Here are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – July 2024:

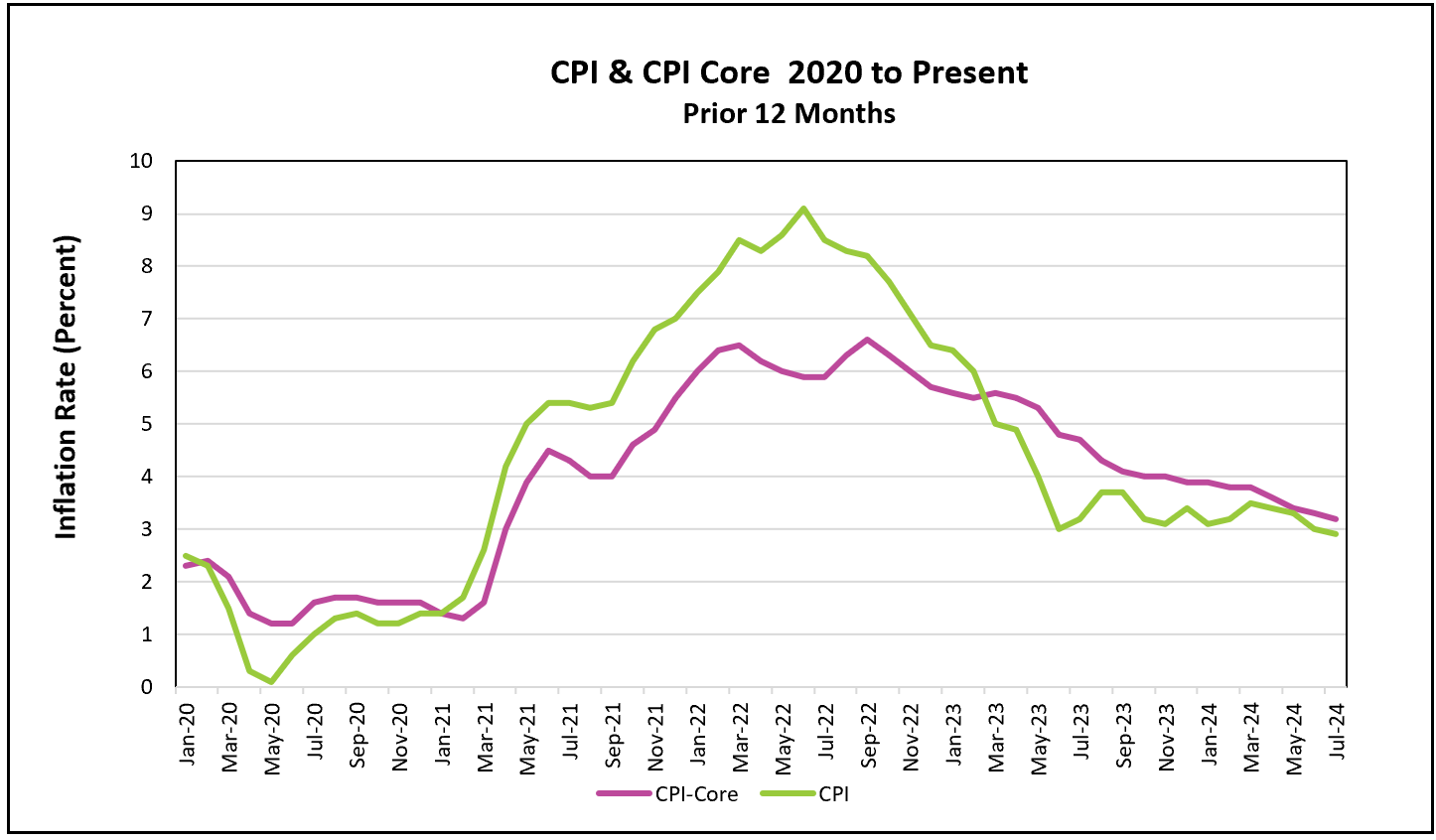

Inflation eased for the fourth consecutive month, reaching its lowest rate in over three years. The ongoing deceleration of the 12-month price level suggests that the worst inflation in four decades is coming to an end. As a result, policymakers at the Federal Reserve are expected to start reducing their benchmark interest rate at their upcoming meeting in September. The annual core rate, which rose by 3.2%, also indicates a deceleration of price increases. Economists prefer the core rate for evaluating trends because it excludes volatile food and energy prices.

Still, July’s monthly indexes accelerated, rising 0.4%, double the increase in June. The significant increase in shelter costs accounted for over 90% of the 0.2% rise in the all-inclusive index and even more in the core index. Since the beginning of the year, the shelter index has been very stubborn. Shelter prices are the most significant component of the CPI index. Rent of the primary residence rose 0.5% in July, the most since February. The shelter index typically changes more slowly because it includes existing rents that do not change much from month to month. Economists have anticipated that the increases in the housing index would decelerate as more apartments are completed and rented. July’s jump came as a surprise and hopefully, a blip in the data.

Food prices rose by 0.2% in July and by 2.2% over the prior 12 months. CBS Morning reported that nearly 9 million chickens have been infected with bird flu, drastically reducing the supply of chickens. As a result, the price of eggs has risen. The cost of eggs has gone up by 5.5% in the last month and by 19.1% compared to a year ago. Grocery prices rose 0.1% in July, while the food away from home index rose 0.2%.

The prices of apparel, new cars, used cars, airfares, and hospital services decreased.

In other encouraging news, the 12-month Producer Price Index (PPI) decreased from 2.7% in June to 2.2% in July. The PPI is a leading indicator of the CPI because it is the inflation rate for suppliers. It measures the weighted average cost of a basket of goods and services sold in the wholesale, manufacturing, and commodity markets.

During the COVID-19 pandemic, inflation surged as the economy’s aggregate supply fell while its aggregate demand increased. Supply-chain challenges such as labor shortages, rising input costs, and distribution challenges made it difficult for producers to deliver the demand for the goods or services they provided. Meanwhile, large and multiple stimulus checks boosted the economy’s aggregate demand. The Fed tightened its monetary policy to tame the resulting inflation.

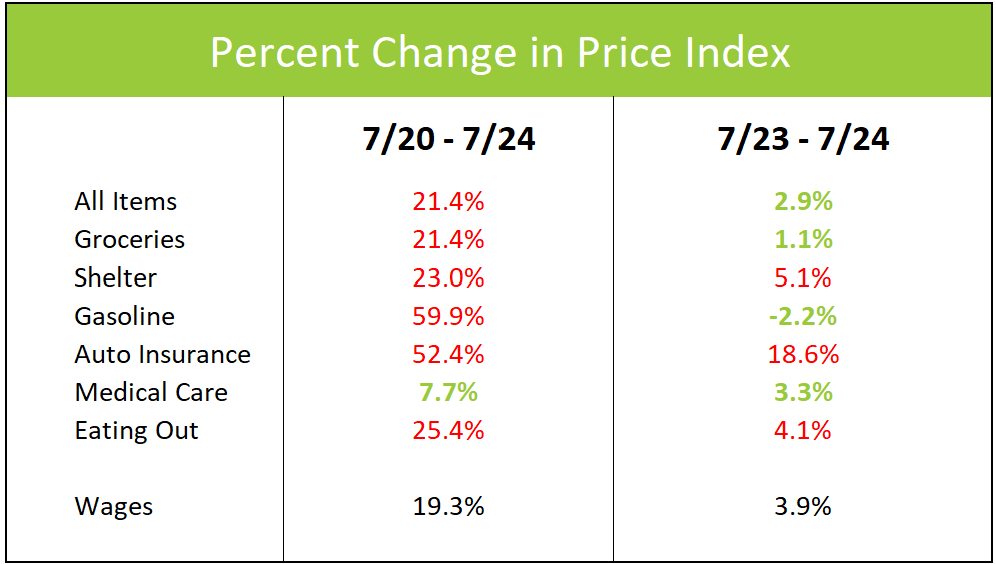

Its strategy has worked but has yet to satisfy many voters. Consumer sentiment remains restrained, and higher prices, particularly grocery prices, remain a top concern. Inflation will be a theme in the upcoming Presidential election. The table below illustrates why.

Between July 2020 and July 2024, the CPI increased 21.4%, while the average hourly wage increased 19.3%. During this period, the price of many essentials, including groceries, gasoline, and shelter, increased more than wages. These items appear in red on the table. Only the cost of medical care rose at a slower clip than wages. However, between July 2023 and July 2024, wage gains exceeded the CPI, with prices for groceries, gasoline, and medical care increasing at a slower pace than wages. While this improvement has provided some relief to strained budgets, the fact that the cost of many essentials has outpaced wage increases over the past four years continues to leave many families anxious.

Policymakers at the Federal Reserve have the dual mandate of keeping inflation under control while maintaining high employment. High interest rates have slowed the economy and cooled inflation. So far, the labor market has remained strong. However, recently, hiring has slowed, and the unemployment rate has increased. These changes have likely switched the Fed’s primary concern from inflation to employment. If so, they will probably lower their benchmark rate at their next meeting in September. A lot of economic data will be released before then. The Fed’s preferred inflation gauge, the PCE price index, will be published on August 30th. The rate reduction in September will depend on August’s employment figures and inflation reports. If little changes, most analysts believe a 0.25% reduction is likely. However, many expect a 0.5% decrease if the inflation index is lower, and the labor market shows any sign of further weakness. HRE will publish its summary and analysis shortly after each report is released.