Below are the highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for January 2025.

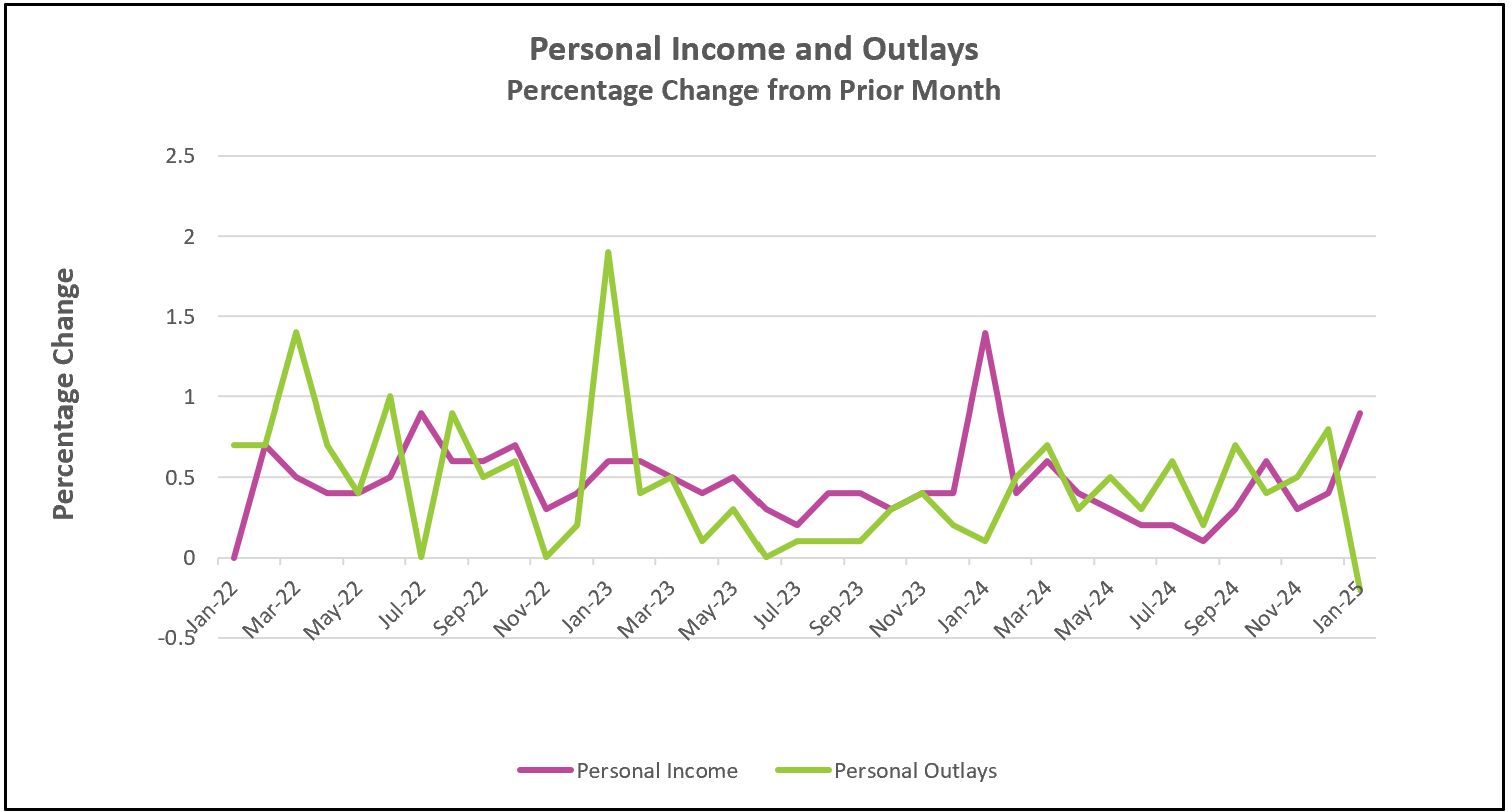

Since the pandemic, strong consumer spending has kept the US economy from slipping into a recession. However, in January, spending fell for the first time in nearly four years despite the largest monthly increase in personal income since January 2024. Disposable income has exceeded or equaled inflation every month since May 2022. Historically, higher income sustains growth in consumer spending.

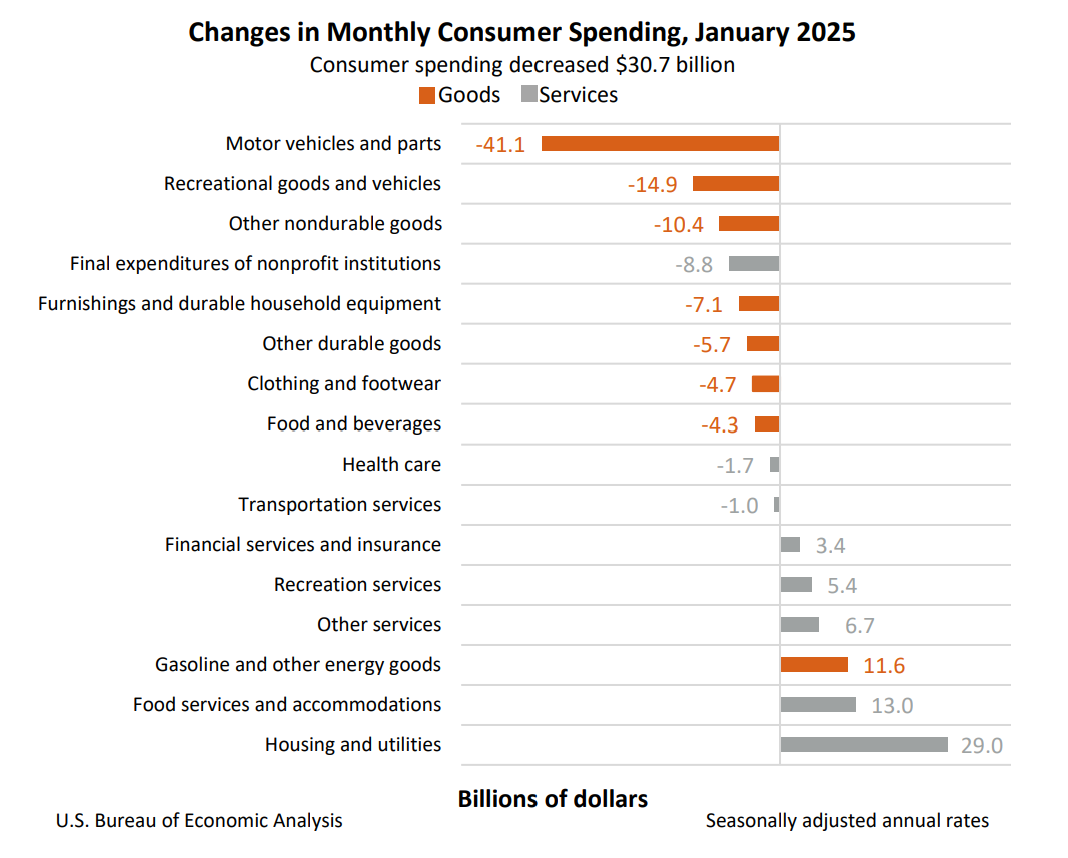

So, why the sudden drop in spending? January’s frigid weather played a key role. Motor vehicle sales fell over 41% and recreational goods and vehicles dropped almost 15%. Few people shop for a car or recreational vehicle when it is freezing and road conditions are hazardous. The abnormally cold weather also explains the surge in spending on housing and utilities. Meanwhile, spending on services rose just 0.3%, the smallest increase since August 2023. The combination of higher disposable income and reduced spending led to a sharp increase in savings, pushing the savings rate to 4.6%, its highest level since June 2024.

While January’s harsh weather contributed to the decline in consumer spending, other factors are likely at play. Consumer confidence has been falling, reaching its lowest level since August 2021. The Conference Board reported that its Expectations Index dropped below 80—a threshold often seen as a leading indicator of recessions. Consumers are increasingly concerned about inflation, less optimistic about their future job prospects, and more uncertain about their income stability.

Consumers are more likely to borrow and spend when they feel confident in their employment. However, economic uncertainty often leads to cutbacks in discretionary spending. Indeed, rising consumer debt has been a key driver of recent economic growth. Adding to the unease, President Trump’s policies during his first 100 days in office have heightened concerns—whether over higher prices due to tariffs or the potential fallout from federal budget cuts.

Another troubling sign, according to a Wall Street Journal report, is that nearly half of all consumer spending comes from the top 10% of earners. Much of their wealth and spending power is tied to the stock and real estate markets, meaning a significant downturn in either sector could significantly reduce overall consumer spending.

Social Security recipients received a cost-of-living adjustment in January, accounting for more than half of the 0.9% increase in personal income. Even without transfer payments, income growth continued to outpace inflation.

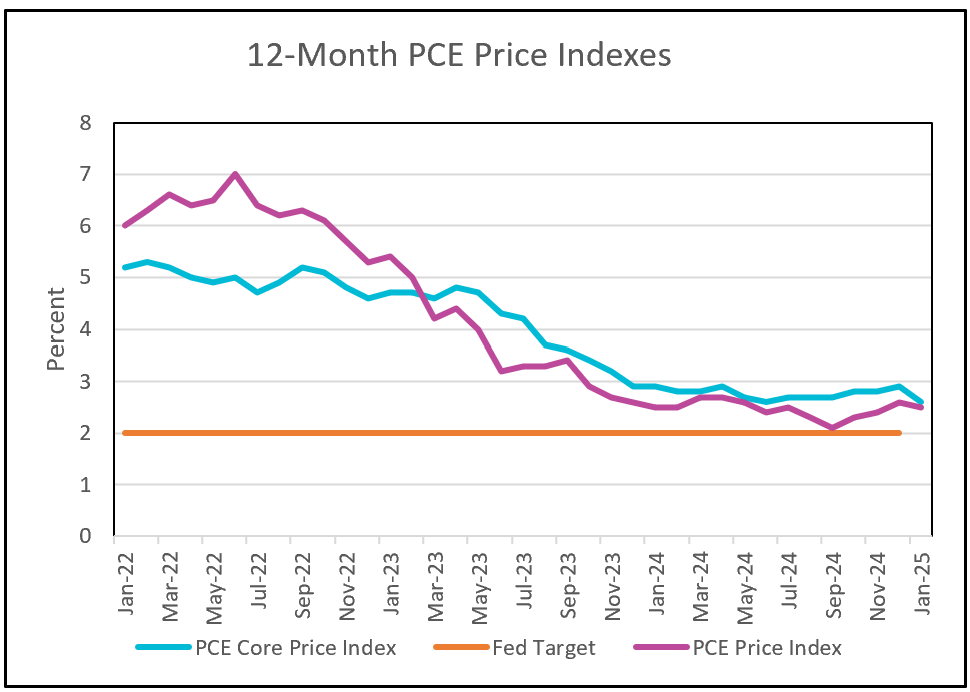

Meanwhile, the Personal Consumption Expenditures (PCE) Price Index—the Federal Reserve’s preferred measure of inflation—fell to 2.5% in January, down from increases in November and December. By comparison, January’s Consumer Price Index (CPI) stood at 3%. Policymakers favor the PCE index over the CPI because it adjusts for shifts in consumer spending patterns. The 12-month core PCE index also declined, matching its lowest level in nearly four years. Economists prefer the core index because it excludes volatile food and energy prices, offering a clearer picture of long-term inflation trends.

The Federal Reserve is treading cautiously in response to President Trump’s proposed tariff increases on imports from Canada, Mexico, and China, citing concerns over potential economic disruptions. Economists warn that tariffs could push inflation higher by raising import costs, ultimately driving up prices for American consumers. A Federal Reserve Bank of Boston study estimates that a 25% tariff on Canadian and Mexican combined with a 10% tariff on Chinese goods could add 0.8% to the core inflation rate. This inflation risk complicates the Fed’s monetary policy decisions as it seeks to balance economic growth with price stability.

Hopefully, January’s spending decline was primarily weather-related rather than the start of a longer-term pullback. More clarity will come on March 7th, when February’s Employment Situation report is released. It will clarify how much uncertainty over government policies affected hiring in February. While federal layoffs and tax cuts may not have significantly impacted unemployment yet, their effects could emerge in the coming months.

HRE will provide a full summary and analysis following the February employment report. Stay tuned.