Core inflation has dropped to its lowest level in three years, raising speculation about a potential decrease in the benchmark rate in September.

Below are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – May 2024:

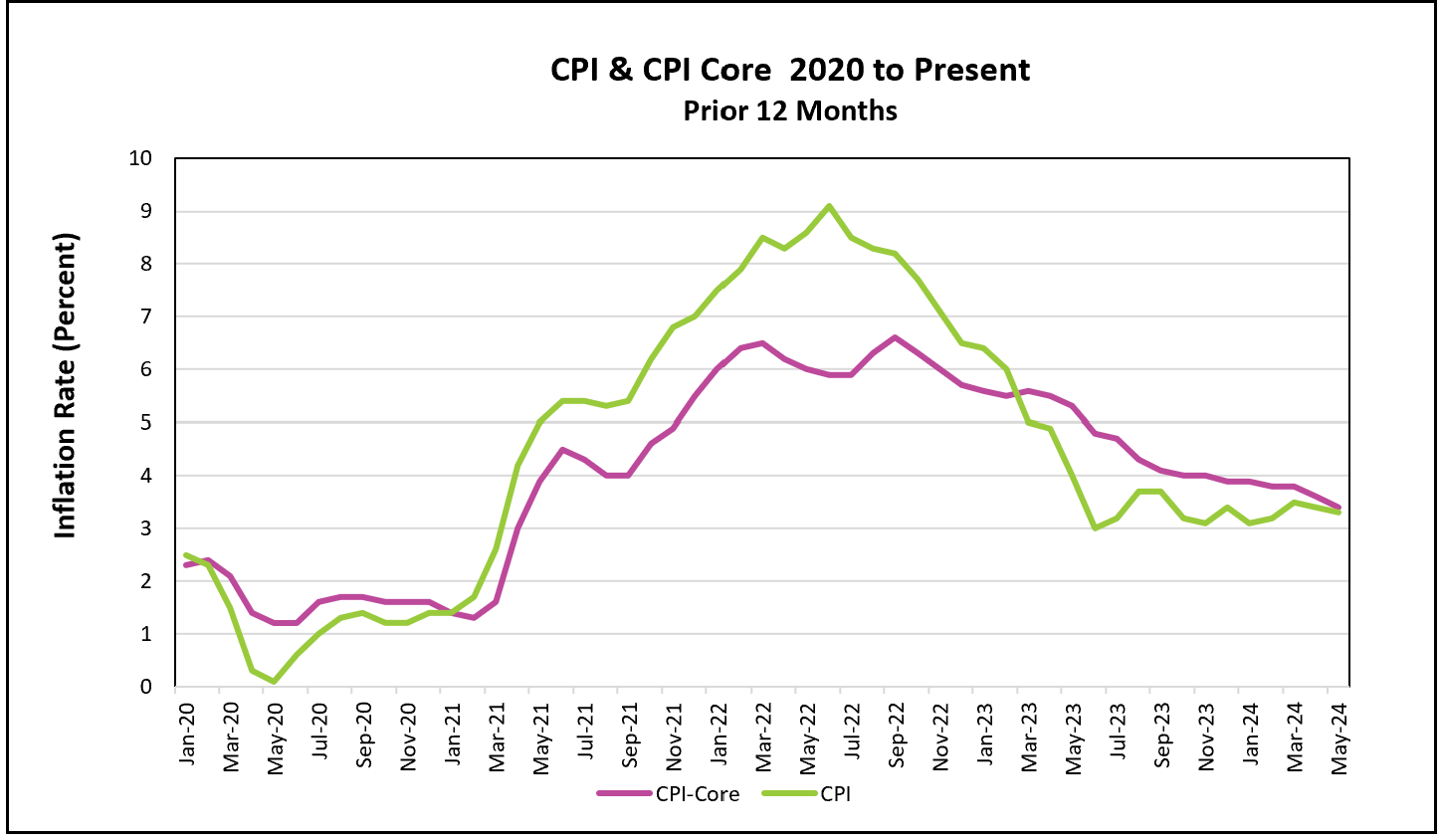

Inflation continues to decelerate. The monthly Consumer Price Index (CPI) stayed the same, marking the first time that prices didn’t change since July 2022. The 12-month CPI also slowed down for the second month in a row. A clear sign that inflation is decreasing is the consistent drop in the 12-month core index, which has declined every month since March 2023. Economists believe the core index is more reliable for measuring trends because it excludes volatile food and energy prices.

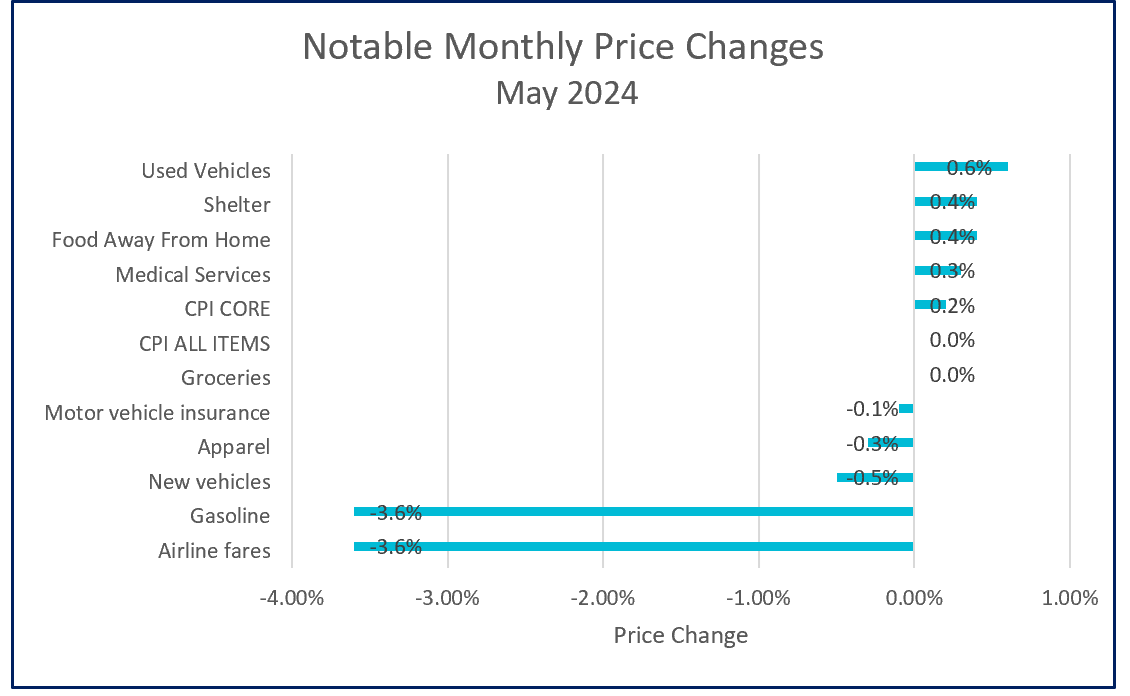

The most significant factor in May’s positive news was a 3.6% decrease in gasoline prices. Consumers might have noticed that their grocery bills didn’t change in May and have only increased by 1% over the past 12 months. Additionally, travel became more affordable as airline fares continued to fall, just in time for the summer travel season.

Escalating rents, which increased by 0.4%, prevented the CPI from falling further. The shelter index, accounting for one-third of the CPI, has remained stubbornly high. High mortgage rates have discouraged many from purchasing homes, increasing the demand for rental housing. Additionally, an influx of immigrants has added to this demand.

Policymakers at the Federal Reserve adjourned their most recent policy-setting meeting after the CPI release. They chose to leave their base rate unchanged and predicted one rate cut before the end of the year. Chairman Powell noted the improvement in inflation but suggested that policymakers want more evidence of moderating prices. They must balance the risk of waiting too long to lower rates and triggering a recession with lowering rates too soon and reigniting inflation.

A resilient labor market concerns policymakers, suggesting the economy is not slowing sufficiently to lower inflation to their 2% target. Elevated payrolls have pushed wages higher. In a separate report, the Bureau of Labor Statistics reported that real wages increased 0.5% between April and May and 0.8% from a year ago.

The Fed’s preferred measure, the PCE price index, remains above the 2% target, with April’s reading at 2.7%. The PCE price index has consistently been lower than the CPI because the CPI weighs housing costs more heavily. May’s PCE price index will be released on June 28th. Higher Rock will provide a summary and analysis shortly after its publication.