The US economy remains strong. Consumer spending and personal income rose. But discouraging inflation figures reinforced the Fed’s belief that the fight to tame inflation is not over. Below are the highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for November 2024:

Federal Reserve Chairman Jerome Powell disappointed Wall Street last week by expressing concerns about persistent inflation. As expected, policymakers lowered the Fed’s benchmark rate by 0.25%. However, Chairman Powell also suggested that only two rate cuts are likely in 2025—two fewer than previously anticipated. During his post-announcement comments, he explained: “I think that the slower pace of cuts for next year really reflects both the higher inflation readings we’ve had this year and the expectation inflation will be higher.” (Chairman Powell Press Conference, December 18, 2024) In response, the Dow Jones Industrial Average plunged over 1,100 points (ABC News). Powell’s comments suggest interest rates for mortgages and car loans will likely remain higher for longer.

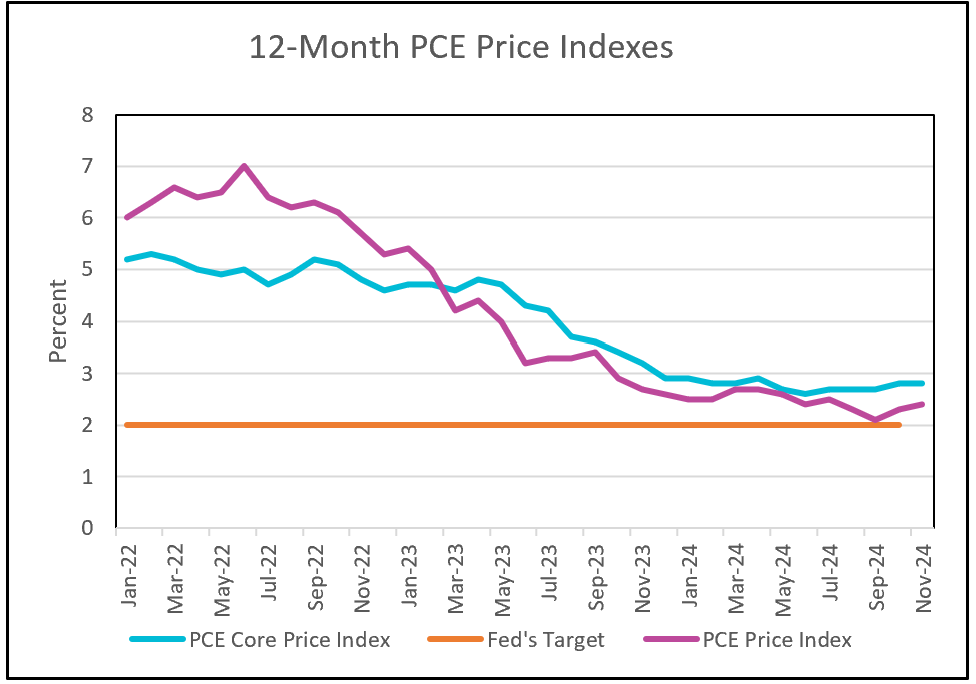

Disinflation has stalled. November’s 12-month overall rate rose slightly. Inflation rates have remained relatively constant throughout 2024 but continue to exceed the Fed’s 2% target. That said, inflation is now less than half of its June 2022 peak and November’s core PCE price index increased by only 0.1%, marking the smallest rise since May.

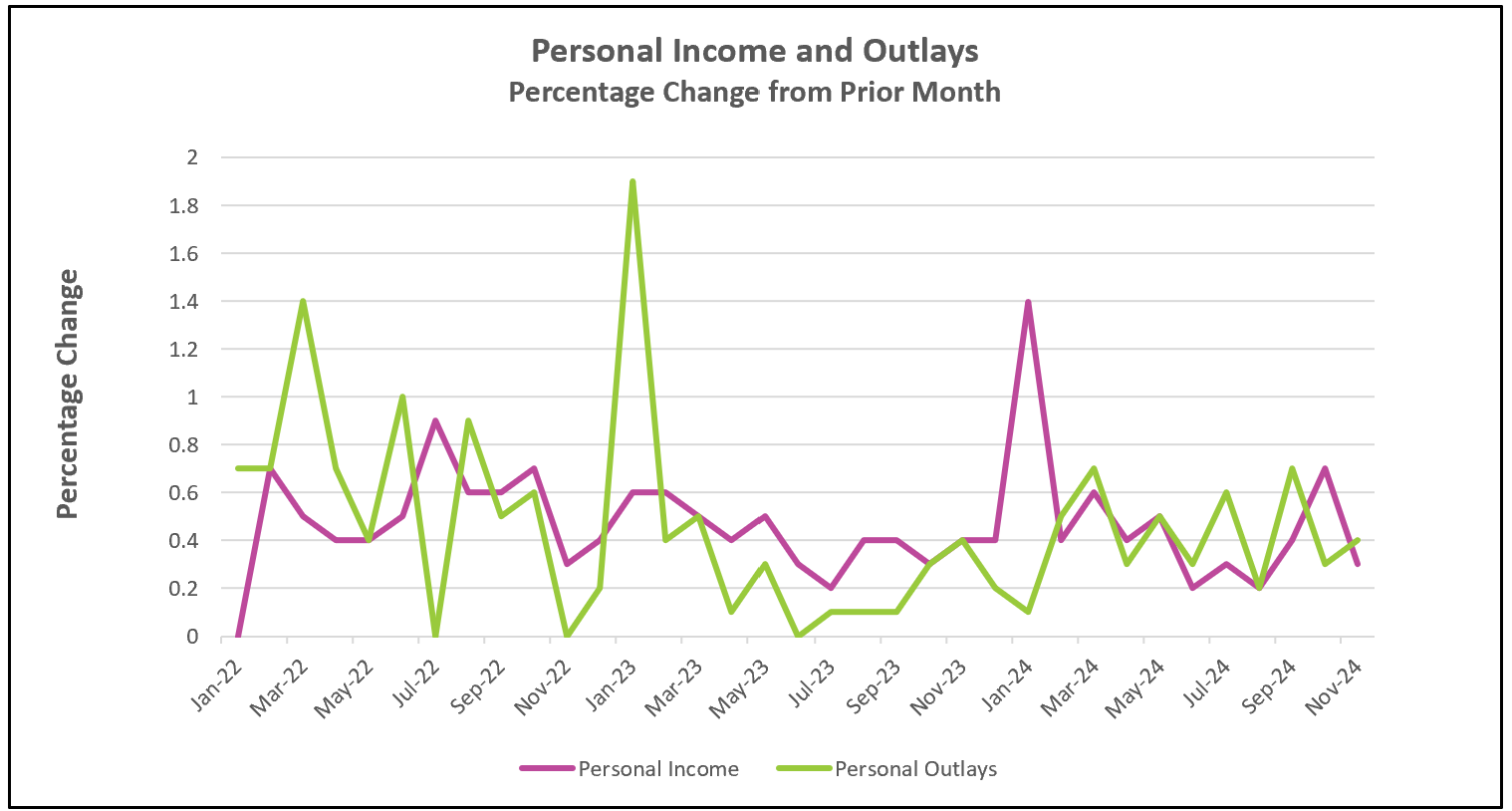

The Bureau of Economic Analysis (BEA) increased its estimate of U.S. economic growth for the third quarter to 3.1%. Higher wages contributed to increased consumer spending, which was the primary driver of the rise in real GDP. This positive trend has extended into the fourth quarter. Personal income growth outpaced inflation in October and November, allowing families to manage their budgets better and spend during the holiday season. Consumer spending on goods rose by 0.8% in November, rebounding from a 0.1% decline in October. However, spending on services increased by only 0.2% in November, marking the smallest gain since August 2023.

Policymakers have managed to reduce inflation without triggering a recession, but inflation remains unacceptably high. Given the economy’s resilience, the urgency to lower interest rates has diminished. Chairman Powell reflected this sentiment, stating: “And as long as the economy and the labor market are solid, we can be cautious as we consider further cuts.”

Caution may also stem from concerns about the potential inflationary impact of President-elect Trump’s proposed policies. He has threatened tariffs of up to 60% on goods imported from China and 25% on Mexican goods. These tariffs—essentially import taxes—are often passed on to consumers. For instance, analysts estimate that a tariff on imported oil could increase fuel prices by 10% (Reuters). (Learn more about how tariffs affect the economy in our lesson: Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas & Licenses.)

As 2024 comes to a close, this is our final summary of economic reports this year. We wish you a Merry Christmas and a prosperous, healthy New Year!

We’ll kick off 2025 with a blog highlighting five key graphs that define the economy President-elect Trump will inherit. We’ll also release our annual report card, detailing our 2025 predictions and reviewing the accuracy of our 2024 forecasts.