Below are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – August 2024:

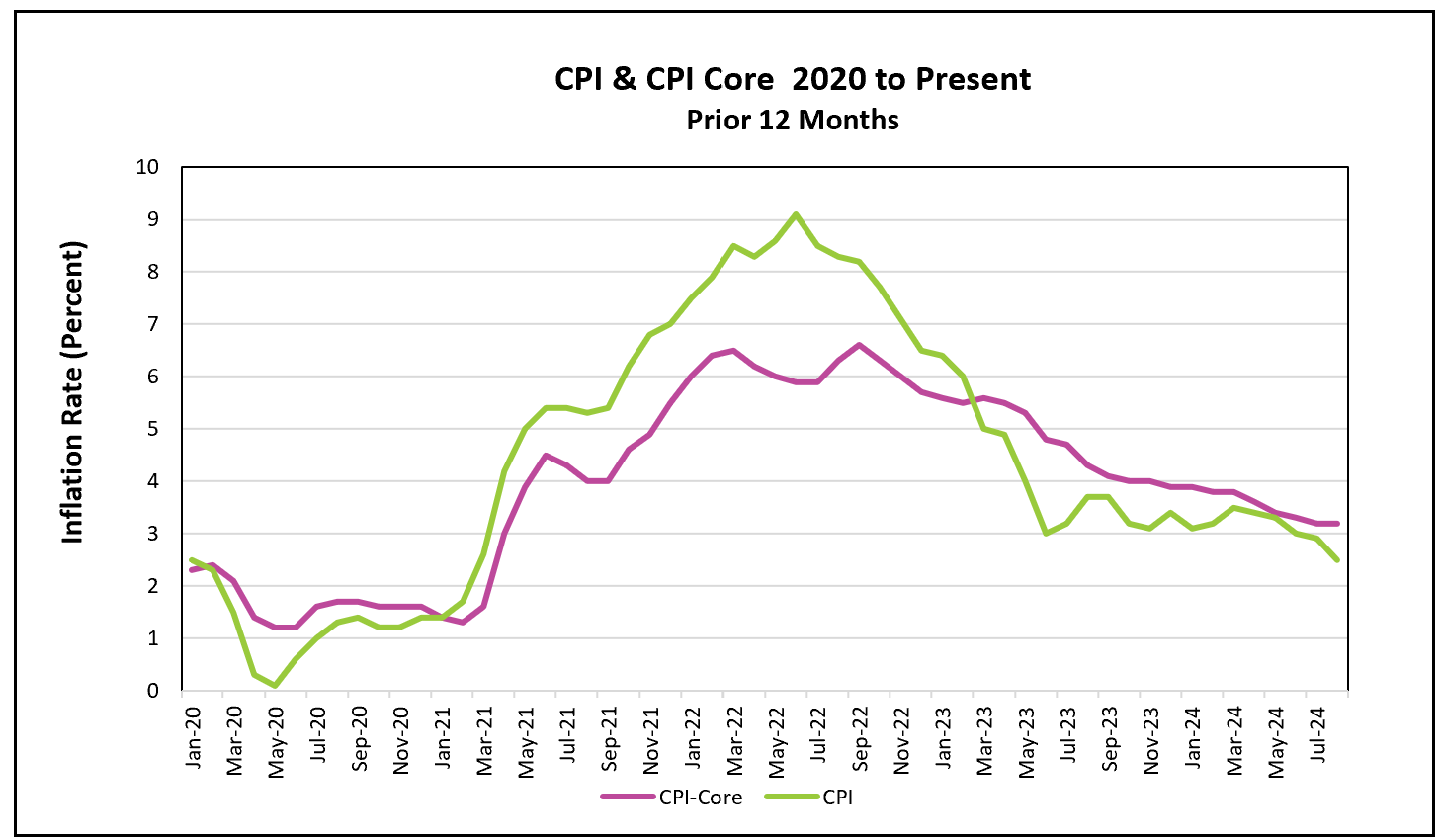

Inflation dropped to 2.5%, the lowest level since February 2021. This ongoing deceleration of the 12-month price level suggests the peak of inflation—the worst in four decades—has passed. In response, policymakers at the Federal Reserve surprised markets by cutting their benchmark interest rate by 0.5% at last week’s meeting, signaling that they believe inflation is now under control and that the weaker labor market warrants more attention.

However, August’s core index increased. Economists consider the core index a more reliable indicator of trends because it excludes volatile food and energy prices. The core index includes housing costs, which have remained persistently high and accounted for 70% of the monthly increase. Housing is heavily weighted in the CPI, as it represents the largest monthly expense for most families. Changes in the shelter index lag changes in the rental market because it estimates what it would cost to rent out owner-occupied homes. Data from Zillow and Apartment List indicate that rent increases are decelerating nationwide, leading analysts to expect the shelter index will eventually reflect this moderation.

Lower energy costs helped contain the overall rise in the CPI and explain the significant gap between the all-inclusive and core price indexes. The cost of a barrel of crude oil is now roughly half of what it was following Russia’s invasion of Ukraine.

During the COVID-19 pandemic, inflation surged as the economy’s aggregate supply dropped while aggregate demand rose. Supply-chain disruptions, labor shortages, rising input costs, and distribution challenges hindered producers’ ability to meet demand. At the same time, multiple stimulus checks boosted aggregate demand. To combat this inflation, the Federal Reserve tightened its monetary policy. Higher interest rates slow economic activity by curbing demand for interest-sensitive items like homes and automobiles. As demand weakens, businesses find it harder to raise prices. However, keeping interest rates high for too long can reduce aggregate demand excessively, leading to higher unemployment.

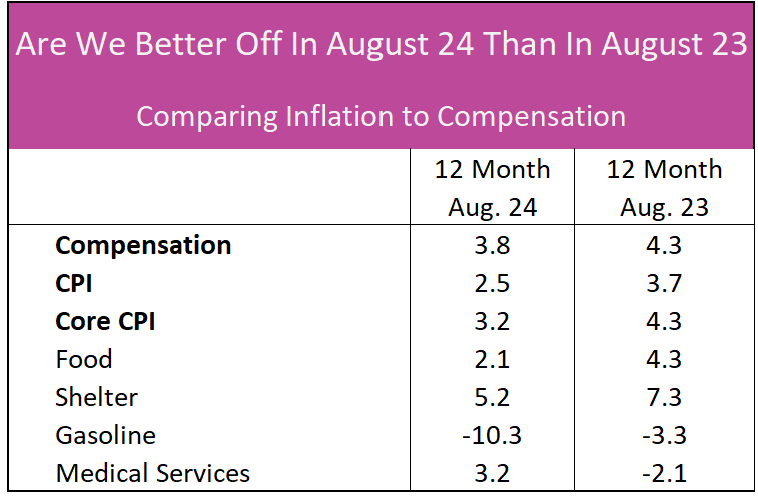

While many items such as food, gas, and rent remain significantly higher than a year ago, monthly price increases have slowed to near pre-pandemic levels. The economy remains a crucial issue in the upcoming presidential election, with many Americans listing inflation as a top concern. Are we better off than a year ago? This question is partly addressed in the table below, which compares wage increases with price increases for necessities. It represents a typical household with average wage growth shopping for the same goods and services.

Wage gains have outpaced the CPI, meaning most households are now better positioned to meet their budgets. In 2023, food prices exceeded the CPI and barely kept up with wage growth, but in 2024, food price inflation has fallen below the CPI and is significantly lower than wage increases. Additionally, lower gasoline prices have given consumers extra income to spend on other goods and services. Although medical care costs rose faster than the CPI, the increase remains smaller than the growth in wages. Housing costs have continued to outpace both inflation and wage gains, but the gap between wage increases and housing costs has narrowed, making housing more affordable than a year ago.

If we only consider the data in the table, it would suggest that households are better off than they were a year ago. However, the unemployment rate rose from 3.8% in August 2023 to 4.2% last month. Those who have recently become unemployed or underemployed are clearly not better off than they were a year ago. Last week, the Federal Reserve reduced its benchmark interest rate by 0.5%, marking the first rate cut in four years. Most analysts had expected a 0.25% reduction, especially given the moderate rise in core prices. The larger-than-expected cut indicates that policymakers have shifted their focus toward the labor market, as rising unemployment and slower hiring have become growing concerns.

The Fed’s preferred inflation gauge, the PCE price index, remains above its 2% target, with July’s reading at 2.5%. The PCE index has consistently been lower than the CPI because the CPI places greater weight on housing costs. August’s PCE price index will be released on September 27th, and Higher Rock will provide a summary and analysis shortly after its publication.