Highlights from the Bureau of Labor Statistics Press Release: Consumer Price Index – November 2024

Analysis

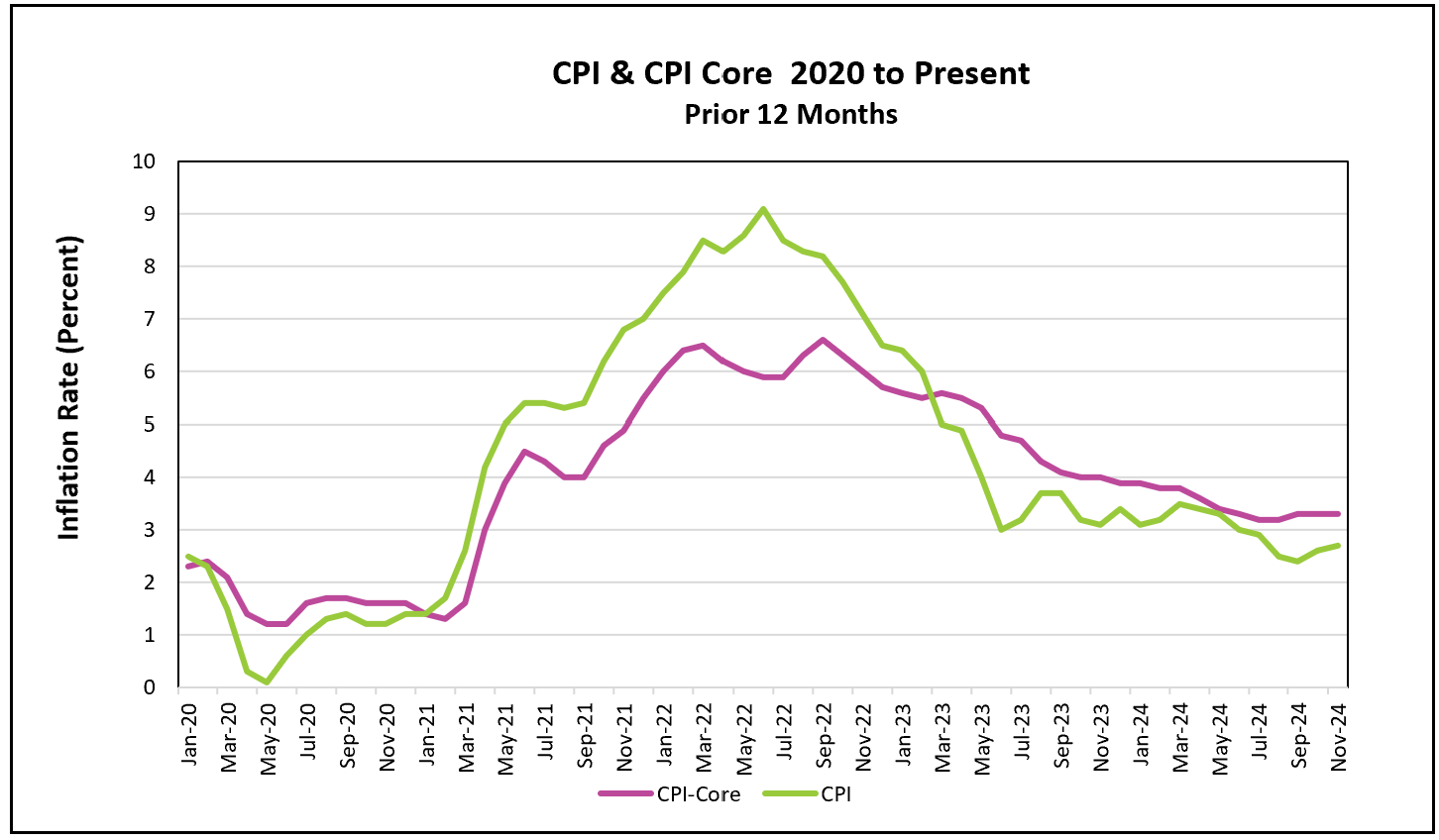

Inflation remains persistent. In fact, the all-inclusive CPI increased for the second straight month for the first time since March. Furthermore, the core rate, which excludes volatile food and energy prices, remains stuck at 3.3%, well above the Fed’s 2% target. However, the increases were expected and are not likely to be significant enough to dissuade policymakers at the Fed from cutting their benchmark interest rate when they meet later this month.

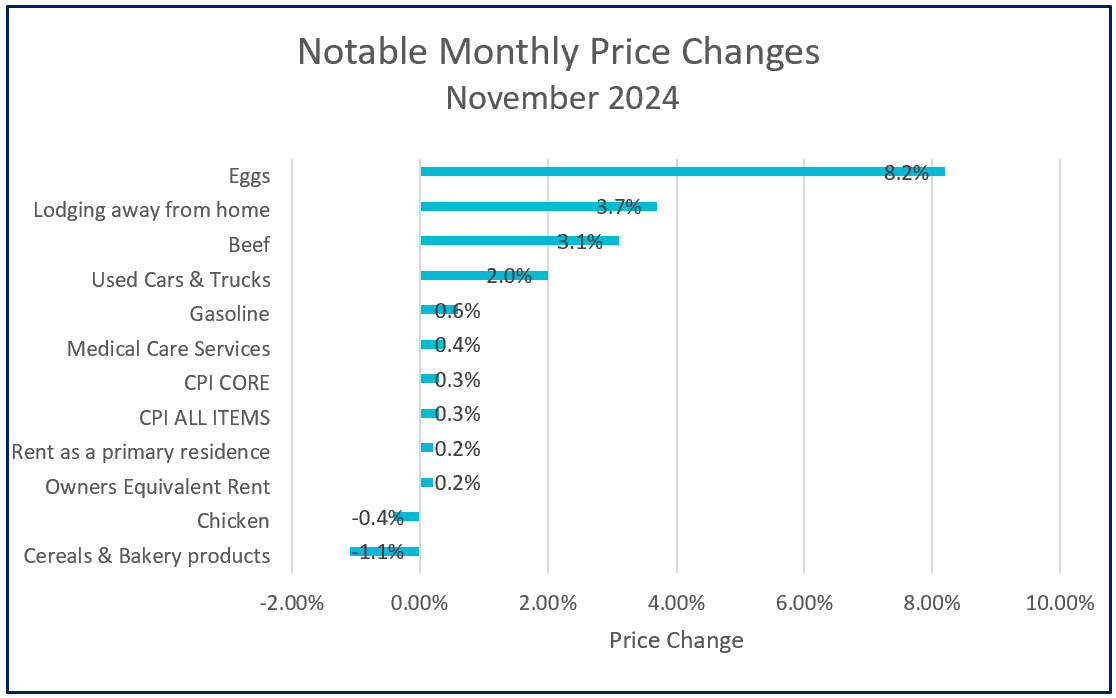

Upward pressure on prices was the greatest in shelter, food, medical services, and energy. Food prices increased 0.4% and are 2.4% higher than a year ago. Jumps in beef and egg prices were the most notable, with beef prices gaining 3.1% and egg prices up over 8%. Egg prices are nearly 38% higher than a year ago, partly because bird flu outbreaks have reduced the supply of eggs. Notable price changes are included in the graph below:

Housing Trends

Policymakers will be encouraged that housing costs for both renters and homeowners are increasing at their slowest pace in years. Rent as a primary residence and owners’ equivalent rent increased by 0.2% in November, the smallest increase in over three years. The 12-month shelter index had the smallest increase since February 2022. However, housing remains the largest contributor to the CPI increase.

Goods, Gasoline, and Potential Tariffs

Goods and gasoline price deceleration have restrained the all-inclusive CPI. However, prices in both categories saw significant increases in November. Gasoline prices rose for the first time since April 2024 but remain significantly lower than a year ago. The price of household furnishings rose 0.7%, the largest increase in a year. This is particularly concerning if President-elect Trump imposes tariffs on imported goods. Tariffs increase the cost of imported goods, and much of the higher cost is passed on to consumers.

Looking Ahead

Following their December meeting, policymakers will announce their interest rate policy and provide projections for the next quarter, giving insight into future rate decisions. Expect fewer rate cuts if recent economic growth and a strong labor market are deemed inflationary.

The Bureau of Economic Analysis will release November’s PCE price index, the Fed’s preferred inflation gauge, on December 20th. While this report will arrive after the Fed’s meeting, it will provide valuable data for their January deliberations. Higher Rock will summarize and analyze this key report shortly after its release.