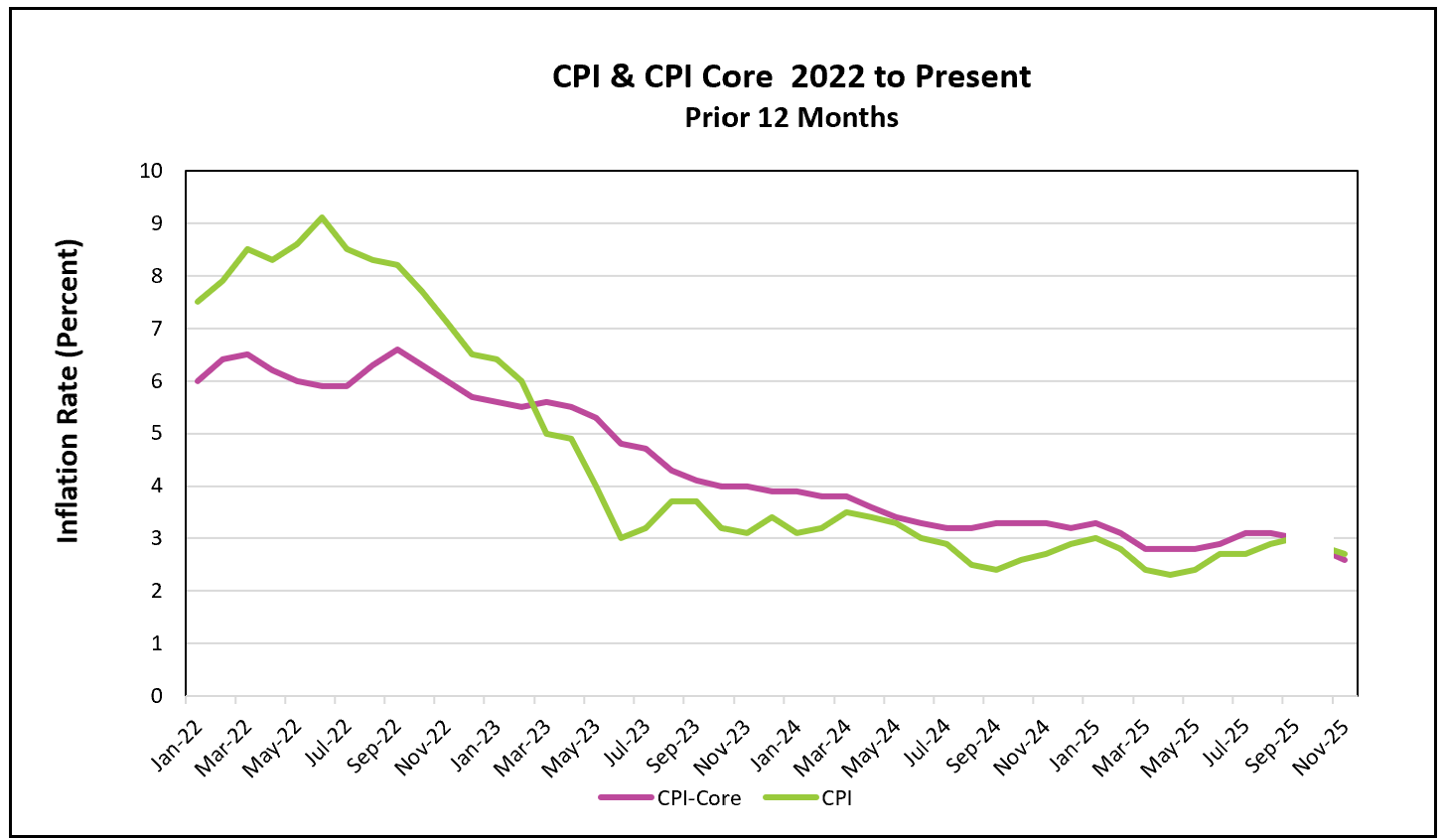

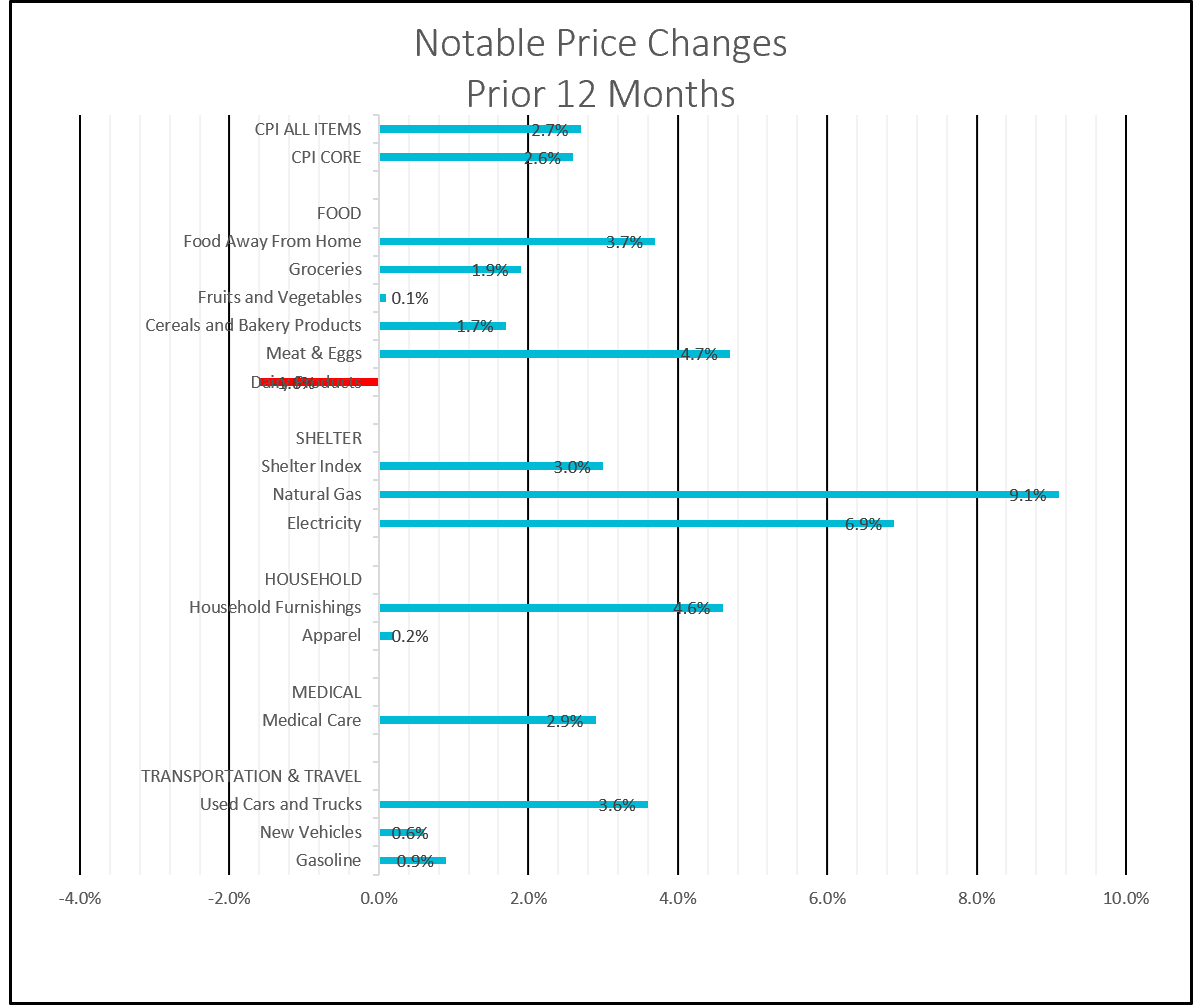

The latest inflation report delivered encouraging headline news, as the all-inclusive consumer price index decelerated to its slowest pace in 12 months. Even more notable, the core CPI—which strips out volatile food and energy prices and is viewed as a better gauge of underlying inflation trends—pegged inflation at 2.6%, a level not seen since the first quarter of 2021. Both measures came in well below economists’ expectations, reinforcing the perception that price pressures are easing more rapidly than anticipated.

However, the report was complicated by disruptions in gathering the data stemming from the government shutdown. Month-to-month CPI figures for October and November were unavailable because the Bureau of Labor Statistics was unable to collect data during the shutdown and cannot retroactively gather it, as government employees did not resume interviews and data collection until the third week of the month. In place of monthly data, the BLS provided inflation figures covering the period from September to November, showing that both headline CPI and core CPI increased just 0.2% over that span.

The White House and the Council of Economic Advisers quickly celebrated the report, taking to social media to argue that the data validate the President’s economic policies. Shelter costs, which rose 3% from a year ago, added to the optimism, marking the smallest annual increase in more than four years. Yet many economists urged caution. Federal Reserve Chair Jerome Powell explicitly warned against over-reliance on the figures, noting concerns about their reliability in his press conference following the announcement of the Fed’s most recent rate cut.

Economists cite two reasons why the report probably understates inflation. First, rents were assumed to be unchanged in October under the BLS’s methodology when data were missing. Housing costs, which comprise a substantial share of the CPI, are particularly challenging to analyze under these conditions. Second, much of November’s price information may have been skewed because it reflected end-of-month pricing, when many retailers were rolling out holiday discounts.

Despite the apparent moderation in inflation, many Americans remain concerned about the rising cost of living. Prices for key necessities rose well above wage growth during 2025. Meat and eggs increased 4.7%, electricity rose 6.1%, and households that rely on natural gas for heating experienced a 9.1% increase. These realities help explain why inflation remains a highly sensitive political and economic issue, regardless of what the headline data suggest.

For the Federal Reserve, the task becomes even more challenging if policymakers must question the accuracy of the very statistics guiding their decisions. The Fed recently reduced its benchmark rate amid concerns about a deteriorating labor market. The low inflation readings could justify another rate cut in January, but officials may instead opt for a wait-and-see approach until more reliable data becomes available. Policymakers are also closely monitoring employment and inflation trends to assess how tariffs are influencing prices and how resilient the labor market remains.

Looking ahead, the Fed’s preferred inflation gauge—the personal consumption expenditures (PCE) price index—is expected to be released before the next FOMC meeting and may provide a clearer signal. December’s CPI, scheduled for release on January 13, will also arrive ahead of the January 27–28 meeting.

Further clouding the Fed’s decision is that many economists believe the full impact of tariffs on prices will not be realized until the first quarter of 2026, as many companies have so far absorbed higher costs rather than passing them on to consumers. That dynamic may change in January or February, when many firms are expected to raise their prices after reassessing their pricing strategies.

In this environment of unreliable data, it is prudent to focus more on trends than on any single data point. Although the recent figures are questionable, they nonetheless suggest a easing of price pressures. Future releases should offer more reliable insight into the true direction of inflation. Higher Rock Education will continue to provide summaries of these developments and a perspective on their broader economic relevance.