Consumer spending, income, and inflation increased, but probably not enough to stifle a September rate cut by the Fed.

Below are the key findings from the Bureau of Economic Analysis’s Personal Income and Outlays - July 2024.

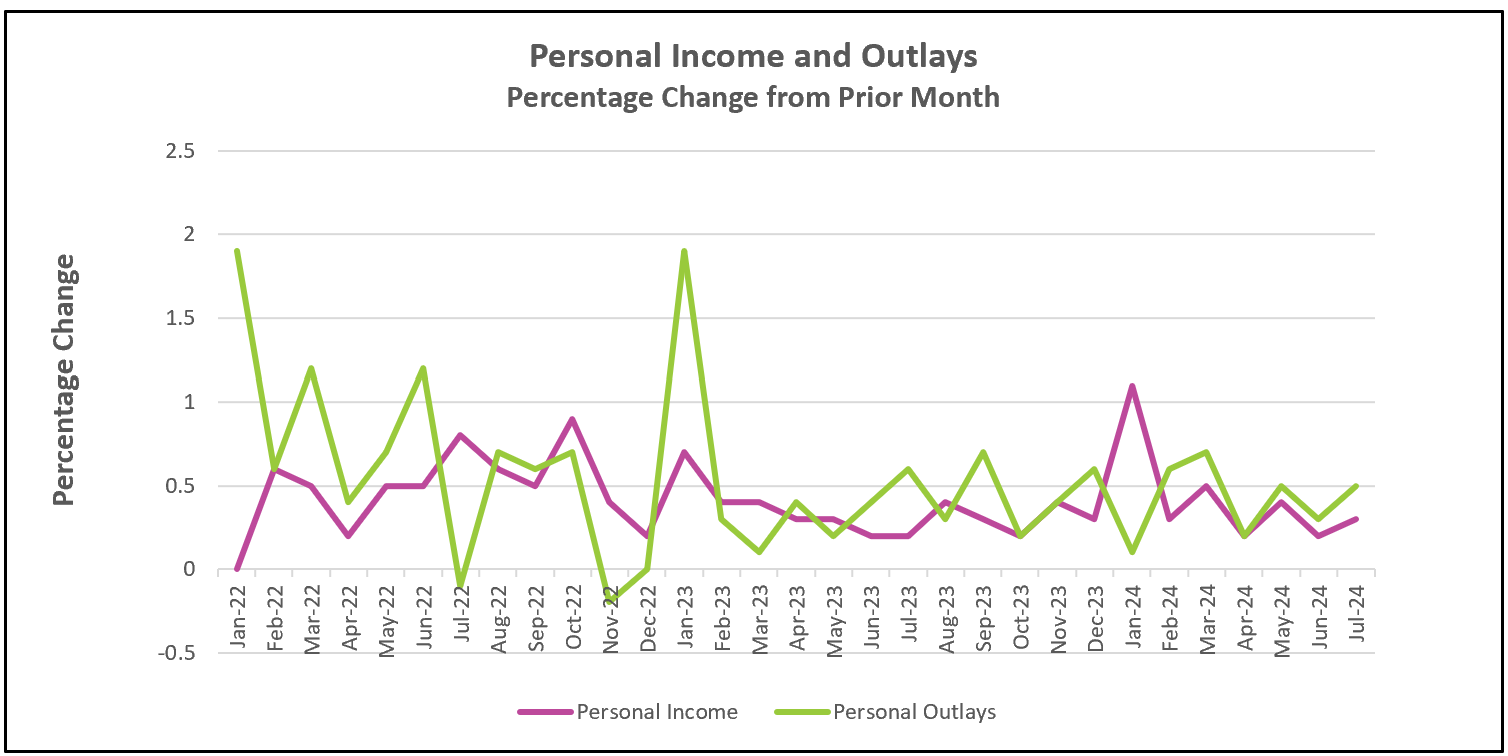

The American consumer continues to support a growing economy. Consumer spending rose 0.5%, matching the largest increase since March. Auto sales were one of the largest contributors to the jump in consumer spending. Spending has consistently outpaced income since the beginning of the year. Higher incomes, less savings, and debt financed the growth.

One of the primary drivers of increased consumer spending has been the rise in personal incomes. Over the past several months, wage growth has exceeded inflation, resulting in an increase in real disposable income for households. This boost in income has fueled economic activity by enabling consumers to spend more on goods and services.

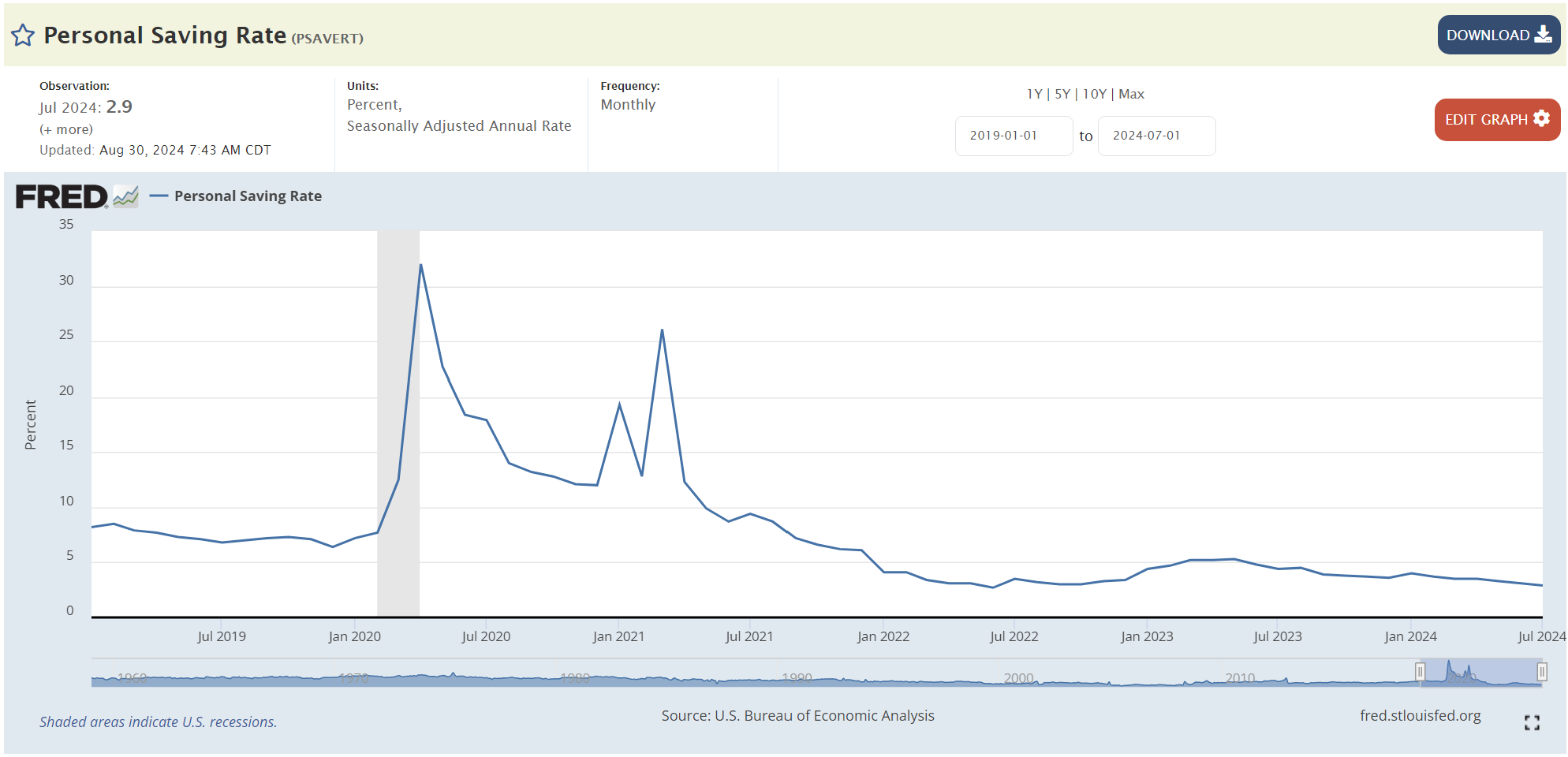

Alongside higher incomes, personal savings rates have sharply fallen. Consumers are opting to save less of their income, choosing instead to allocate more funds toward immediate consumption. July’s savings rate was the lowest since January 2022, when it dipped to 2.7%.

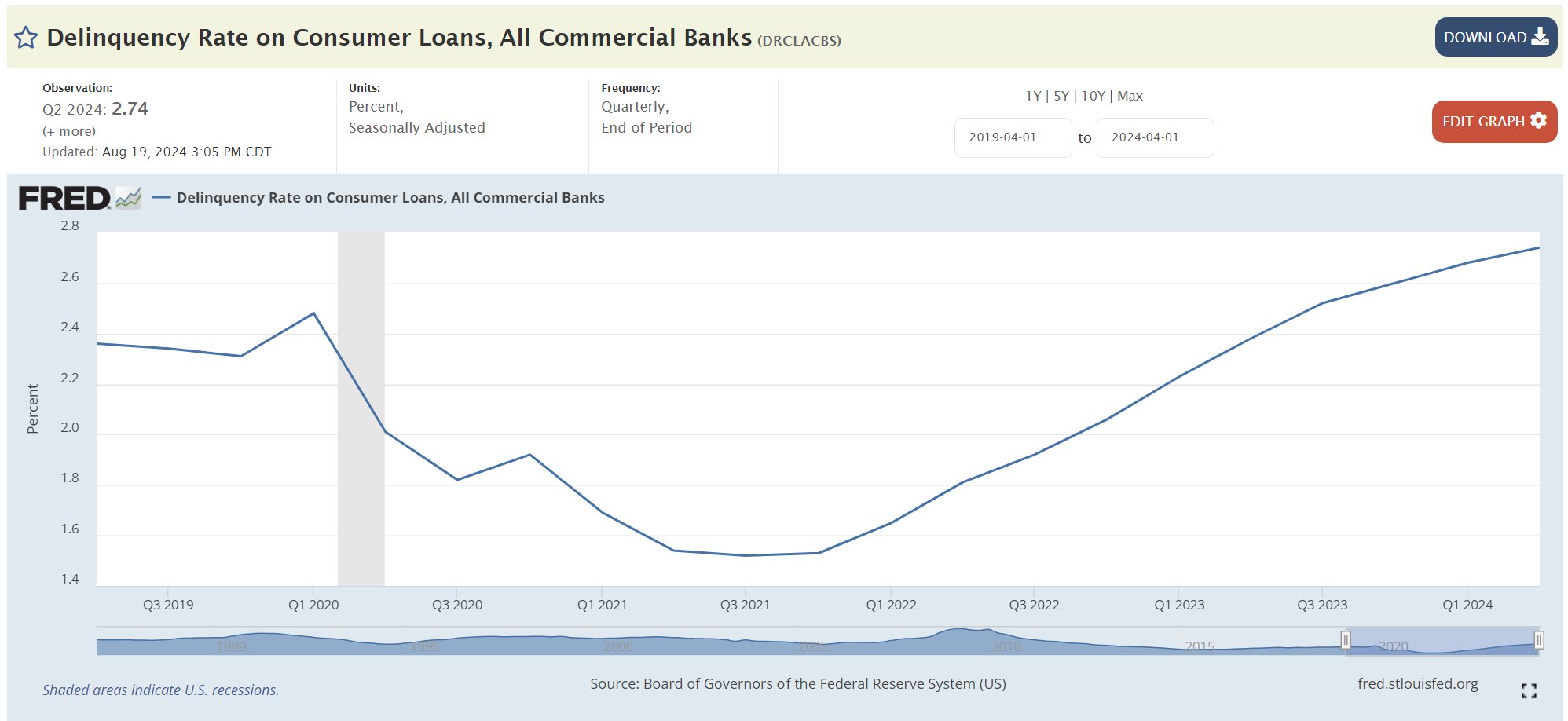

An increase in household borrowing contributed to the rise in consumer spending, as the increase in debt has not kept pace with income gains. During the early stages of the pandemic, households paid down their debt with supplemental income checks from the federal government. Household debt service was less than 8.5% of disposable income, a historic low. However, higher payments have since increased that ratio to nearly 10%. Unfortunately, many have struggled to cope with this increased burden, as the delinquency rate has almost doubled since the end of 2021.

While the increase in consumer spending has contributed positively to recent economic growth, the underlying factors—higher incomes, reduced savings, and increased debt—pose significant risks. Economists warn that the current spending trajectory is unsustainable and may lead to economic instability. Policymakers at the Federal Reserve will closely scrutinize the employment figures that are due to be released on Friday. Last month’s figures painted a strong labor market that was beginning to show some signs of weakening. Payroll gains slowed for the third consecutive month as the unemployment rate ticked up to 4.3%.

Federal Reserve Chairman Powell stated that it is time to begin lowering interest rates. Indeed, inflation, as measured by the PCE price index, has fallen just over 7% to 2.5%. It remains above the Fed’s target of 2.0% but has been trending lower since peaking in June 2022. When measured on a three-month rolling average, the core PCE price index increased at an annual rate of 1.7%.

The Fed will likely lower its benchmark rate when policymakers meet on September 17th and 18th. The question is, how much? The size of the rate cut likely depends on the strength of the labor market, as policymakers are beginning to shift their attention to it. Friday’s release will be the last employment report before Fed officials meet. A poor report may prompt them to accelerate their rate reductions from an expected 0.25% to 0.5%. HRE will release a summary and analysis of the Employment Situation shortly after its release.