The highlights from the Bureau of Economic Analysis’s Personal Income and Outlays - September 2024 are outlined below.

The US economy is in a good place. On Wednesday, the BEA reported that the economy grew 2.8% in the third quarter, driven by resilient consumer spending. Higher real wages and growing confidence continue to support household consumption, while inflation is approaching the Federal Reserve’s 2% target.

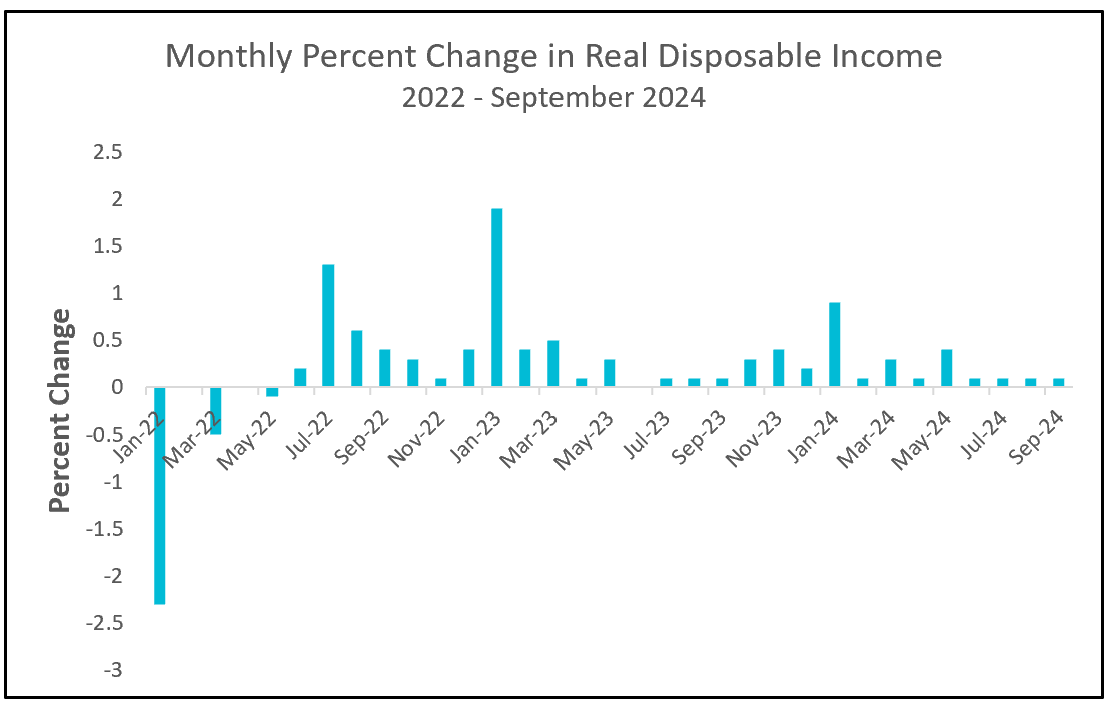

However, wage growth has slowed. The Bureau of Labor Statistics (BLS) reported that its Employment Cost Index rose 0.8% in the third quarter, marking a three-year low. After adjusting for taxes and inflation, income increased by just 0.1% every month in the third quarter. Despite this, real disposable income has been positive every month since May 2022, giving workers additional purchasing power and helping households manage their budgets.

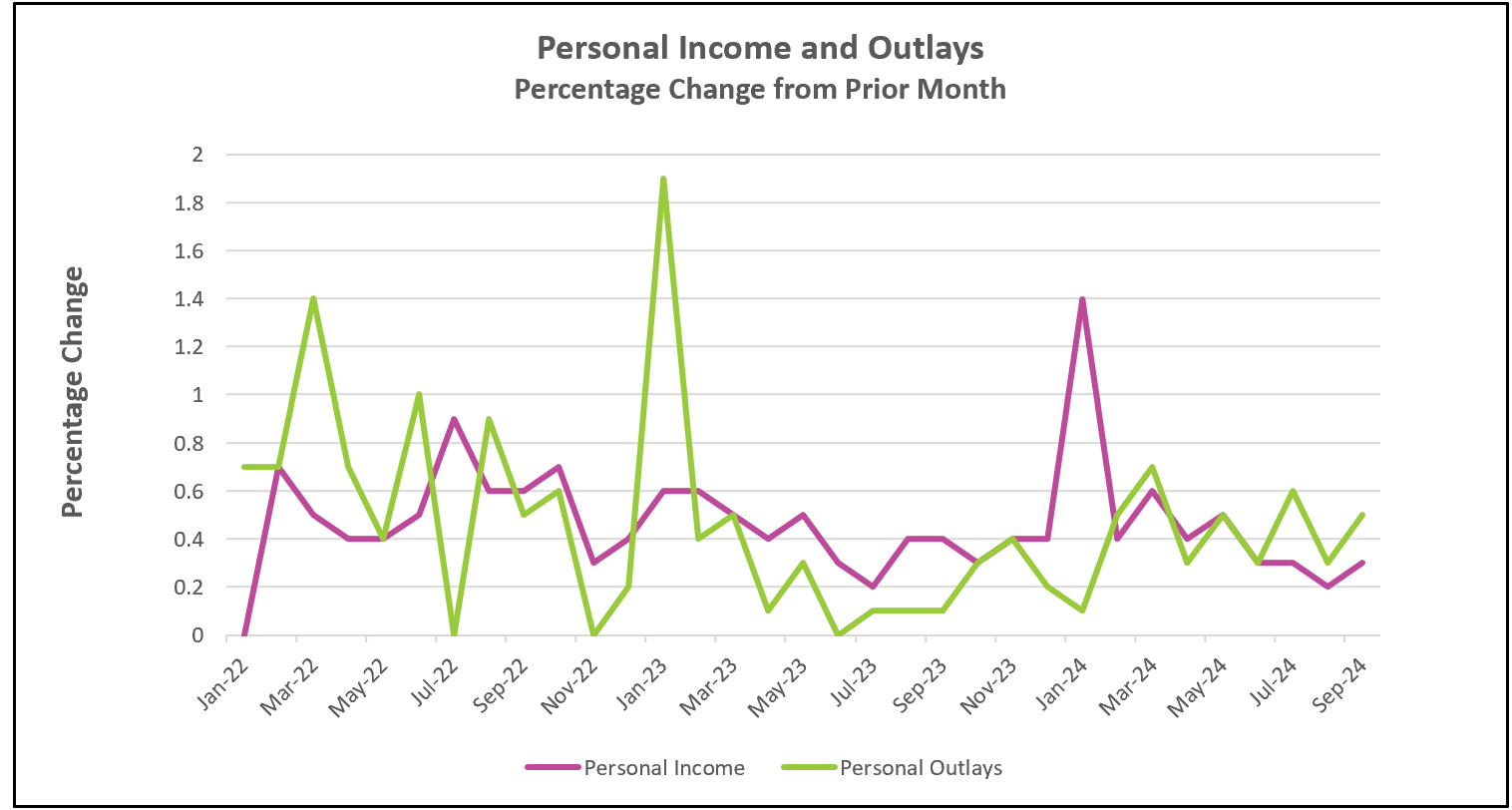

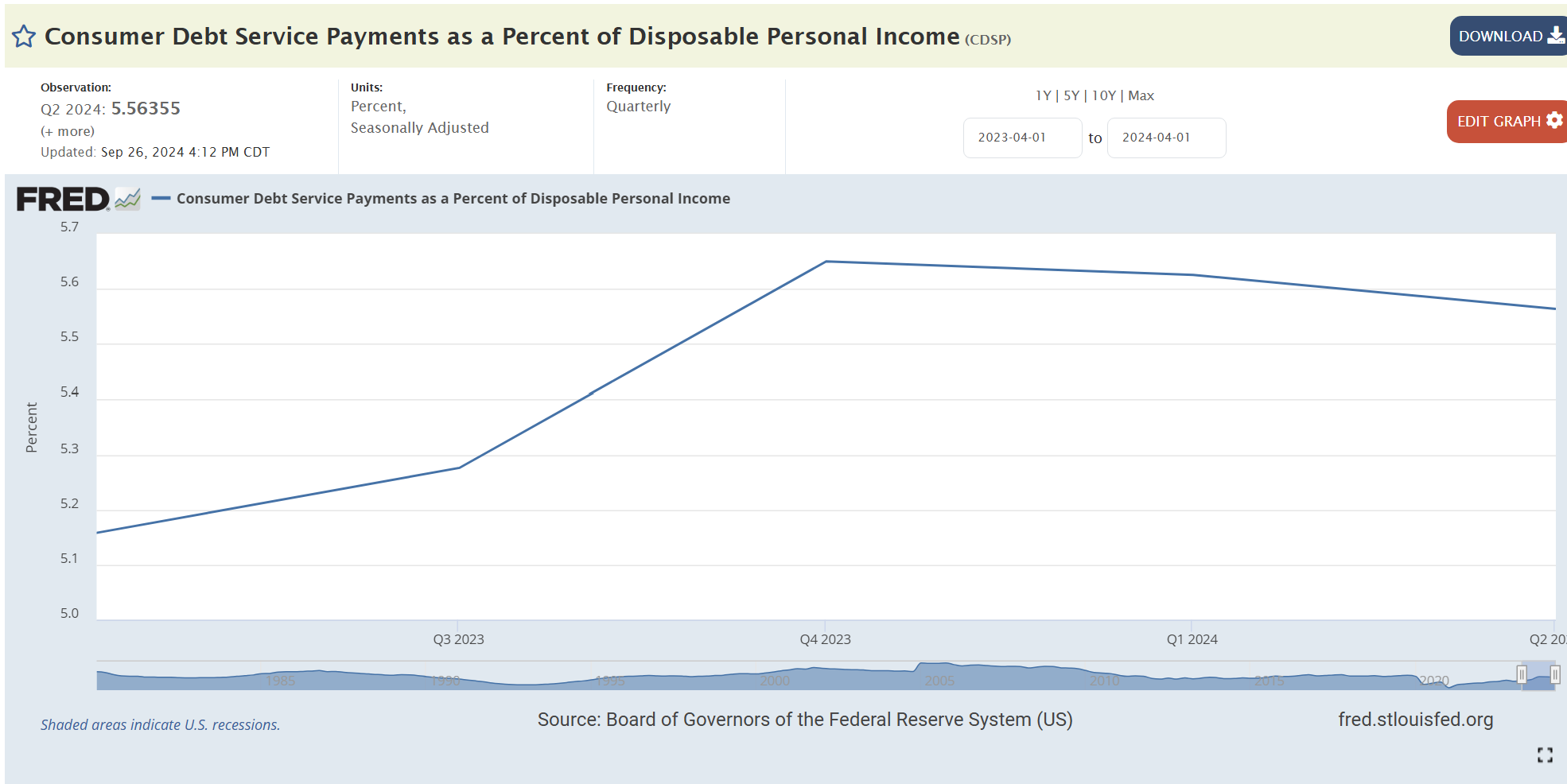

Consumer spending remains critical to the U.S. economy, accounting for nearly 70% of Gross Domestic Product (GDP). It drives economic growth, employment, and overall stability. The resilience of the American consumer has been pivotal in sustaining the current health of the U.S. economy. Consumer confidence directly impacts spending, as people tend to cut back when they fear job loss or income declines. The Consumer Confidence Index saw its largest monthly gain since March 2021. Consumer spending rose by 0.5% in September. However, when spending growth outpaces the growth of real disposable income, it suggests that consumers are either borrowing more or saving less. The personal savings rate has declined every month in 2024. (FRED)

Meanwhile, consumers are borrowing more, and an increasing share of their income is being used to pay their debts. (FRED)

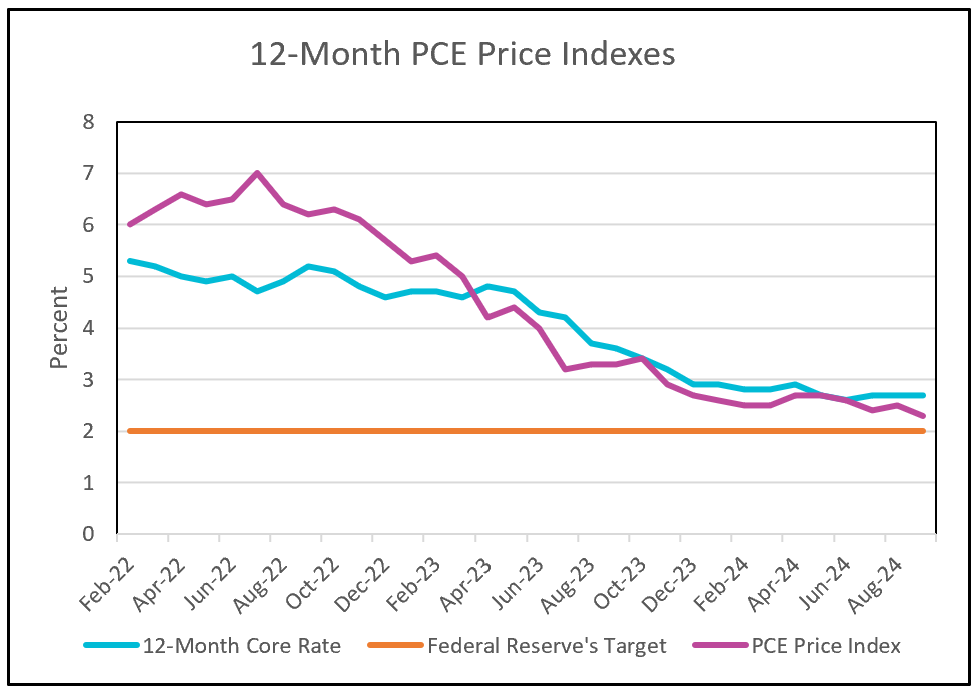

Inflation continues to approach the Federal Reserve’s 2% target. Policymakers favor the PCE indexes over the more publicized CPI because they account for changes in consumer behavior, such as switching to more affordable alternatives—like buying more chicken when beef prices rise. The PCE indexes give less weight to housing costs, which have surged over the past two years. Economists generally regard the core indexes as a more accurate measure of inflationary trends because they exclude volatile energy and food prices. For example, since 2022, the all-inclusive index has declined more than the core index because of a drop in gasoline prices.

The PCE price index peaked at 7.0% in June 2022 and has steadily declined as supply chain issues eased and higher interest cooled aggregate demand. The index is now near the Fed’s 2% target, but the core index appears to be stuck at 2.7%. Furthermore, September’s core index increased to 0.3%, up from 0.2% in August.

Four years ago, the US economy was reeling from the COVID-19 pandemic. The economy contracted by 3.5% in 2020. Wages, when adjusted for inflation, fell, not due to high inflation, but because wages were low. (Inflation was only 1.3% at the time.) The unemployment rate equaled 6.7%. The US federal government began sending stimulus checks in March 2020 to prevent an economic collapse, ultimately distributing over $841 billion in relief to households. (Pandemic Oversight) The strategy worked, but the cost was steep: inflation surged to a four-decade high, and American families faced over 20% increases in essentials like food and shelter.

While today’s economy—with low inflation, strong consumer spending, rising real wages, and low unemployment—would typically be seen as thriving, many voters remain dissatisfied. They still feel the effects of higher prices from the inflation spike and hold the Biden-Harris administration accountable. As a result, the question remains: Will the current economic improvements be enough to sway voters in favor of Kamala Harris, or will they choose to return Donald Trump to the White House?

On Friday, the BLS reported that payrolls grew only by 12,000, while the unemployment rate held steady at 4.1%. This was the last economic report before the election. Be sure to read HRE’s summary and analysis on Monday.