The key findings from the Bureau of Economic Analysis’s Personal Income and Outlays - June 2024 are outlined below.

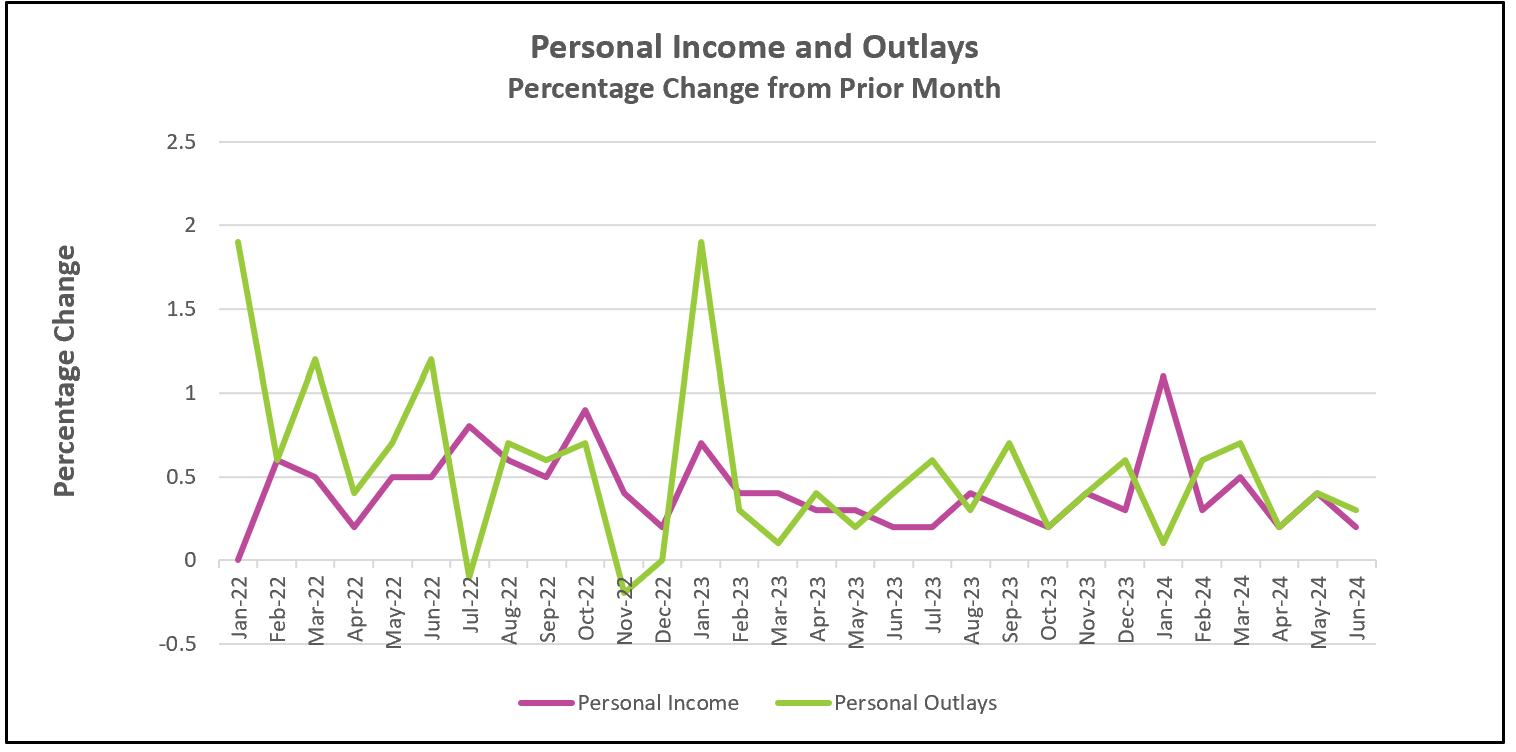

The economy is performing strongly. According to the BEA’s report last week, the economy expanded by 2.8% in the second quarter, following a growth of only 1.8% in the first quarter. Consumer spending demonstrated resilience once again, increasing by 0.3%. Wages are rising faster than inflation despite high interest rates.

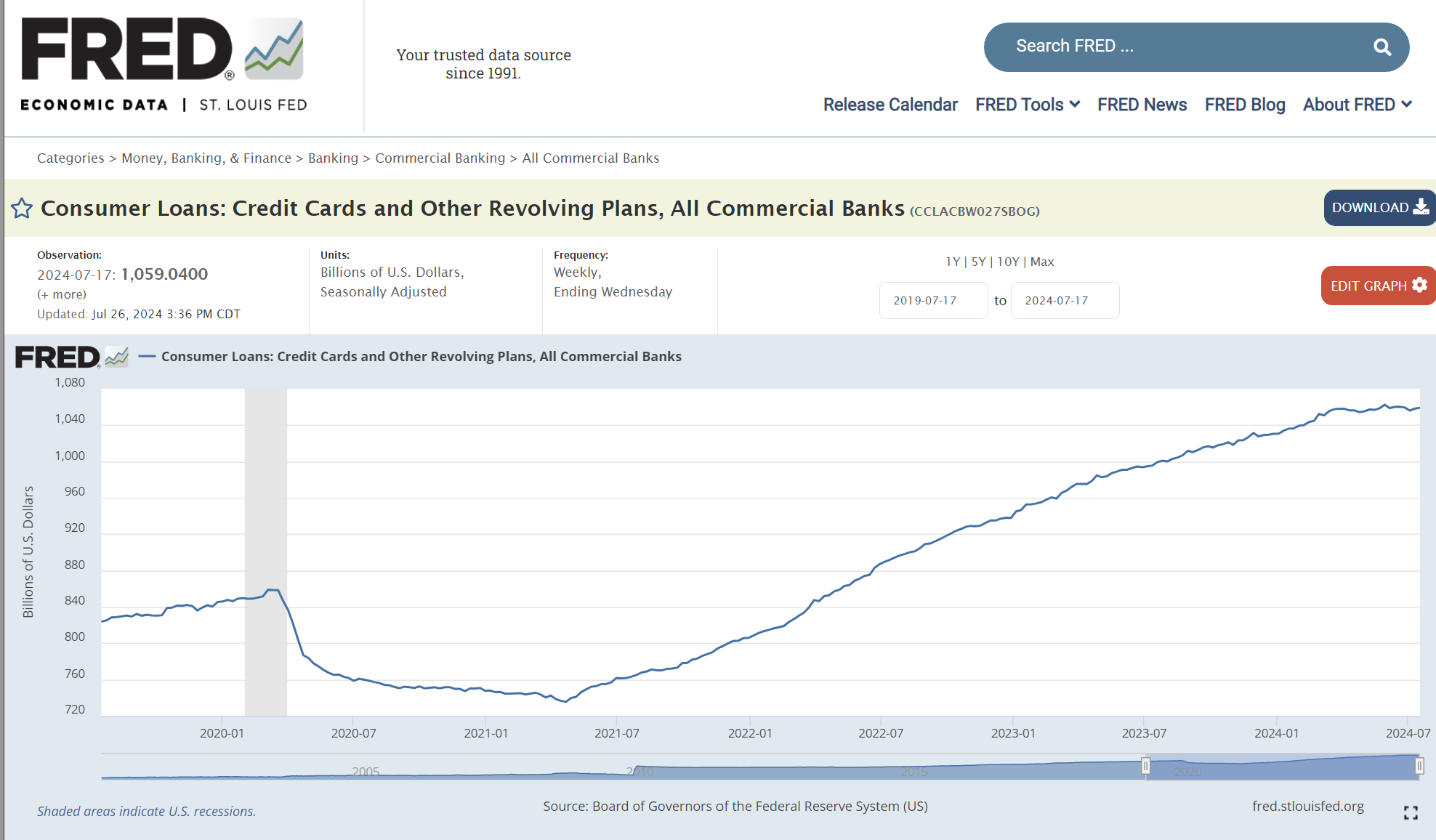

However, there are signs that the monetary policy is working. The increases in consumer spending, wages, and prices are not as drastic as when the PCE price index peaked at just over 7%. Consumers are showing signs of being overextended and are not happy. The University of Michigan’s index shows that consumer sentiment fell to an eight-month low due to “high prices continuing to drag down attitudes.” While real wages increased in June, they rose at half the pace of May’s increase. Apart from May, real disposable income has barely kept pace with inflation since the beginning of the year. Consumers are spending more, but households rely more on debt and savings. Consumer debt has steadily increased since 2021, and the delinquency rate reached its highest point since 2011. Households are saving less, with the personal savings rate falling from over 5% to less than 3.5% in just over a year. If attitudes persist and the labor market weakens, consumer spending will likely decrease.

The Federal Reserve policymakers are likely very pleased with this report. The slight increase in consumer spending, stability of wages, and decreasing inflation all indicate a successful soft landing. It almost guarantees an interest rate cut in September. The Bureau of Labor Statistics will release July’s Employment Summary on August 2nd, with a detailed analysis to follow on Higher Rock Education. If there are fewer gains in payrolls, an increase in unemployment, and further weakening of wages, it would support lowering interest rates.