The key findings from the Bureau of Economic Analysis’s Personal Income and Outlays - May 2024 are outlined below.

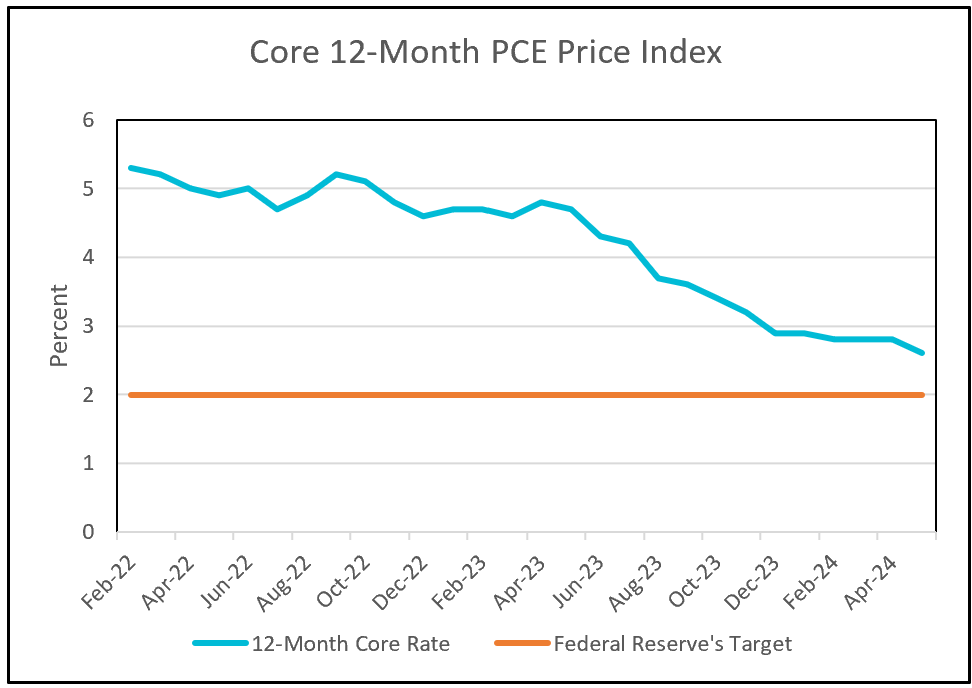

The recent cooling of inflation has sparked optimism that the Federal Reserve may soon lower its benchmark interest rate. The 12-month core PCE price index has decelerated to 2.6%, its lowest level in three years. Economists prefer the core rate when evaluating trends because it does not include volatile food and energy prices. The all-inclusive PCE index also slowed, aided by declining gasoline prices.

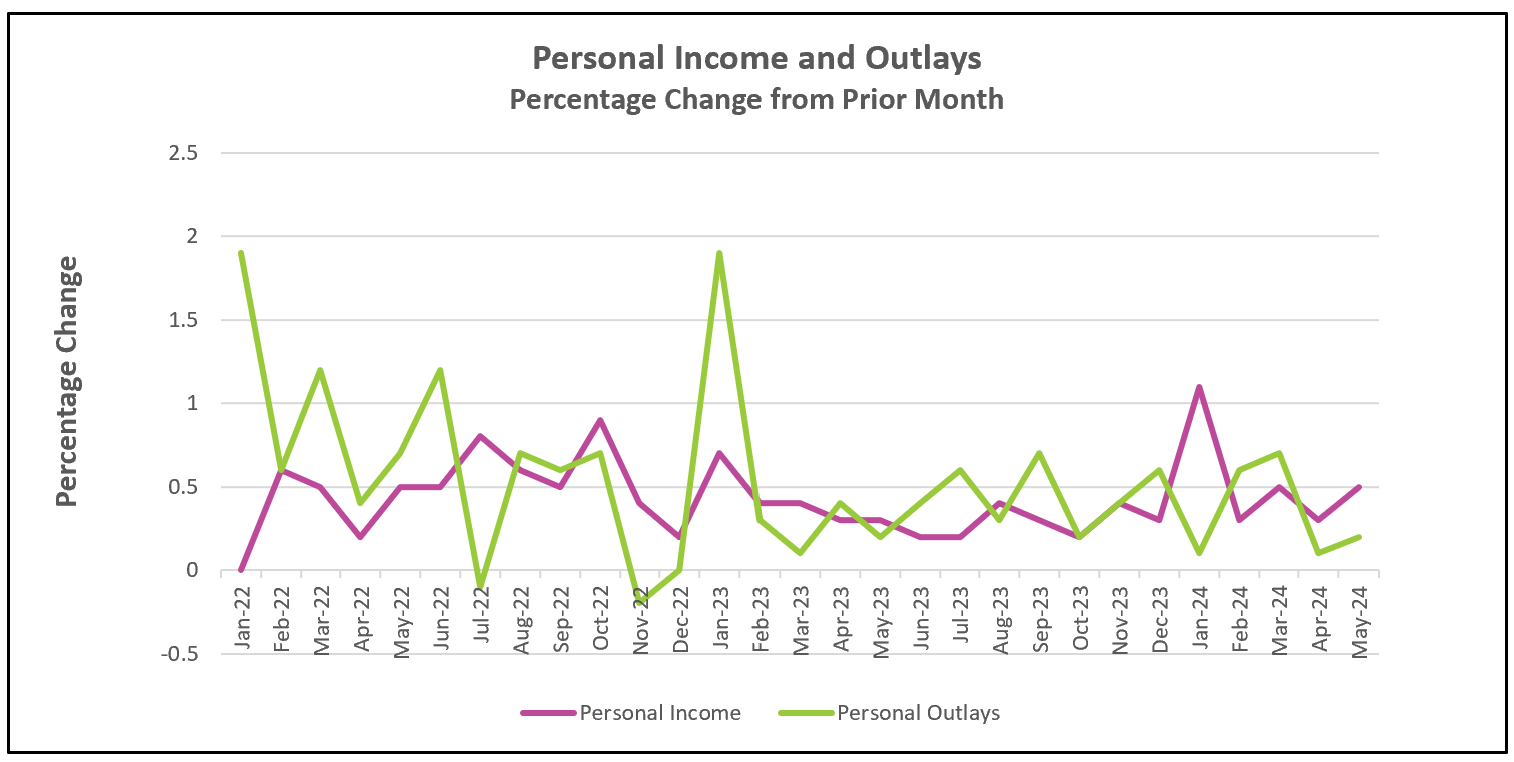

Earlier this year, inflation-adjusted disposable income barely kept pace with inflation, making it difficult for many families to increase consumer spending. Many households resorted to using savings and borrowing, while others cut back on spending, as evidenced by the slowdown in consumer spending growth, thereby reducing demand-pull inflation. However, in May, a rise in disposable income combined with no inflation resulted in a 0.5% increase in real disposable income, the largest increase since January 2023. This additional income contributed to a rise in consumer spending, with services spending increasing by an inflation-adjusted 0.1%, driven by health care and airfares. Spending on computer software and vehicles increased goods purchases by 0.6% despite a drop in gasoline prices. Households also saved more of their additional income, with the savings rate climbing to 3.6%.

While core inflation remains above the Federal Reserve’s 2% target, it has significantly declined from its peak of over 5% in 2022. The more widely recognized consumer price index (CPI) peaked at 9% and has since fallen to 3.3%. Higher interest rates have curbed consumer and business spending, slowing economic growth. The Commerce Department reported a 1.4% annual growth rate for the U.S. economy in the first quarter, down from 3.4% in the previous quarter. Preliminary data suggest minimal growth for the second quarter. The BEA will release its initial estimate on July 25th. A slower economy would alleviate some inflationary pressures.

Policymakers would like to see a balance between a rise in income and inflation. Payroll growth exceeded expectations in May, and wages increased, bolstering the economy. If real wages continue to rise, demand-pull inflation will increase. In a tight labor market, a surplus of job openings can drive up wages and fuel demand-pull inflation. However, there are indications that the labor market is softening, with fewer job openings, a rising unemployment rate, and a slight increase in jobless claims. The Bureau of Labor Statistics will release June’s Employment Summary on July 5th. Higher Rock will publish its comprehensive analysis shortly after its release.