Highlights from the Bureau of Labor Statistics (BLS) Press Release: Consumer Price Index – February 2025

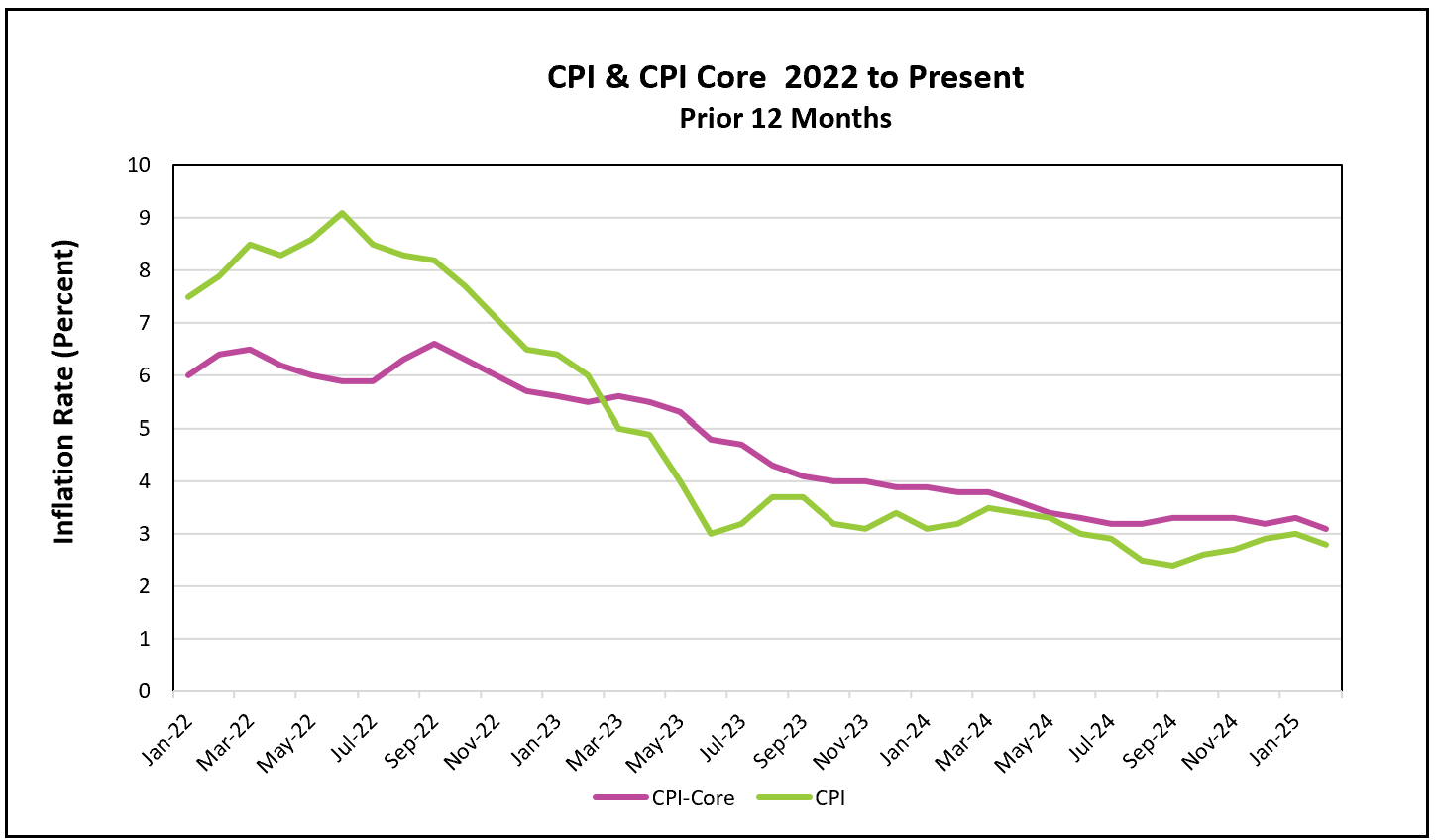

Economists closely monitored this report to evaluate the initial impact of President Trump’s newly implemented trade policies, especially the tariffs on Chinese goods. Most had expected higher inflation readings. The 12-month all-inclusive CPI was the lowest in three months, while the core year-over-year increase was the smallest since April 2021. A separate report from the BLS indicated that February’s wages slightly exceeded inflation, marking a positive development for households with strained budgets.

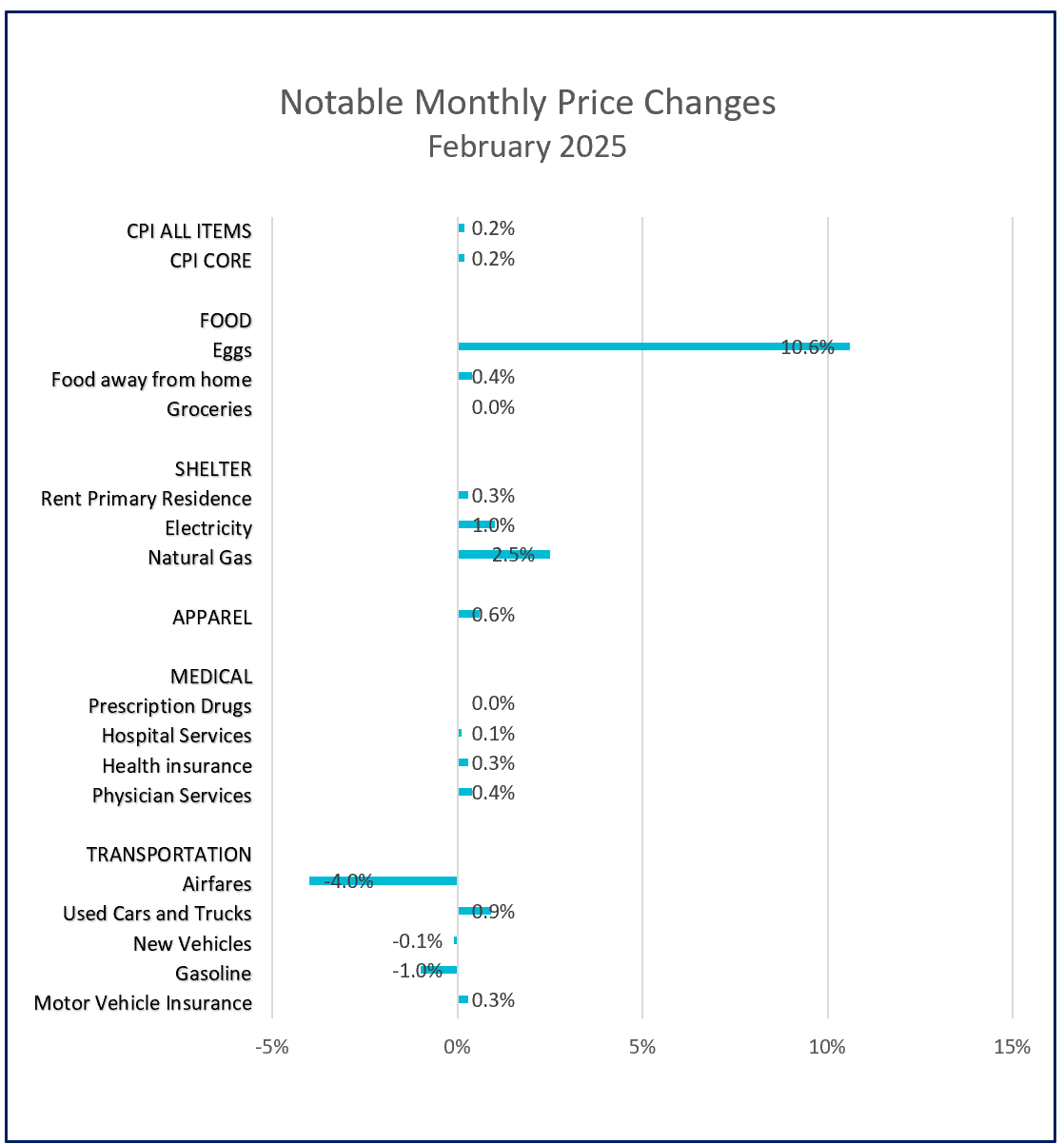

Heating costs rose significantly, with piped gas and electricity among the largest increases. In contrast, transportation costs fell, led by a 4% decrease in airline fares and a 1% drop in gasoline prices.

Food prices were generally stable, except for eggs, which rose by over 10% and pushed grocery prices up by 0.2%. A dozen eggs cost approximately $5.90 in February, which is nearly 60% higher than a year ago. A three-year bird flu outbreak has forced farmers to cull their flocks, killing approximately 150 million chickens (Nerdwallet).

The shelter index had the most significant impact on the monthly CPI, although the 12-month index recorded its smallest increase since December 2021. After months of falling rents, the monthly shelter index now reflects some stabilization, as the CPI accounts for shelter costs through existing rental agreements and estimates of what homeowners would pay if renting their homes. These figures adjust gradually because rents typically change during lease renewals, causing a lag in reflecting market conditions in the official inflation data. However, according to The Wall Street Journal, rents have recently started to rise again.

The impact of the recently imposed tariffs was likely muted and may not fully reflect the long-term economic consequences of the trade policy shift. While tariffs lead to higher prices, the extent of their influence will depend on the specific tariffs enacted and how much of the increased costs businesses choose to pass on to consumers. According to Yale’s Budget Lab, these tariffs could cost the average American household as much as $3,400.

Stagflation, the dreadful combination of a stagnant economy and inflation, is now a real possibility if an escalating trade war slows the economy while increasing prices. Since President Trump’s inauguration, stock prices have dropped over 10%, reflecting investor concerns that a trade war will harm the economy.

Tariffs can impact economic growth by increasing prices, which diminishes consumer purchasing power and slows spending. This uncertainty often causes businesses and households to postpone purchases, hindering overall economic activity. When consumer and business confidence wanes, growth can be affected. Notably, consumer confidence took a significant dip in February.

In addition, other countries frequently impose retaliatory tariffs on U.S. exports, which makes American goods less competitive in the global market. This results in decreased demand for U.S. products and adversely affects industries like agriculture and manufacturing, potentially resulting in job losses. If these tariffs also slow down the economies of key trading partners—such as China, Canada, Mexico, and the EU—the global demand for U.S. goods and services could further decline, compounding an economic slowdown.

With inflation remaining above target, the Federal Reserve will be cautious about lowering borrowing costs to stimulate the economy. Fed Chairman Jerome Powell acknowledged that more progress is needed to control inflation and warned against cutting interest rates prematurely, emphasizing the importance of maintaining a firm stance until substantial improvements are achieved.

This report does not fully capture the long-term economic consequences of many of President Trump’s economic policies. Policymakers are closely monitoring how his policies—including tariffs, immigration, deregulation, tax cuts, and potential increases in energy production—will impact inflation and growth. At the same time, the Fed is wary of letting the economy stagnate. If signs of an economic contraction emerge, the Fed will likely start lowering interest rates before the economy reaches its 2% target.

The Bureau of Economic Analysis (BEA) will release its Income and Outlays Report for February on March 28th. This report will include the Personal Consumption Expenditures (PCE) price index, which is the Federal Reserve’s preferred measure of inflation. It will also provide a clearer view of household income and consumer spending. Higher Rock will publish a summary and analysis shortly after the report’s release.