The highlights from the Bureau of Economic Analysis’s Personal Income and Outlays - August 2024 are summarized below.

.png)

Victory over inflation was declared last week when Federal Reserve policymakers lowered their benchmark rate by 0.5%. Their next challenge is to achieve a “soft landing,” a term economists use to describe slowing the economy to a sustainable growth rate without triggering a recession. Achieving a soft landing typically involves monetary policy actions, such as raising interest rates to control inflation without severely impacting economic activity. The Fed’s preferred inflation gauge, the PCE price index, eased to 2.2%, nearing its 2.0% target. Policymakers favor the PCE price index over the CPI because it accounts for changes in consumer behavior, such as switching to more affordable options—like buying more chicken when beef prices rise. Additionally, the PCE price index gives less weight to housing costs, which have surged over the past two years.

The report also included annual revisions of income and outlays since 2019 which revealed that higher incomes fueled more robust economic growth in 2022 and 2023 than previously reported. This additional income also enabled households to save more.

Consumer spending has remained resilient and, thus far, has prevented the economy from entering a recession. In August, spending rose by 0.2%, the smallest monthly increase since January. Spending for services rose by 0.4% while spending on durable and nondurable goods declined. Americans have been cutting back on new and used vehicles, which are sensitive to interest rates. August’s employment data reflected these trends, with job losses in manufacturing and gains in services. Overall, goods producers lowered prices in response to weaker demand.

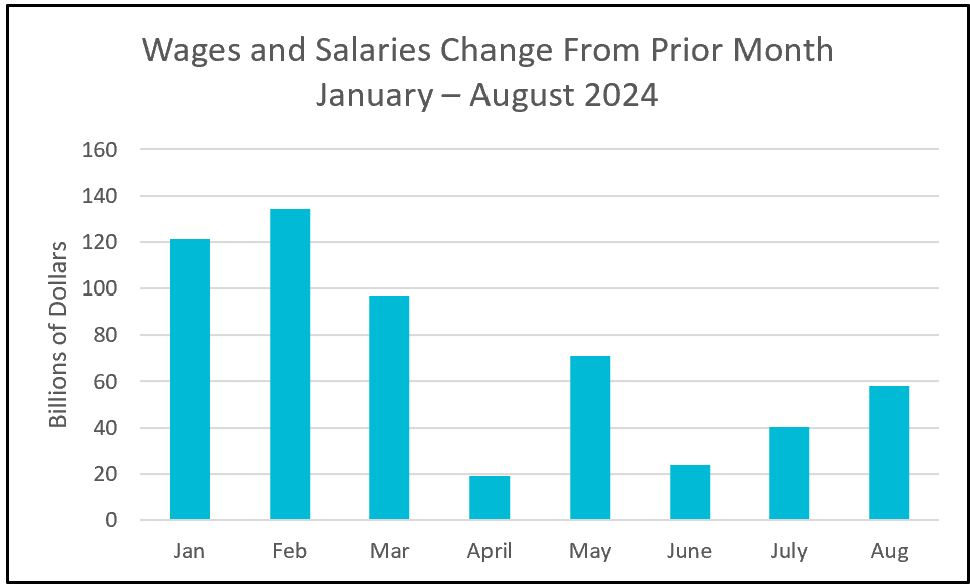

Wages increased the most since May, and compensation gains were the most significant contributors to income growth. However, the trend since the beginning of the year remains downward. A reduction in income generated by proprietorships, interest, and dividends caused personal income to increase by only 0.2% after gaining 0.3% in July.

The Federal Reserve’s larger-than-normal 0.5% rate reduction indicates the likelihood that the Fed is concerned about a recession. A slower pace of income gains and spending increases are signs of a slowing economy. Households are more challenged to meet their budgets. They are saving less and borrowing more to support their spending. The delinquency rate on consumer debt reached its highest level since the third quarter of 2012 (FRED). Despite these challenges, consumer confidence has improved: the University of Michigan’s Consumer Sentiment Index rose to its highest level since May.

The upcoming Employment Situation report for September will offer more insights into the labor market and the economy’s direction. Businesses are still hiring, and the unemployment rate remains below its average of 4.7% since 2015. However, the unemployment rate is increasing, and hiring has slowed since early 2024. HRE will provide a summary and analysis after the Bureau of Labor Statistics releases its report on Friday, October 4th.