Higher energy prices fuel the increase in the all-inclusive inflation rate, but the core rate declines for the first time in six months.

Highlights from the Bureau of Labor Statistics Press Release: Consumer Price Index – December 2024

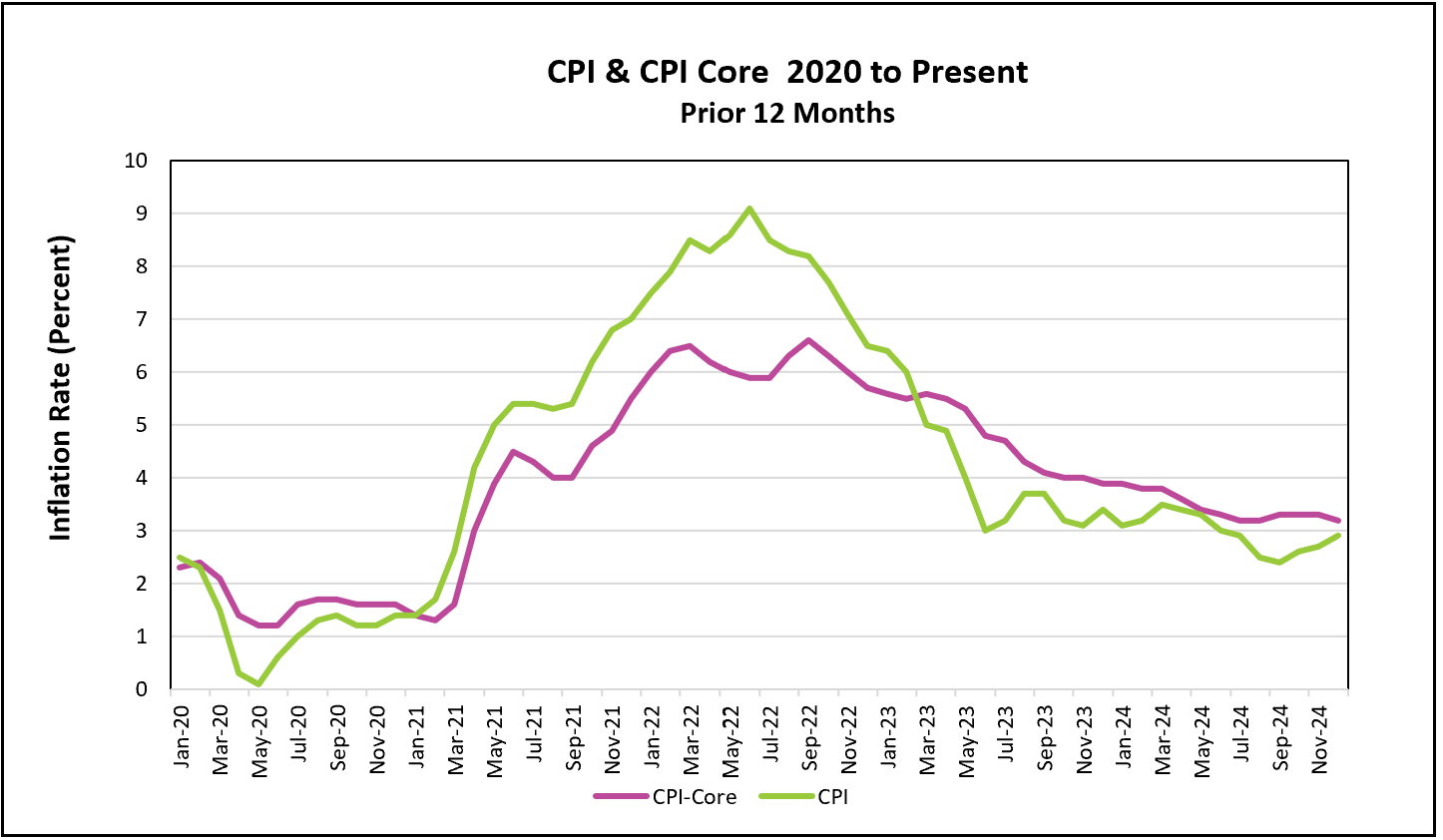

While inflation rose in December, the decline in the core price index for the first time in six months was encouraging for economists and investors. The core index excludes volatile food and energy prices, providing a more stable measure of underlying inflation trends. This measure is particularly important for policy decisions. Wall Street reacted positively, with a 700-point rally and lower bond yields.

The core rate had been rising in the latter half of 2024, raising concerns among economists that the Federal Reserve may have lowered interest rates too soon. A strong labor report earlier in the week heightened those concerns. However, the drop in the core rate provided some relief.

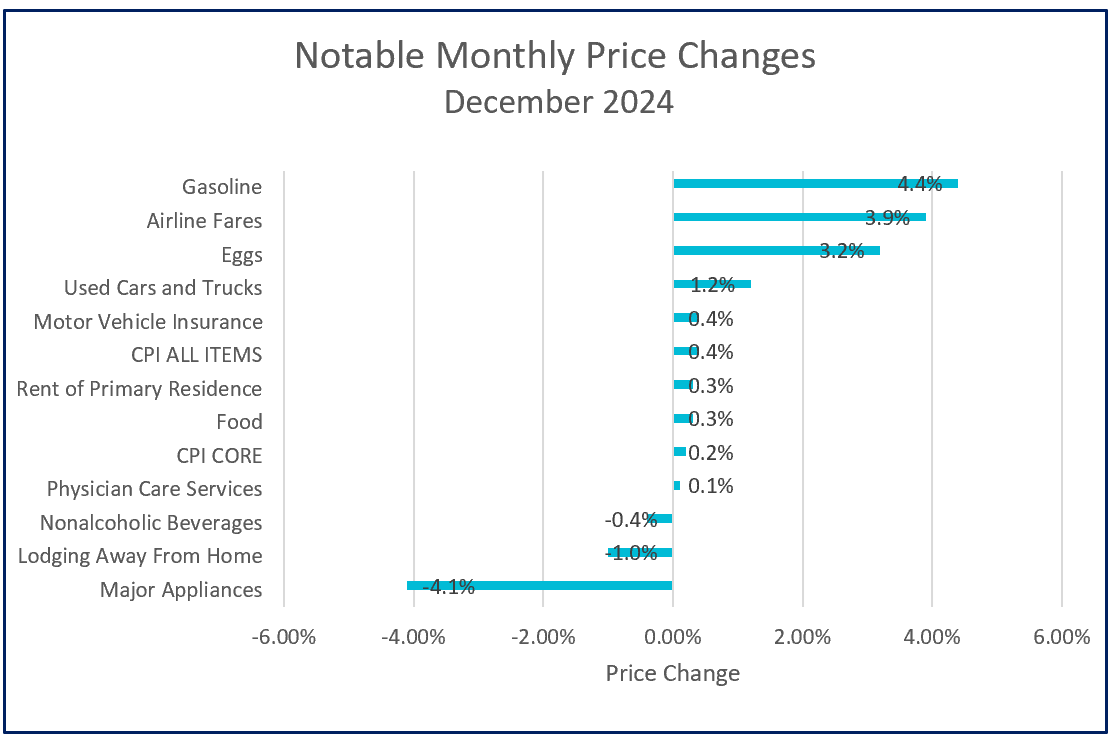

Despite this positive sign, the all-inclusive index saw its largest monthly increase since March and has not declined since that time. Higher energy prices were a significant factor, accounting for over 40% of the December increase. Gasoline prices rose by 4.4%, while most other items increased by less than 0.2%. Notable price changes are listed in the table below.

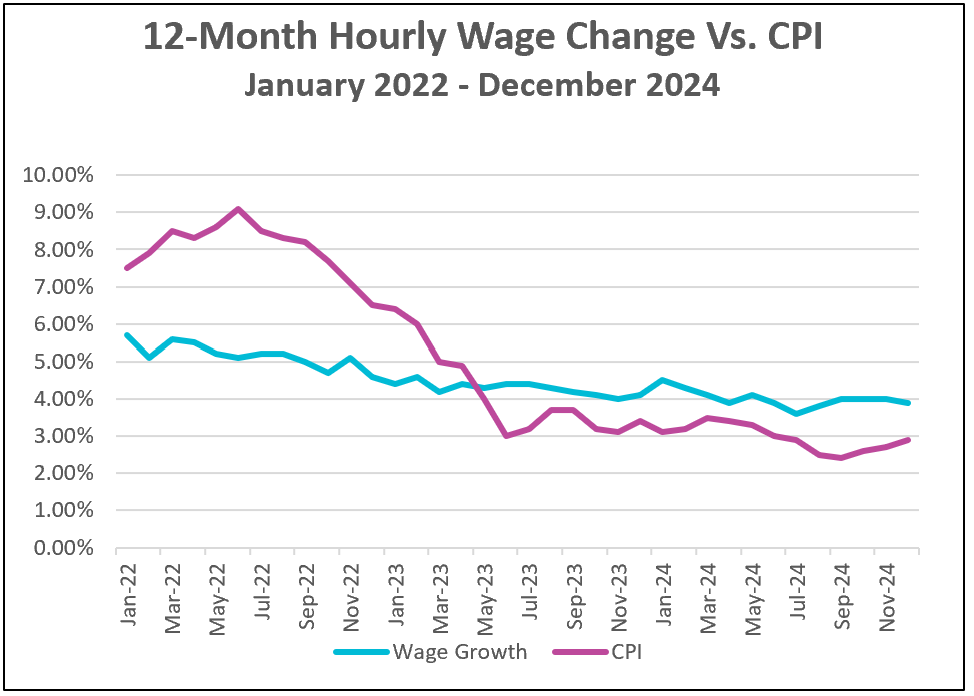

Wage growth continues to outpace inflation, contributing to demand-pull inflation. Real wages rose by 1% in December, marking the smallest increase since July.

Housing costs, which account for about one-third of the CPI, showed continued signs of disinflation. The monthly gain rose slightly, but the 12-month shelter index increased by just 4.6%, the smallest annual increase in nearly three years. A shortage of new housing and higher mortgage rates have contributed to this trend.

Housing costs, which account for about one-third of the CPI, showed continued signs of disinflation. The monthly gain rose slightly, but the 12-month shelter index increased by just 4.6%, the smallest annual increase in nearly three years. A shortage of new housing and higher mortgage rates have contributed to this trend.

The Federal Reserve is unlikely to adjust interest rates at its upcoming meeting on January 28–29. Policymakers will want to consider the economic influence of President-elect Trump’s economic policies. Industries heavily reliant on immigrant labor—such as agriculture, construction, hospitality, and healthcare—could face workforce shortages, potentially driving up costs and reducing business efficiency. The labor shortage could increase wages in affected sectors, contributing to inflationary pressures.

Companies paying higher tariffs will likely raise their prices to absorb the higher cost. (Read our lesson Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas, and Licenses to learn more about the impact of tariffs.) However, proposed tax cuts and deregulation could counterbalance these pressures by promoting economic growth and easing inflation.

Key economic data releases in late January, including the Bureau of Economic Analysis (BEA) reports on the PCE price index and its advance estimate of the fourth-quarter GDP, will provide valuable insights for the Fed’s March deliberations.

Stay tuned for Higher Rock’s summaries and analyses of these reports, as well as an overview of the economy President-elect Trump will inherit and predictions for economic trends in 2025.