Highlights from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index – March 2025

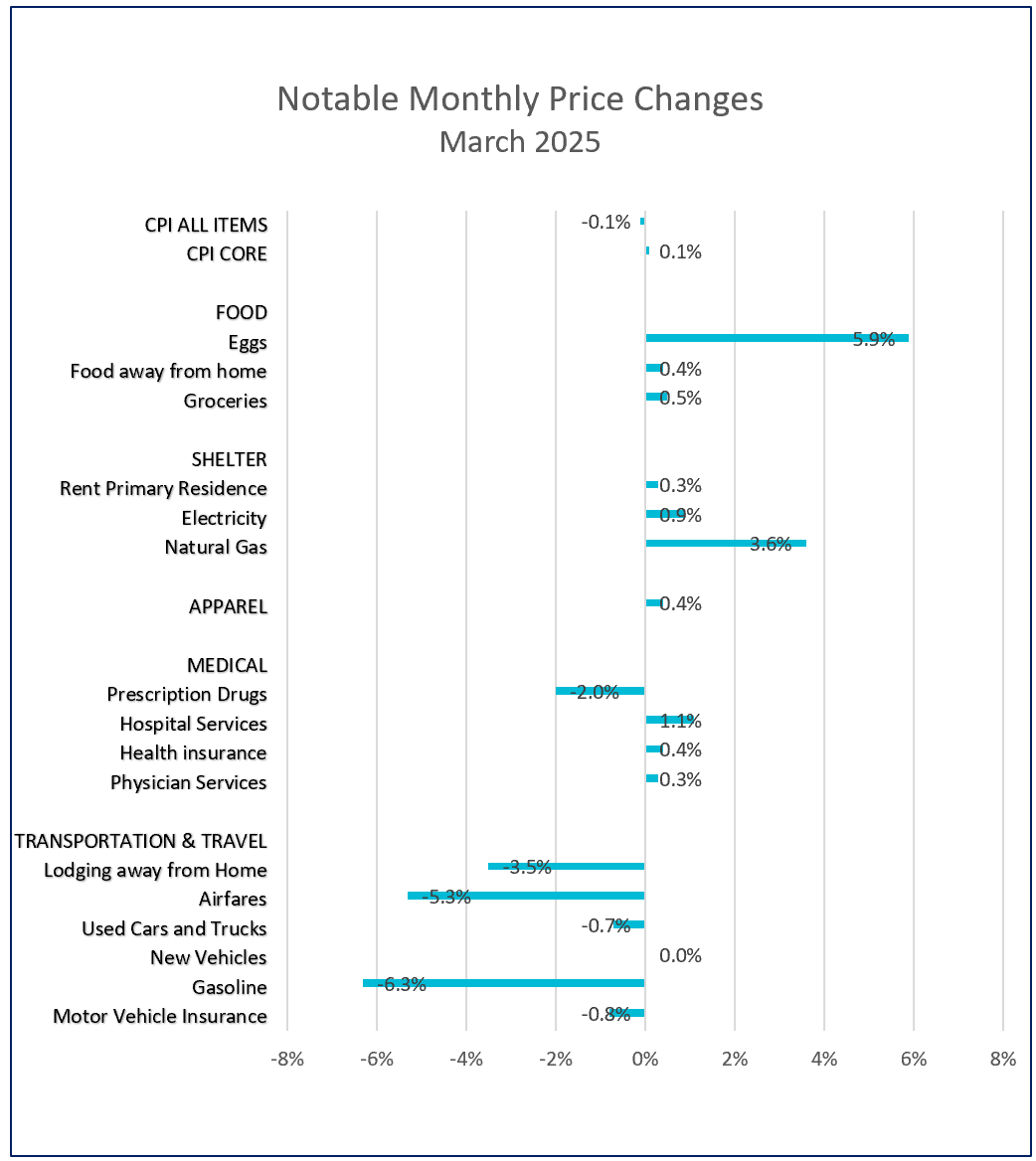

Prices fell in March for the first time since May 2020, offering some relief to budget-strapped families. However, food and shelter costs continue to rise. Travel was the most significant contributor to the overall price decline. Gasoline, airfares, and lodging away from home each dropped by more than three percent. In addition, used car prices fell while new car prices rose modestly, and the cost to insure them decreased, reversing a recent trend of escalating rates.

Still, families continue to face higher food costs. Grocery prices rose 0.5%—the largest monthly increase since October 2022 and well above the 0.2% average over the previous year. Egg prices, in particular, remain elevated, though the rate of increase has slowed from over 10% to just under 6% because of an avian flu outbreak that has led to the culling of millions of egg-laying chickens.

An especially stubborn shelter index—comprising more than one-third of the CPI—has limited the extent of the index’s overall decline, especially compared to the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index. Nevertheless, the rise in March’s shelter index was the smallest since November 2021. A significant drop in lodging costs helped offset increases in rent. Rent for a primary residence rose 0.3% for the third consecutive month, while the owner’s equivalent rent increased slightly more in March than in February.

Cooling aggregate demand is helping restrain price increases. Many consumers have cut back on discretionary spending due to concerns about the economy’s outlook. The University of Michigan Consumer Sentiment Index fell for the fourth straight month, declining 11% in March. Expectations deteriorated across all demographic and political groups as concerns about the business climate, trade tensions, inflation, and employment weigh heavily on households.

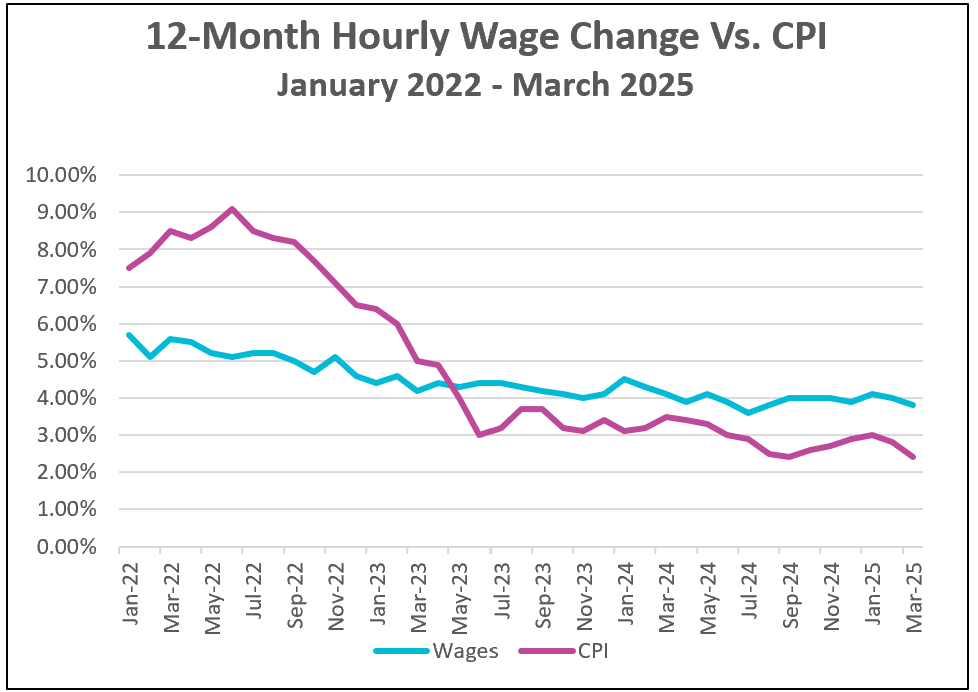

The decline in travel costs may be partly due to a decrease in tourism, which is likely related to aggressive trade policies. According to Visaverge, U.S. tourism is projected to lose $64 billion in revenue by the end of 2025. However, wage growth continues to outpace inflation. In a separate report, the Bureau of Labor Statistics stated that real hourly earnings increased by 1.4%, marking the largest rise since November.

However, the recent cooling of inflation may be temporary. The CPI is a lagging indicator, meaning it reflects past economic conditions. March’s data shows that tariffs already in place have had little impact. Tariffs are a duty charged to domestic companies for the goods they import. They are inherently inflationary, as businesses often pass the added costs onto consumers—especially when tariffs are broad-based, and competitors face the same pricing pressures. The current wave of tariffs is so extensive that businesses may find it easier to raise prices without fear of losing market share.

President Trump’s “Liberation Day” on April 2nd marked the imposition of a new round of tariffs, which are not yet reflected in March’s numbers. Even tariffs introduced earlier in March are unlikely to have filtered through the economy, as their effects typically take months to materialize. However, their impact will be felt – even though President Trump has paused implementation for most countries for 90 days. The earlier tariffs were significant and widespread, as imports from most countries are still subject to a 10% tax, and China is paying a 145% tariff. (The tariff on Chinese goods was not paused.)

While the recent dip in inflation is encouraging for Federal Reserve policymakers—who have been working to tame inflation through a series of interest rate hikes—it is unlikely to shift their overall stance immediately. Policymakers recognize that the full economic impact of the newly imposed tariffs has not yet been fully realized. As a result, policymakers are likely to interpret the current decline in prices with caution. They will seek additional evidence from future inflation data, particularly focusing on the PCE price index before making any adjustments to their policy. If tariffs prove to be strongly inflationary, the Fed may be forced to keep interest rates higher for longer than previously anticipated, despite the recent softening in price growth.

The Bureau of Economic Analysis (BEA) will release March’s PCE price index on April 30 as part of its Personal Income and Outlays report. The report will also shed light on how declining consumer sentiment may be affecting spending behavior. Although consumer spending rebounded in February following a decline in January, overall growth remains slower than during the last quarter of 2024. A significant drop in consumer spending could push the economy into a recession, as consumer spending accounts for 70% of the US GDP. HRE will provide a summary and analysis shortly after the report’s release.