The highlights from the Bureau of Economic Analysis’s Personal Income and Outlays - October 2024 are outlined below.

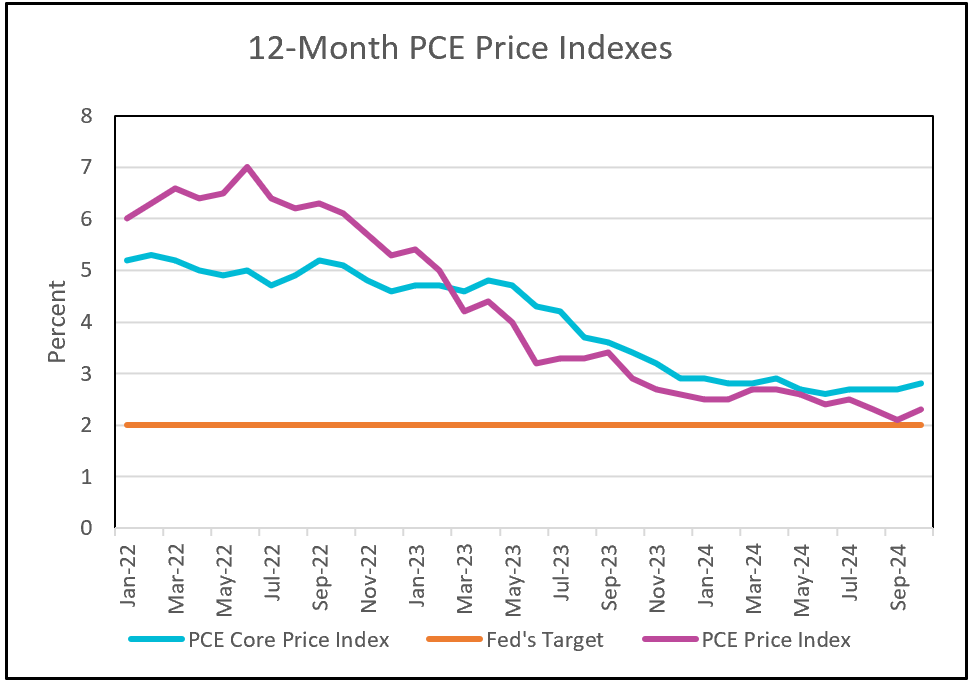

The U.S. economy is doing well—perhaps too well—since recent increases in income and consumer spending have slowed the decline of inflation. The core personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred measure of inflation, has been trending downward since it peaked in February 2022. However, the core PCE index rose in October, fluctuating between 2.6% and 2.9% since January 2024. With the Fed’s inflation target set at 2%, this recent increase is concerning and may prevent policymakers from lowering their benchmark interest rate during the upcoming December meeting.

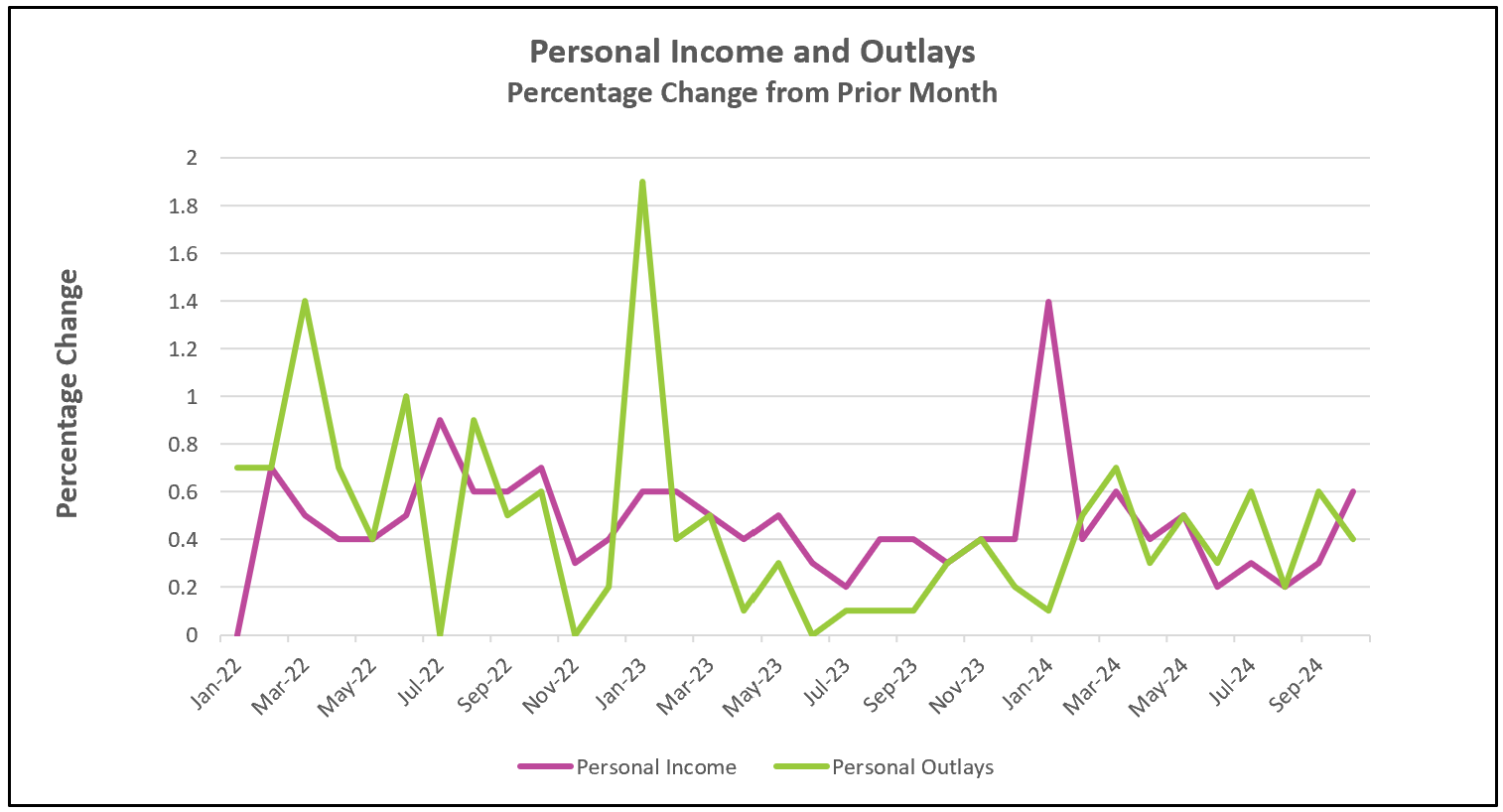

The economy’s strength has added to the Fed’s challenge of reducing inflation to its 2% target. The labor market is notably resilient. A sustained demand for workers reflects the economy’s underlying strength as businesses expand operations to meet consumer needs. In October, compensation increased by 0.5%. Meanwhile, The Conference Board reported that a robust labor market has improved consumer sentiment. While these factors indicate a strong economy, they also contribute to increased consumer spending, which may act as a catalyst for inflation.

Most economists believe that President-elect Trump’s proposed policies could lead to inflation. He has suggested implementing tariffs of up to 60% on goods imported from China and 25% on goods from Mexico. Tariffs function as import taxes, much of which consumers end up paying following an increase in the price of the taxed good. For example, Reuters reported that analysts estimate that a tariff on imported oil would increase fuel prices by 10%. (Read our lesson, Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas & Licenses to learn how tariffs affect the economy.)

President-elect Trump also wants to restrict immigration, which could significantly reduce the workforce and drive up wages due to a decreased labor supply.

On the other hand, relaxing regulations can reduce inflation. Businesses often incur costs to comply with laws, such as environmental standards, safety requirements, or reporting obligations. Relaxing these regulations can make it easier and less expensive for companies to invest in new projects, expand production, or enter new markets. Ultimately, deregulation can increase the supply of goods and services, which helps reduce their prices.

The Federal Reserve’s policymakers will discuss their next steps regarding monetary policy at their December 17–18 meeting. Most analysts expect the committee to move forward with plans to lower the benchmark interest rate. However, they might consider pausing due to the economy’s stronger-than-expected performance and the inflation risks associated with the President-elect’s policies. Upcoming reports from the Bureau of Labor Statistics, including the Employment Summary and Consumer Price Index (CPI), could impact their decision. Stay tuned for HRE’s comprehensive analysis of these reports shortly after they are released.