Below are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – June 2024:

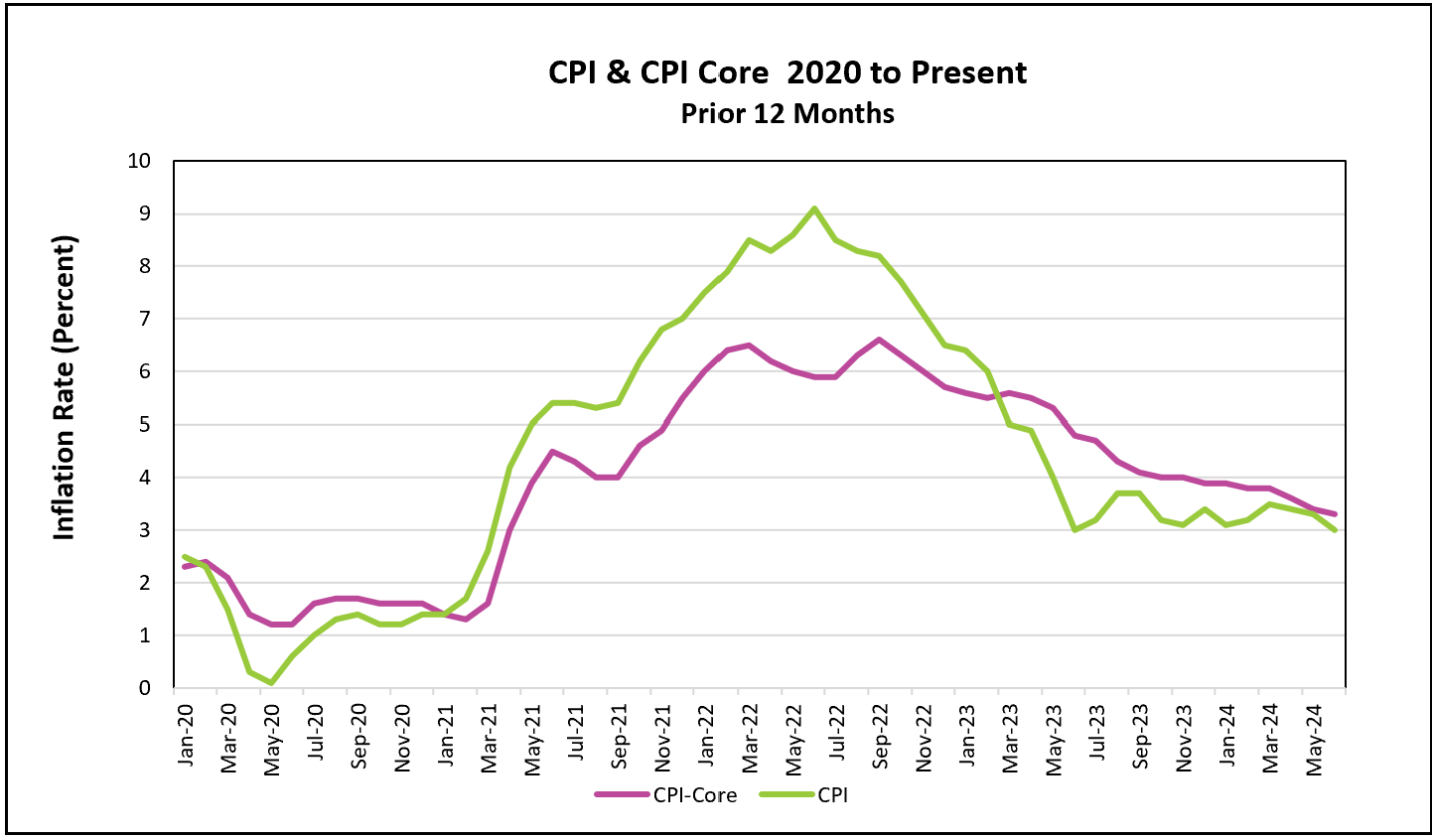

June’s consumer price index fell, while the annual index rose by 3.0%. The monthly price drop was the first since May 2020 and the smallest annual increase since last June. Furthermore, both rates have decreased every month since March 2024. The core rates, which economists consider a better measure of trends, have also fallen in each of the last four months on a monthly and annual basis.

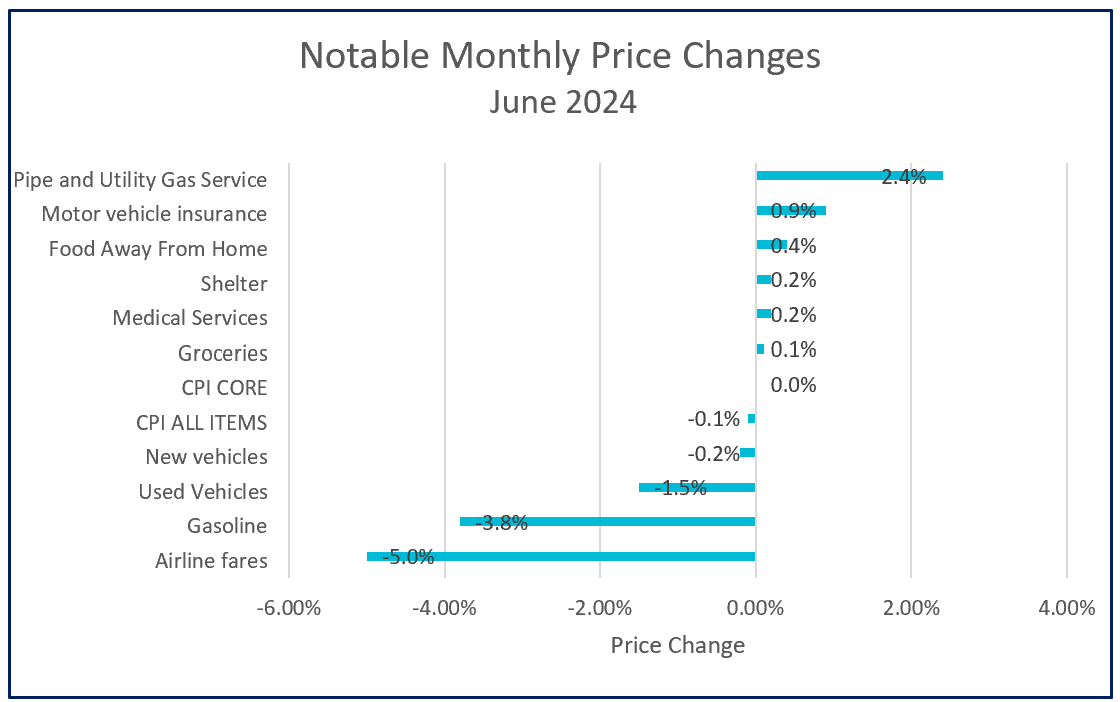

A 3.8% drop in June’s gasoline prices contributed significantly to the drop in the monthly all-inclusive index. The shelter index has been very stubborn since the beginning of the year. It is usually slower to fall because it includes existing rents that do not change much from month to month. Economists’ predictions that the housing index would decelerate as more apartments are completed and rented have finally been realized. June’s index was up 0.2%, half of the 0.4% increase in each of the last four months. The graph below includes other notable price changes in June.

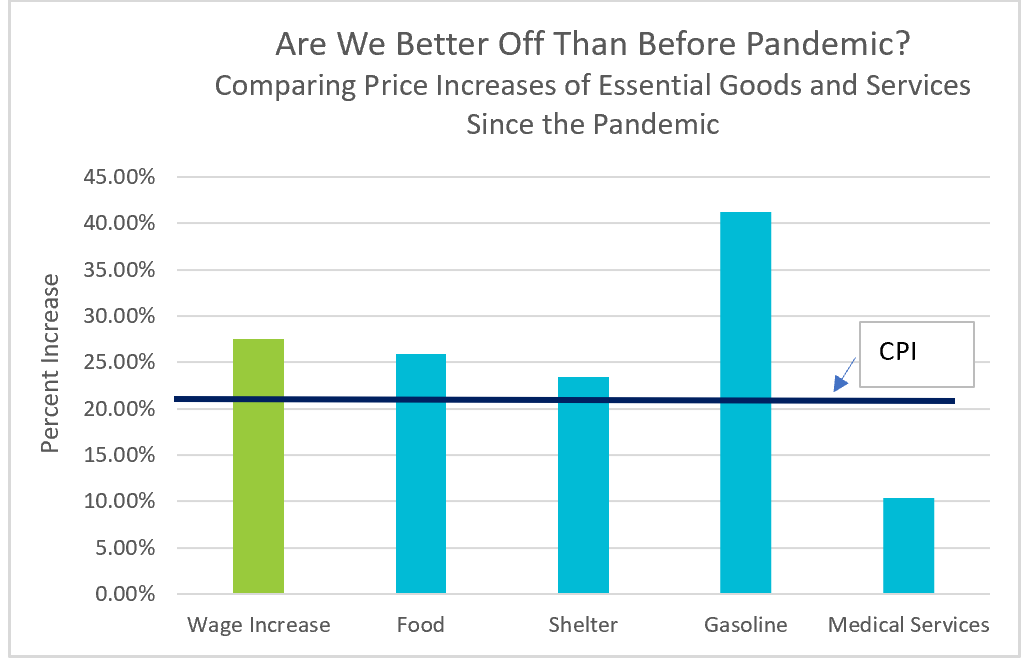

Inflation’s deceleration is welcome news for policymakers and consumers. However, many people feel worse off because prices remain well above pre-pandemic levels. But are we really worse off? Wage gains have actually exceeded inflation. The graph below illustrates the relationship between wage increases, the prices of several essential goods and services, and inflation. The consumer price index (black line on the graph below) increased by 21.5% between February 2020 and June 2024, while wages increased by 27.6% during the same period. The price of most essential goods and services indeed increased more than the consumer price index, but only the price of gasoline increased more than wages. (Remember paying over $4.00 at the pump two years ago!) Food is up 26%, shelter 23%, and medical care 10%.

Sources: Wages – BLS: The Employment Summary February 2020 and June 2024, Table B-4

Prices – BLS: Consumer Price Index February 2020 and June 2024, Table 1

It is easy to look at averages and conclude that we are better off. However, millions of households have wages that have not kept pace with inflation, leading them to struggle with paying higher prices.

Late in 2023, inflation had subsided quickly enough for many economists to forecast that the Federal Reserve would begin to cut its benchmark rate. But, inflation accelerated as payrolls and wages surged during the first quarter, dampening hopes among economists that policymakers would reduce interest rates in 2024. Chairman Powell stressed that the policymakers needed more data to substantiate a sustainable downward trend in inflation. However, his testimony earlier this week marked a change when he stated that the labor market was “not a source of broad inflationary pressures for the economy.” This testimony, combined with several recent reports, brings a rate cut in September (and even in July) back into play.

The Federal Reserve’s mandate is to use “monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the US economy.” Its primary focus has recently been taming inflation, but June’s unemployment rate exceeded 4% for the first time since January 2022. Higher unemployment will demand more attention from policymakers. A softening labor market and cooling inflation justify beginning to lower rates.

Policymakers will convene at the end of July. Several key economic reports will be released before then, providing better insights into the state of the US economy. The Bureau of Economic Analysis (BEA) will publish its initial estimate of economic growth in the second quarter on July 25th, along with June’s PCE price index, the preferred inflation measure by policymakers, on July 26th. If these reports confirm a decelerating economy and decreasing inflation, policymakers may start reducing rates. Otherwise, analysts expect them to wait until their meeting in September. Higher Rock will provide a summary and analysis following the publication of each of these reports.